Policy administration is a pivotal stage in the entire Insurance Value chain. With many of the insurers relying on back-dated core system, there are heaps of operational challenges that Carriers face in streamlining Policy Administration. Lack of efficiency in Policy Administration causes a significant pitfall in the entire policy issuance process.

This case study will be delving into the ways that our Modular and digital core platform streamlined Policy Administration for one of our customers who is one of India’s trusted and independent Health insurance providers in India. Additionally, will be reflecting upon the key wins that our solution unlocked for them.

Objectives

Implementation of an efficient core platform to streamline end-to-end policy administration and accelerated policy issuance

Modern-day solution to unify the fragmented Policy Administration processes

Results

Successfully streamline health insurance policy issuance processes

Enhanced visibility into the transactions and accounting metrics

Accelerated the bulk policy issuance time

The Problems

Manual Policy Issuance

Manually issued bulk number of policies with limited digitization

Heavy Group Payments

Lacked a proper management of the Cash deposit account leading to high number of transactions and huge volumes of policy issuance

Difficulty in Bulk Policy Issuance

Manual intensive policy issuance processes caused a difficulty in bulk policy issuance

The Solutions

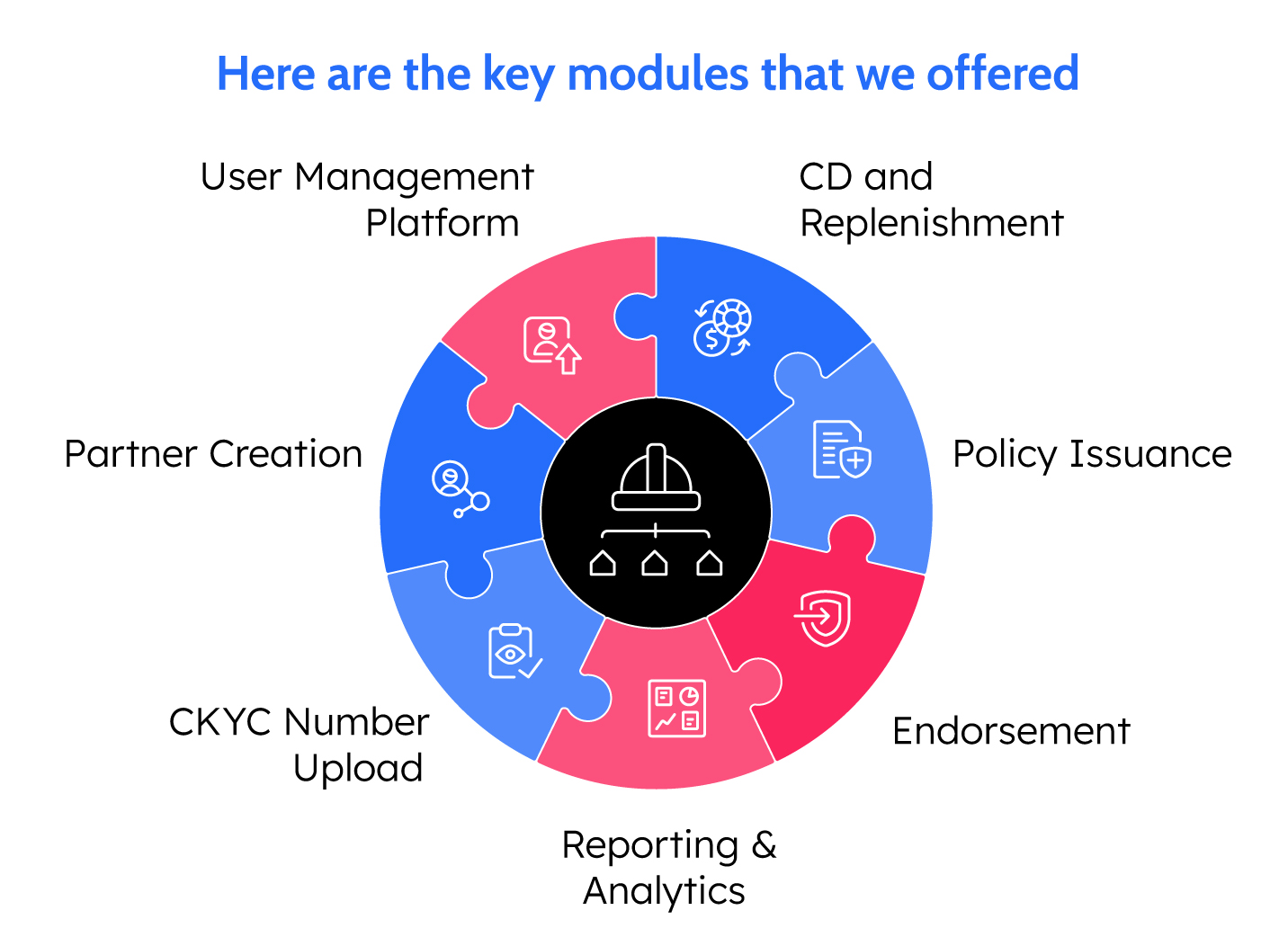

We offered a robust, Modular Digital core platform that catered to solve the complex policy issuance challenges of the customer.

The system enabled the client to streamline and digitize end-to-end policy administration process and made policy issuance hassle-free.

Also, the system allowed for bulk policy issuance and offered comprehensive and real-time visibility into the accounting details.

The iNube Impact

Over 580k+ Policies issued

Over 600k+ Quotes issued

90k+ volumes handled per month

250+ users created

About the Customer

Our client is one of the trusted General insurance providers, based in India who offers innovative as well as comprehensive products which makes them the best in the business. Their aim is to strive for the better and offer insurance accessibility to all with a varied range of products catering to diverse individuals. Recently, they have ventured into Travel insurance and iNube’s Modular Digital Core platform played a key role in their policy issuance process.