What prompts you to trust a Health Insurer? Thinking of a reason? Well, let me tell you, in an ideal situation, its technology, isn’t it? If you are thinking of an elevated customer experience, then it’s because of the seamless experience that technology has offered you. However, if you are thinking to the contrary, then it’s time for Health insurers to rethink Insurance customer experience and specifically in Health Insurance. Keep reading the article till the end to decode some of the amazing strategies that Health insurers can adopt to offer an enhanced customer experience apart from taking aid from Insurance technology.

Top Strategies for Enhancing Customer Experience in Health Insurance

Enhancing customer experience in Health Insurance in 2025 will prove to be a strategic advantage for the Health Insurers in 2025. The reason is that in 2024, the trust in Health Insurers has sunken consecutively for three years, with only 56% of the Health insurers saying that they would trust their Health Insurers to do what is in their best interest.

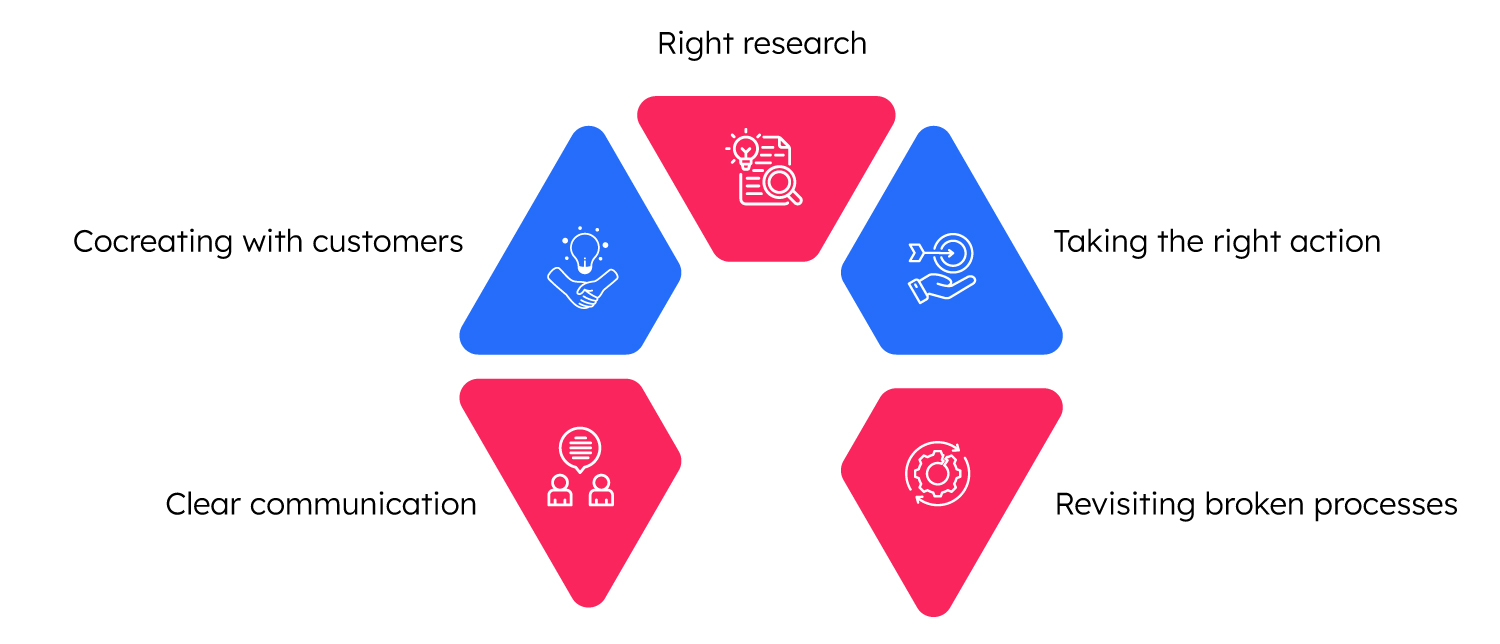

To pace up, here are the top five strategies that insurers need to keep in mind to enhance customer experience in Health Insurance:

Clear Communication

Clear communication is the key to enhancing customer trust. Make sure to be transparent about what you learn and what you are going to change. If customers are facing trouble in adapting to the change in your product innovation or navigating through any of the processes, then Health Insurers must communicate the change to the customer and set expectations for how long it will take for you to deliver. Health insurers can also follow the same approach if they are planning to change the experience of providers, employers, brokers, or other key ecosystem partners.

Right Research

Imagining isn’t the way out to understand customers, it’s immersing in their world. Conducting the right kind of research will enable transforming the customer experience. Analyzing the existing market data and acknowledging the issues lingering in the market will enable the Health insurers to deliver a superior Insurance digital experience.

Cocreating with Customers

This is one of the key strategies for enhancing customer experience in Health Insurance. Collaborating with customers in every step of improving customer experience will enable not only them to test the solutions but also to identify the needs and problems as well as ideate solutions. It is time to understand the customer needs from the lens of customers, so customer obsession where customers form the Centre of leadership, strategy, and operations will enhance acknowledging the customer experience problems in Health Insurance.

Taking the Right Action

It is more important than ever for Health insurers to focus on incremental improvements. They can demonstrate that they continue to listen and collect feedback to stay on the right track. Offering the right improvements can help deliver value to members, providers, and insurers.

Revisiting Broken Processes

Personalized policies are the norm in Health Insurance in 2025. It is important to offer products that not only align with the specific health needs of the individuals but also enable them easy access to those tailored products. Mending broken processes is important for enhancing customer experiences while also offering tailored products.

While these strategies are important for insurers to enhance the back-end processes for enhancing Customer experience, it is also important to understand the key strategies to implement with the aid of Insurance Technology to enhance Customer experience.

Top Technology Trends to Enhance Customer Experience in Health Insurance

Insurance Technology is shaping the Insurance sector, while it has successfully enhanced customer experience, its contribution to strengthening the Health insurers’ existing processes is tremendous.

Here are the key technology strategies that insurers can use to enhance Customer experience in Health Insurance:

AI Adoption

AI is no longer a buzzword but a reality. Automating key processes in Insurance will not only save up Insurers’ time and effort but will enable them to enhance customer experience. From offering automated claims processing to customized products, AI adoption will make it easier for Health insurers to elevate customer satisfaction.

Omnichannel Experience

Insurers are widely investing in Modern Customer experience Technologies to enhance customer experience across digital and traditional channels. Health insurers can offer the same by integrating these Customer experience technologies with CRM, and Contact Centre combined with AI tools.

Conclusion

Offering an enhanced customer experience is no longer an option but a necessity. Enhancing customer trust and offering seamless customer services will enable Health insurers to make a watershed moment possible. These strategies will prove to be a turning point for Health Insurers and help them elevate the customer satisfaction rate in Health Insurance.