The Life Insurance landscape is undergoing a complete change and with multiple trends emerging in 2025, the Life insurers are approaching the business with a Modern perspective. Especially with the emergence of Artificial Intelligence (AI), tedious operations are now taking a backseat and paving the way for faster and smoother workflow. For instance, GenAI has resulted in a 20-30% reduction in underwriting time. That’s how Artificial Intelligence is making a scalable impact in the Insurance space

Let’s dig deeper!

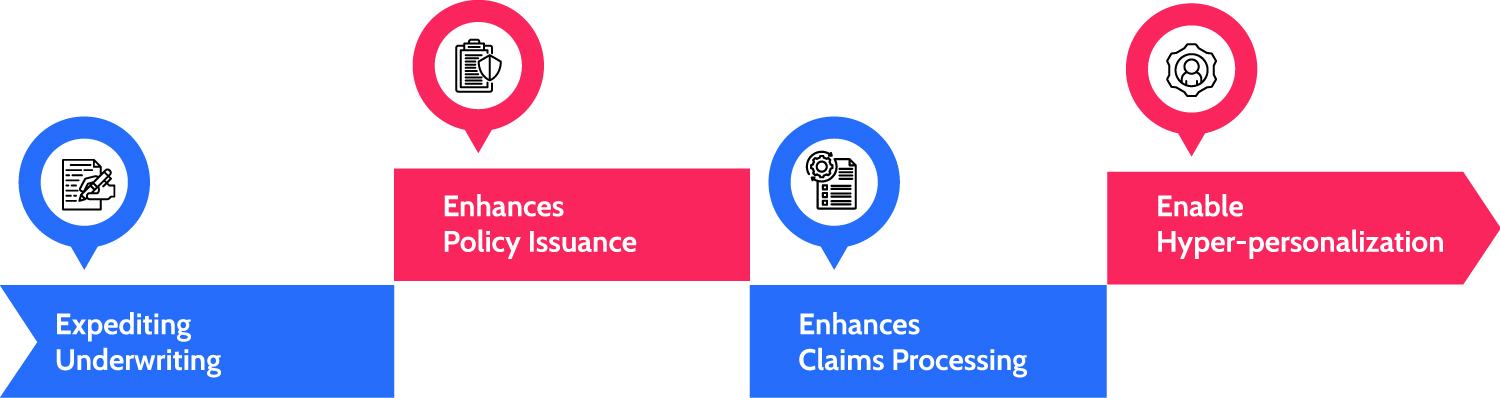

The Impact of AI Across the Insurance Value Chain

AI is definitely a catalyst for innovation across the insurance value chain. With its agility and efficiency, insurers are transforming operations with the power of innovation and unparalleled technology. From offering personalized products to enhancing claims processing, AI is redefining processes across the Insurance value chain.

Here’s a closer look at how AI Quest is transforming operations across the insurance value chain:

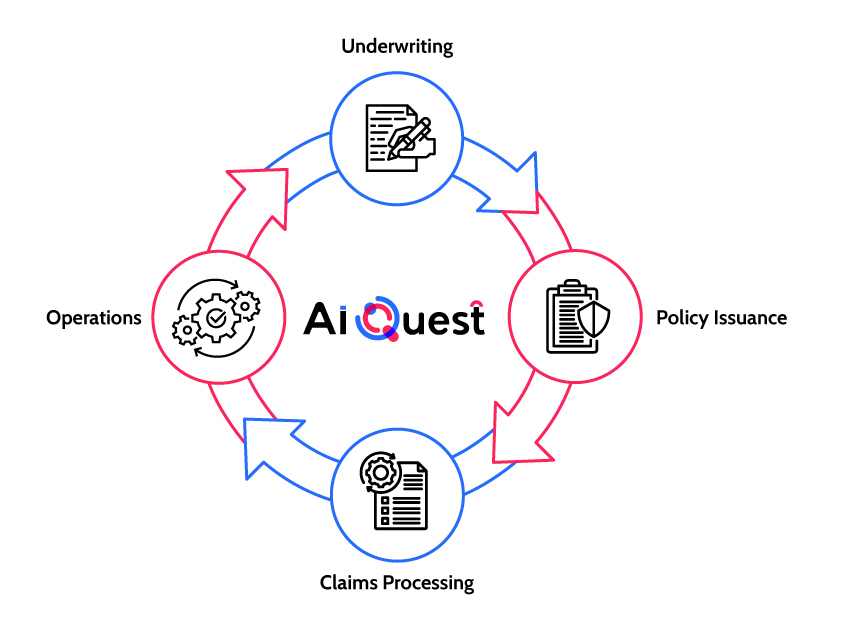

AI Quest by iNube

Usher in the future with a modern-day tool that is equipped with advanced GenAI capabilities that will transform operations across the Insurance value chain. AI Quest is our dedicated lab’s wing comprising skilled AI enthusiasts and insurance experts who have dedicatedly developed modern GenAI capabilities that will give your typical insurance operations an AI-powered spin.

Did we pique your interest? Hop onto the next section to decode more!

Unveiling the Power-Packed Impact of AI Quest in Life Insurance

AI Quest by iNube has developed advanced GenAI capabilities across the insurance value chain that transforms your regular operations in Life Insurance.

Here’s a closer look:

Transforming Policy Issuance the AI Quest Way!

Underwriters constantly face the challenges of paper heavy processes tardiness in processing proposals, insufficient document uploads by Agents, and more such critical issues which lead to delays in policy issuance.

Here’s how our AI Quest slashes these challenges in a whiff:

Connecting with the Customer Right and Selling Accurately- AI Quest by iNube has a quick fix for gaining customer’s trust in the selling process using a GenAI-powered Agent Assist. The Agent Assist handles various queries on the products for customers and agents, ensuring the right product is offered by equipping the insurance agent with adequate product related information that enables them to sell the right product to the right customer. The best part? It offers 24/7 support.

Digitizing Physical Proposals and Enhancing Customer Experience– AI Quest’s GenAI solution digitizes and processes the proposal documents, flags any discrepancies/ insufficiencies and auto-buckets them as STP or NSTP policies. This allows the underwriter to spend time only where it’s needed, like the NSTP policies. Offering a quicker conversion of proposal to policies, thereby expediting the policy issuance time.

From Worries to Ease- Effortless Underwriting Documentation Validation -Streamline underwriting documentation validation with AI Quest’s GenAI solution, which efficiently validates and flags missing or incorrect documents, eliminating manual hassles while streamlining the validation process for accurate underwriting decision-making.

Quicker processing of a lapsed policy – Policy Revival Document Validation Made Simpler, Easier, and Better-iNube’s AI Quest’s GenAI solution effortlessly automates policy document validation against the original documents and flags discrepancies during the policy revival process. Allowing the underwriter to eliminate manual errors, infuse accuracy in decision making, minimize potential risks and also improve their operational efficiency.

A Spin from Underwriting Woes to Underwriting Wows

Slow processes and inaccurate underwriting decisions have long been plaguing underwriting that ultimately affects the policy issuance time. Additionally, insufficient data availability, frauds and lack of modern digital tools contributes further to underwriting hurdles.

Here’s how our AI Quest slashes these challenges in a whiff:

Time to Flip Proposal Discrepancies and Expedite Policy Issuance 2x Times- Slash manually processing proposal discrepancies with AI Quest’s GenAI solution, which compares new against the existing proposal forms to flag issues. Simplifies the tedious review process while eliminating manual checks, enhances accuracy in the proposal review process and effortlessly expedites policy issuance time.

From Anomalies to Achievements-A PRO Medical Report Analyzer- Increase underwriting efficiency and policy issuance time with a GenAI powered solution that effortlessly analyses and summarizes key findings from the medical reports and flags anomalies. Save time, optimize resources, flag potential fraud and enhance accuracy in underwriting decision-making.

A Digital Consent Validation for Underwriting that is Accurate and Smooth- Eliminate consent validation discrepancies with iNube’s AI Quest, a GenAI powered solution for verifying names and signatures on the consent document against the NSTP policy documents. Slash manual efforts and improve operational bandwidth, safeguard against potential fraud and policy-misselling with our advanced GenAI solution.

Categorize the Right Proposals under the Right Categories and save 5x Efficiency-Save time with AI Quest’s GenAI solution that automates categorization of NSTP proposals into various categories based on their level of completeness and discrepancy found, allowing for accelerating the proposal approval time. Improve operational bandwidth, optimize resources and save a significant amount of time and efficiency with this cutting-edge GenAI solution.

Imagine reducing your Claims processing time by at least 10 days—AI Quest is built to deliver just that

High volumes of claims, complexity of the claims and manual processes are the constant challenges that underwriters face in claims processing. However, with GenAI, these challenges can take a back seat. For instance, Insurance companies using AI in claims processing have achieved a staggering 99.9% accuracy.

Here’s how our AI Quest slashes these challenges in a whiff:

An Expert Claims Analyzer that improves 3x Times Underwriter’s Productivity-Our AI plug-in in powering Smart Underwriting seamlessly analyzes death claims documents against requested forms, leveraging vast amount of data for quick and accurate comparisons. Effortlessly ensure document completeness and accuracy in a blink.

A Virtual Assistant that is Available All Round the Clock -Enhance customer experience and save significant manual effort with a GenAI-powered Chatbot that provides accurate information on beneficiaries, timelines, and claims-related queries anytime, anywhere.

Establish Transparency and Improve Customer Satisfaction -Enhance customer experience with our AI plug-in, which transparently communicates claims status, flags missing documents, and follows up with the beneficiaries, saving underwriters time and effort significantly.

Simplifying Matured Claim Verification in Annuity Policies and Life Certificate Real-Quick-Eliminate manually verifying matured claims in Annuity policies and Life certificate from multiple sources with AI Quest’s GenAI powered solution that automates verification of matured claims and Life certificate from multiple sources under a unified platform. Save time, improve accuracy and expedite claims processing.

Automate KYC Verification and Improve 3x Efficiency -Automate KYC verification with AI Quest’s GenAI solution, which extracts key details in API format from the nominees’ KYC from multiple sources and checks its authentication against the original documents. This saves a significant amount of underwriter’s time and accelerates claim processing.

Spinning around Regular Operations

Manual operational processes are significant challenges that are still plaguing underwriters in 2025.

Here’s how our AI Quest helps tackle these crucial bottlenecks:

Expedite operational bandwidth by 50% with a GenAI powered Medical Bill Verifier and Tarriff Comparison Solution -AI Quest’s GenAI solution automates medical bill verification by comparing policy data from the MSPs against the tests list submitted by the underwriter and checks for its authenticity. Additionally, it also compares the charges levied by the MSP against the agreed charges documents for identifying any discrepancies for billing accuracy. Save time, effort and increase accuracy in medical billing and compliance with an advanced GenAI solution.

Complex Documents now Turned into Simple Explanations in A Minute -AI Quest’s GenAI solution simplifies complex product documents into easy-to-interpret data, enhancing underwriter’s understanding of the complex product related topic. Gain instant product information effortlessly and boost operational efficiency.

Take a step ahead in innovation and usher in the new wind of AI’s innovation and prowess with AI Quest by iNube.

Contact our Insurance technology expert today!