Policy Administration is a pivotal part of the Insurance value chain and legacy systems lay the ground for operational challenges. Relying on traditional operational process is a significant roadblock that insurance providers face in streamlining end-to-end Policy Administration. These systems cause a significant hurdle in accessibility as well as in scalability.

This case study will be reflecting upon the Modular solutions that iNube implemented for one of its customers who is one of the leading General Insurance providers. Additionally, will be exploring the key business benefits that our solutions unlocked.

Objectives

- Implementation of a Modular solution that is efficient in handling Policy issuance

- Enhancement of policy management and increasing agent activity visibility

- Faster business expansion and product launch

Results

- Streamlined end-to-end Policy Administration with Modular Digital Core platform

- Accelerated product launch with much lesser time constraints

- Enhanced visibility into agent performance with automated reports and dashboards

The Challenges

Limitation in business expansion

Legacy systems slowed down product launch time and offered a hurdle in seamless scalability

Manual Policy Administration

Manually conducting administrative tasks slowed down the policy issuance time

Delays in Tracking Agent Performance

Lack of real-time insights into tracking agent performance

Limited Automation in Policy Issuance

Older systems had limited automation feature in policy issuance process

The Solutions

iNube implemented Modular solutions- Digital core platform, and Distributor portal solution that eased out end-to-end Policy Administration.

The modern platforms streamlined the processes of Policy management and included automation in Policy issuance. Additionally, there was enhanced visibility in the agent performance with automated reports and dashboards which enhanced the customer’s visibility.

The Digital core platform increased scalability with faster product launch and thereby accelerated business expansion.

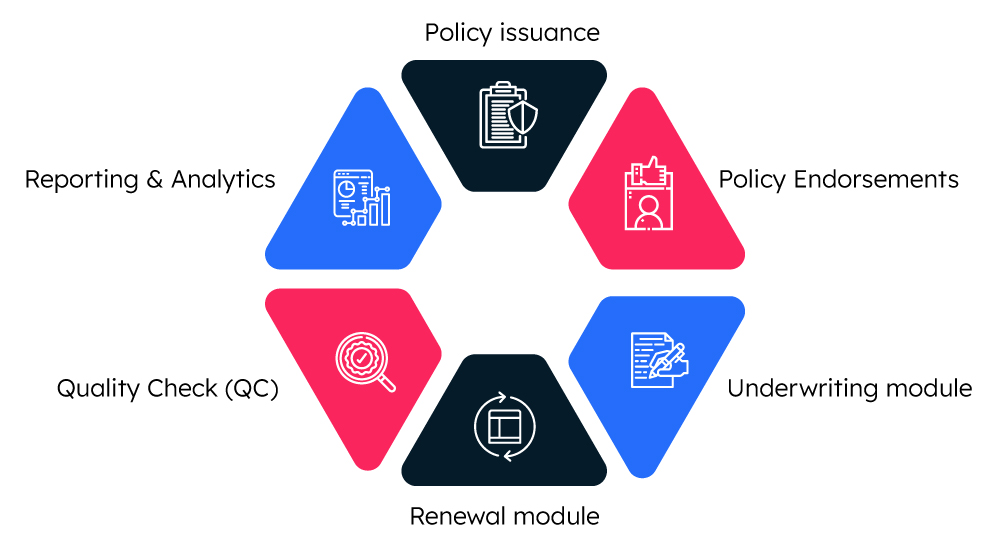

Here are the key functional modules that we implemented:

The iNube Impact

- Implemented 25+products across multiple LOBs- Life, Health, Motor, Fire &Property, Marine, Cyber, Workmen Compensation, Engineering and Package

- 1800+ policies sold so far and counting

- 500k+ Policies processed in the last 12 months

- $ 8M premiums booked in the last 12 months

About the Customer

Our customer is one of the leading General insurers, based in India. They offer a diverse range of products across different Lines of Business (LOBs) and are committed to enhancing customer experience while offering world-class products and services. They are one of te trusted General insurers who has been recognized by multiple reputable institutions adding to their long list of accolades. With a broader vision, they strive towards achieving sustainable premium growth and focus on bottom-line profitability.