The Digital Shift Reshaping Insurance in 2026- Top 5 Reasons

December 4, 2025

Unveiling the Secret to Zero-Downtime with Insurance Cloud Migration

November 27, 2025

Automation for Insurance Agencies- Top Tips to Know in 2025

November 27, 2025

Growth within Grip- Channelizing it Effortless for Insurance Agencies with Cloud Platforms

November 24, 2025

How Insurance Cloud Platforms Will Add Value in 2026

November 20, 2025

Insurance Cloud Solutions Explained: How to Select the Ideal Platform

November 19, 2025

Can Cloud Platforms Empower Insurance Agents go Beyond Sales

November 17, 2025

Why Top Agencies Choose Cloud-Native platforms

November 13, 2025

The Underwriting Algorithm: A Practical Guide to Cloud-Powered Risk Assessment

November 12, 2025

Top 5 Ways Insurance Agencies Can Grow with a Platform Mindset

November 10, 2025

How AI Becomes A Super Customer Service Representative: Top 3 Practical Applications

November 6, 2025

How Insurance Data in Cloud Platforms Unlock Speed for Insurers in 2025

November 5, 2025

Why Insurance Agencies Need a Digital Makeover Now

November 3, 2025

Cloud Platforms: Redefining How Insurance Operates in 2025

October 30, 2025

How AI Is Transforming Insurance Agencies

October 29, 2025

AI Insurance: Will Algorithms Replace Agents?

October 27, 2025

Actionable Insights Insurance Companies Often Overlook and Why It Matters

October 23, 2025

Software Technology Driving Insurance Innovation: From Automation to Transformation

October 22, 2025

Insurance Solutions that Actually Work in 2025

October 16, 2025

Health Insurance Policy: Is AI Repairing or Reinventing?

October 15, 2025

AI and Insurance: The $1 Trillion Disruption

October 13, 2025

Motor Insurance Companies: AI vs Human Touch

October 10, 2025

Slashing the Claims Management Bottlenecks in Motor Claims with iNube!

October 9, 2025

AI and Insurance: Can Smarter Risk Outpace Rising Claims?

October 8, 2025

Insurance Companies Using AI Cloud Platforms: What’s Next?

October 6, 2025

The Unfair Advantage: How AI is Rewriting the Rules of Competition

October 3, 2025

AI’s Competitive Paradox: Is Your Advantage Built to Last or Designed to Be Copied?

September 29, 2025

Is AI Still an Advantage, or Just the New Baseline in Insurance?

September 26, 2025

Beyond AI: Finding the Real Insurance Advantage

September 23, 2025

Life Insurance Wave and Technological Revolution- What this Means for India?

September 19, 2025

How Smarter Technology Solutions Can Unlock New Growth Paths

September 17, 2025

Insurance Technology: Competitive Advantage or Just Operational Efficiency?

September 15, 2025

Can Technology Solution Providers Solve Insurance’s Biggest Headaches?

September 12, 2025

How to Choose Insurance Technology Vendors: Avoid These 5 Costly Mistakes

September 10, 2025

Parametric Insurance: Are You Geared to Offer Event-Triggered Solutions?

September 8, 2025

The Human-in-the-Loop: Why Automation Won’t Replace Your Underwriters

September 3, 2025

Agency Channels or Online Platforms- Is the Future Dark or Bright?

August 29, 2025

Streamlining Operational Hurdles in Policy Administration for Health Insurance with iNube

August 29, 2025

Insurance Distribution for Millennials & Gen Z: What Works

August 26, 2025

Direct-to-Consumer or Bancassurance- Who’s Winning in India?

August 22, 2025

Digital Infrastructure at the Forefront: The Insurance Revolution

August 20, 2025

Trust & Transparency in Indian Insurance: What’s the Reality?

August 18, 2025

Insurance Distribution: Distribution 3.0 vs Traditional

August 8, 2025

Is Insurance Distribution Ready for a Redefinition?

August 6, 2025

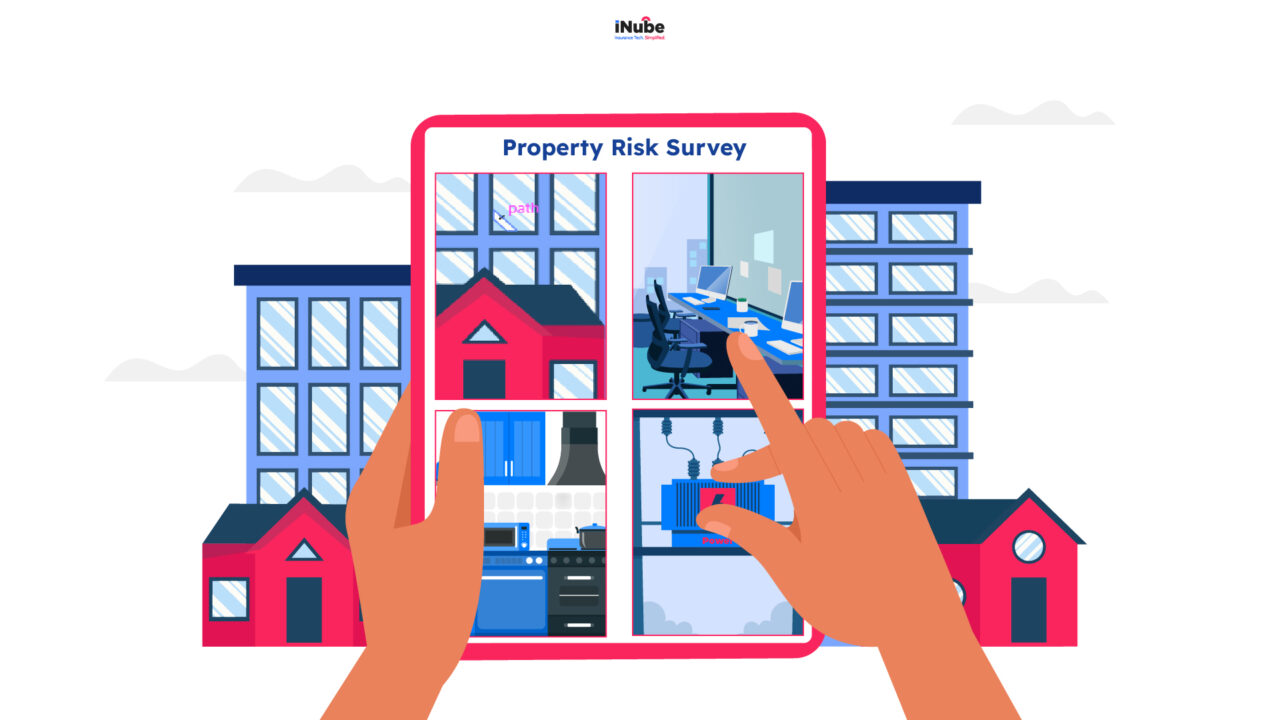

Reinventing the wheel in Property Risk Survey in Insurance

August 5, 2025

Accelerating the Wavelength of Insurance Operations with the Power of iNube’s Virtual Office

August 1, 2025

Modular Insurance: Rethinking Core Modernization

July 28, 2025

The Underwriting Dilemma: More Data, Less Insight

July 25, 2025

Exploring the Digital Challenge for SA Insurance Agents

July 23, 2025

The Code Conundrum: Is it Slowing Insurtech?

July 21, 2025

Reimagining Claims Management: Smarter, Faster, Seamless

July 18, 2025

Insurance Software Solutions- A Gateway to Reinvent Insurance from Inside Out!

July 16, 2025

Unlocking Insurance Innovation with Low-Code No-Code Platforms

July 14, 2025

What if An API Strategy Could Drive Growth and Not Just Integrations?

July 12, 2025

Is Distribution Efficiency Slipping? Rethink Policy Management

July 9, 2025

Connection Over Coverage: The Omni-Channel Impact

July 7, 2025

Risk Assessment from the Lens of iNube’s Digital Platform

July 7, 2025

Speed in Policy Management: Trust Builder or Breaker?

July 7, 2025

Modern Policy Management: Tech Shift or Ignored Necessity?

July 1, 2025

Revolutionizing Vehicle Inspections with iNube

June 27, 2025

Security, Scalability & Speed: Core Pillars of Cloud for Insurers

June 26, 2025

Choose a Low-Code Platform That Truly Understands Insurance

June 25, 2025

Embedded Insurance: The Rise of New Assurance

June 25, 2025

From Idea to Launch with No-Code Cloud Technology

June 19, 2025

Which Tech Platform Fits Your Insurance Needs?

June 17, 2025

Beyond Hype: How iNube’s Low-Code Insurance Platform Delivers Tangible ROI for Insurers?

June 13, 2025

Automated Underwriting and Fraud Detection: A Symbiotic Relationship

June 12, 2025

Insurtech: Is It Better to Compete or Collaborate?

June 10, 2025

Behind the Scenes: The Engine Behind Effortless Insurance Ops

June 6, 2025

Can Insurtech Meet Gen Z’s Insurance Demands?

June 5, 2025

Smarter Tools for Insurance Agents: Decoding the Reality

June 2, 2025

Bridging the Protection Gap- India’s Bright Future

May 29, 2025

Digital Insurance Meets Live Streaming Innovation

May 27, 2025

The Renewal Rut: Why Churn Still Haunts U.S. Carriers

May 26, 2025

iNube’s Life Insurance Impact: Seamless D2C Tech for Agents

May 26, 2025

Low-Code Insurance Solutions: Why Agents Are Switching Fast

May 23, 2025

AI in Insurance: From Claims to Customer Experience

May 21, 2025

Unlocking MGA Scale with GCCs Post-Funding

May 20, 2025

Still Using Legacy Claims Systems? Here’s the Cost

May 20, 2025

From Paper to Digital: The LI Agent’s Journey

May 16, 2025

Insurance Agents: Close Deals 5x Faster with Tech

May 15, 2025

AI-Powered Hyper-Personalization in Home Insurance Coverage

May 14, 2025

Is Your Insurance Software Outdated? What 2025 Demands

May 13, 2025

UBI Travel Insurance: Tailored for Digital Millennials & Gen Z

May 13, 2025

Transforming Health Insurance in Maldives with iNube

May 9, 2025

Smart Vehicle Inspection in Motor Insurance

May 8, 2025

AI Image Recognition Rebuilds Trust in Insurance Claims

May 7, 2025

How Claims Management Systems Can Reduce Turnaround Time by 60%?

May 6, 2025

Insurance Reinvented: Agents at the Core

May 5, 2025

Enhancing Policy Issuance with iNube’s Administration System

April 30, 2025

Top 4 Signs You Need a New Claims System

April 30, 2025

Elevating Multi-Channel Insurance Distribution with a Gen AI plug-in

April 29, 2025

AI in Insurance: The Secret Weapon of Top Underwriters

April 28, 2025

Invoice Automation: Streamlining Accounts Payable with AI

April 25, 2025

Is GenAI a Quick Win or Challenge for Insurers?

April 23, 2025

Cybersecurity Insurance vs. AI: Two Distinct Risk Landscapes

April 22, 2025

From Legacy to Modern PAS: Upgrade Without Business Disruption

April 21, 2025

Exploring The AI Revolution in LTC Insurance

April 18, 2025

The Future of Long-Term Care: Tech Transforming Elder Care

April 16, 2025

AI & Insurtech: Redefining Life Insurance Retention

April 16, 2025

The AI Spin in Commercial Underwriting with AI Assistants

April 15, 2025

Why Insurance CIOs Should Adopt Low-Code/No-Code Platforms

April 14, 2025

Competitive Advantage: AI in Strategy & Culture

April 10, 2025

The AI Spin- Transforming Regular Operations for TPAs

April 9, 2025

Top 3 AI Insurance Claims Trends- From Hours to Minutes!

April 7, 2025

Cyber Insurance with AI: Speeding Up Risk Assessment

April 3, 2025

Harnessing the Key Levers of Insurance Customer Relationships

April 2, 2025

AI in Healthcare- Explore the Top Health Insurance Benefits

April 1, 2025

The 300-Year Future: Life Insurance, Tech & Longevity

March 27, 2025

How can AI Humanize Experience in Insurance?

March 26, 2025

AI and Insurance Distribution- Is it a Scalable Match?

March 25, 2025

Boosting Motor Insurance Efficiency with iNube’s AI Maverick

March 24, 2025

Health Insurance Surge- What’s Prompting GenZ and Women to Aggressively Consider Health Insurance?

March 24, 2025

Strategic AI: Driving Value-Based Innovation in Insurance

March 21, 2025

Pet Insurance: Multimodal Intelligence with Image AI

March 19, 2025

Customer-Centric Insurance Personalization with SaaS Solutions

March 17, 2025

The Swarm Mind: Your New AI Insurance Agent

March 17, 2025

Property Survey 2025: Going Digital with Risk Engineers

March 14, 2025

Reimagining Pet Insurance with iNube’s Gen-AI Wizard

March 13, 2025

Cyber Insurance and AI: Are Traditional Risk Models Obsolete?

March 11, 2025

The Gen-AI Moment: How Underwriters Can Unlock AI Potential

March 10, 2025

Beyond the Chatbot: AI’s New Role in Insurance

March 7, 2025

A Winning Spin- Leveraging AI’s Prowess and Driving Innovation in Life Insurance

March 6, 2025

Closing the Insurance Gap: A Race for Value

March 6, 2025

Can AI Close Gaps in India’s Insurance Market?

March 5, 2025

P&C Insurance: Digital Ecosystems & API Solutions

March 4, 2025

Streamlining Policy Issuance with Modular Policy Administration System

February 28, 2025

Future of Insurance: Risk Prediction with Digital Twins

February 28, 2025

Low-Code vs Custom Development: Which One Fits Best?

February 27, 2025

AI-Powered Innovation in Modernizing Health Claims

February 25, 2025

AI Underwriting and Human Expertise in Workers’ Compensation

February 25, 2025

Will Unifying Insurance Ecosystem Modernize Insurers?

February 24, 2025

Transforming Pet Insurance: AI-Powered Digital Claims

February 21, 2025

Maximizing Potential with Innovation-Powered Insurance Tech

February 19, 2025

Cutting through the Red Tape with iNube’s Digital Core Platform

February 18, 2025

Simplifying Policy Issuance for India’s Top Life Carrier with iNube

February 18, 2025

Moving Beyond the ‘Smart’ Insurtech Buzzword in 2025!

February 18, 2025

Maximizing Efficiency: Insurers & Smarter Tech in 2025

February 17, 2025

InsurTech Upgrade: MGAs Moving from Legacy to Digital

February 14, 2025

Parametric Insurance- A Paradigm Shift in Risk Assessment

February 12, 2025

Insurance and India 2025 Budget- What Lies Ahead for Insurance?

February 11, 2025

Is Embedded Insurance Canada’s Next Big Thing?

February 11, 2025

Modern Marketing with Affinity Partnerships in Canadian Insurance

February 7, 2025

Hit or Miss- Top Ways to Enhance Customer Experience in Health Insurance?

February 6, 2025

Gamifying Adventure Travel Insurance with Hyper-Personalization

February 5, 2025

AI Innovation: Finding a Balance with Privacy

February 4, 2025

Policy Administration & Personalization: Myth or Reality?

January 31, 2025

Insurtech’s Role in Expanding Insurance Access in 2025

January 29, 2025

Driving Insurance Efficiency with AI Tech

January 24, 2025

Top 3 Insurance Fraud Prevention Trends for 2025

January 22, 2025

Value Over Growth: Reimagining Insurance Through Adaptability, Proactivity, and Personalization

January 22, 2025

How AI & Tech Are Reshaping Indian Insurance

January 20, 2025

Transforming the Insurance Landscape with Gen AI in 2025!

January 17, 2025

Customer Centricity and Insurtech for the Win in 2025!

January 16, 2025

Why Digital-First Models Are the Norm for Insurers in 2025

January 8, 2025

Digital Insurance Platforms: What to Consider

January 7, 2025

Next-Gen Policy Admin: A Deep Dive into the Future

January 3, 2025

Why is Customer Centric Claims Process a Necessity?

January 2, 2025

Top 3 Trends for Insurance Software Providers to Stand Out

December 27, 2024

How STP in Insurance Can Be a Game-Changer for Insurers?

December 24, 2024

Exploring the Transformative Benefits of Insurance Cloud

December 20, 2024

How AI-in Insurance Fraud Detection is Now a Reality?

December 18, 2024

Insurance Mis-selling: What Insurers Should Know as IRDAI Alerts Banks

December 13, 2024

Top 3 Tech Tools for Health Insurance Fraud

December 11, 2024

Top 4 AI in Insurance Trends for 2025 to Drive Growth

December 9, 2024

Will 100% FDI Be Profitable for India’s Insurance Market?

December 3, 2024

How will Motor Insurance Risk Assessment Transform with UAE’s Traffic Law Changes?

November 28, 2024

Top 3 Strategies for Enhanced Claims Management in Insurance

November 27, 2024

Top 5 Crop Insurance Software Advantages that Every Insurer Must Know!

November 22, 2024

How AI is Boosting Insurance Fraud Detection and Prevention?

November 21, 2024

Why Insurers Are Slow to Adopt Digital Customer Onboarding?

November 19, 2024

Ushering Hassle-Free Claims Management in Health Claims with iNube!

November 15, 2024

AI’s Role: A Threat or a Scalable Solution?

November 15, 2024

Plug, Play, Detect: Motor Underwriting Anytime, Anywhere

November 12, 2024

How AI Agents Improve Insurance Sales Ethics

November 5, 2024

Top 5 Reasons Why You Need A Modern Policy Admin System

November 4, 2024

Unfolding the Legacy Systems Challenges in Insurance!

October 23, 2024

Unleashing the Power of Claims Investigation Solution- The Investigative Steward You Can Trust!

October 14, 2024

iNube and Sonata Software Announce Strategic Partnership to Deliver Cutting-Edge Digital Platform and Bolster Go-To-Market for US and UK Insurers

October 9, 2024

Navigating the Challenges of Adopting New Insurance Tech

October 8, 2024

iNube Launches AI Quest: Transforming Insurance with AI

September 26, 2024

The Growing Role of API Integrations in Insurance Tech

September 5, 2024

Relevance of AI in Transforming Insurance Decision-Making

September 5, 2024

iNube’s 14 Years of Success and on Forging a Future of Bright Possibilities

September 2, 2024

Transforming India’s P&C Insurance with InsurTech

August 28, 2024

Low/No-Code Insurance Tech: A Game-Changer for Mid-Sized Insurers

August 28, 2024

The Evolution of Insurance Technology Over the Years

August 26, 2024

Enhancing Crop Insurance: Streamlined Workflows & Integrity

August 20, 2024

Automating Crop Insurance System for Efficient Processing

August 20, 2024

Transforming Crop Insurance with Data & Operations Integration

August 20, 2024

The Power and Promise of Insurance Technology

August 19, 2024

Unified Claims Management with iNube’s Motor Claims System

August 14, 2024

Vehicle Inspections Go High-Tech with Insurance

August 14, 2024

Crop Insurance Landscape in India

August 13, 2024

Are Insurers Harnessing the Full Potential of Insurance Tech Innovation?

August 12, 2024

Bima Sugam: Simplifying Insurance for Everyone

August 9, 2024

Cutting Customer Churn with Smart Vehicle Inspection Solutions

August 6, 2024

API Integrations: Impact on Modern Insurance Platforms

July 31, 2024

Legacy Insurance Systems: Mistakes to Avoid

July 23, 2024

Intelligent Vehicle Inspections in Kenya: A New Approach

July 22, 2024

The Must-Have Policy Management Software Guide

July 19, 2024

Top Insurance Risks & How Tech Is Solving Them

July 18, 2024

The Challenging Waters of the Global Insurance Market

July 18, 2024

Redefining Policy Management System with Smart Automation

July 12, 2024

Tackling Policy Management Challenges with Modular Solutions

July 12, 2024

Before You Buy: 2024 Health Insurance Changes

July 5, 2024

Enhancing Insurance with Intelligent Technology

July 5, 2024

Empowering Insurers with Cutting-Edge Tech

July 4, 2024

Pioneering Digital Insurance Solutions

July 4, 2024

Unlocking Scalability while ensuring Stability: How iNube streamlined Policy management for India’s largest Life Insurer

June 28, 2024

Insurance Technology for Every Part of the Globe

June 26, 2024

Digital Inspections: Speeding Up Insurance TAT

June 12, 2024

The Pathway to the Frontlines of Insurance Market

June 10, 2024

IRDAI’s Big Shift: Steps Toward ‘Insurance for All’ by 2047

June 6, 2024

Tech-Driven Insurance: Solutions for Tomorrow’s Risks

May 15, 2024

Tech Up Your Insurance: The Insurtech Advantage

May 15, 2024

Digital Transformation: Key Steps for Insurers in Africa

May 15, 2024

How Tech Is Making Insurance Easier in Africa

May 15, 2024

Power of Insurtech: Insurance Management with iNube

May 15, 2024

From Tradition to Tech: The New Face of Insurance

May 15, 2024

Digital Onboarding: A Game Changer for Insurers

October 9, 2023

Streamlining Auto Insurance: Transforming Vehicle Inspections

September 21, 2023

Break-in Period in Vehicle Insurance

September 13, 2023

Streamlining the Insurance Claims : A Guide

September 11, 2023

Unveiling MACH Architecture: Shaping the Future of Digital

August 17, 2023

5 Effective Ways to Improve Claims Processing

July 27, 2023

Policy Management System: Why Your Business Needs It

July 20, 2023

How Legacy Systems are Holding Back Insurers?

July 19, 2023

5 Ways in which InsurTech Creates Cost Saving Opportunity

July 13, 2023

The Role of APIs in Digitalizing Insurance Companies

July 8, 2023

What is NO-Code Insurance Software

June 30, 2023

How is Cloud Technology Transforming Insurance Industry

June 26, 2023

Trends in Insurance Claims Management: What You Should Know

June 20, 2023

How Insurtech helping the Insurance companies?

June 17, 2023

InsurTech & its Contribution towards Insurance Companies

June 15, 2023

Benefits of Health Insurance

June 7, 2023

Challenges in the Insurance Broking Industry

June 5, 2023

How to become an Insurance Broker

May 29, 2023

Digital Insurance: Simplifying the Value Chain

December 5, 2022

A Hyper-Personalization in the Insurance Industry

September 19, 2022

Adapting to the Post-Pandemic World for Insurance Brokers

September 9, 2022

The Embedded Insurance Transforming Insurance Industry

August 23, 2022

Bancassurance – Ways to Win & Retain Customers

July 13, 2022

How Will a Good Insurance Broker Software Set You Apart?

July 11, 2022

How SaaS transforming the Insurance Companies best?

June 6, 2022

Embedded Insurance – A Quick Guide to Understand

May 27, 2022

How to Achieve Best Health Insurance Claims Experience?

May 26, 2022

Should You Build or Buy Insurance Software?

May 25, 2022

Simplifying Insurance Distribution: How to Reshape it?

May 11, 2022

digital Insurance Distribution in Africa: Key Strategies

April 25, 2022