Imagine purchasing Insurance but with a twist! What if you buy Travel Insurance and you are said to be part of an adventure game? Sounds cool, isn’t it? While this is still a farfetched reality, there is still scope for infusing gamifying elements in Travel Insurance. Travel Insurance has seen a staple growth over the few years; however, the past year was much more noteworthy. The adventure tourism market, valued at $406.12 billion in 2024, is projected to grow at 16.8% CAGR through 2030. With more travellers seeking unique, immersive experiences, the need for specialized travel insurance is rising. Sound interesting, yet? Keep reading till the end to decode more!

The Need for Adventure Travel Insurance

Let’s face it Insurance was largely seen as a profit-based market, rather than a customer-centric domain. However, with time this notion is changing with the need for personalised experiences and adventure. This is interesting, isn’t it? The Carriers need to move beyond the mundane ways of offering products and go beyond the traditional methods of selling. The need for adventure in selling Travel insurance is just that, it will be amping up the user experience.

Here’s how Adventure tourism in the U.S., UK, and Canada requires tailored coverage for:

Extreme Sports & High-Risk Activities – insurers can offer tailored coverage for injuries, accidents, and rescue services.

Medical Emergencies – offering Global health coverage for unexpected issues will enable the insurers to enhance user experience and increase customer retention.

Trip Cancellations & Delays – insurers can offer Protection against last-minute changes which is one of the most least covered areas in offering Travel insurance.

Gamification in Travel Insurance

The World Travel Market 2011 Report identified gamification as a major trend, with 18-34-year-olds leading adoption. Here are the Key strategies that Travel Carriers are including to enhance user experience:

Rewards & Incentives

While Travel Insurance is a majorly purchased by the younger demographics aged 18-34 years, it will be fair to amp up their user experience with gamification elements such as points for safe travel behaviour.

Leaderboards & Challenges

Safety is the key factor in Travel Insurance; to further reinforce its importance amongst the policy holders, the Carriers can encourage engagement through safety drills and quizzes.

Interactive Learning Modules

Risk awareness is yet another key factor where Travel Carriers can infuse gamification elements. They infuse gamification elements for making risk awareness engaging and also hold the policyholder’s attention in a creative way.

Hyper-Personalization in Travel Insurance

With AI in Insurance, offering hyper personalised products is becoming a breeze. The same applies for Travel Insurance as, AI streamlines the data collection enabling the Carriers get an in-depth customer data analysis in no time.

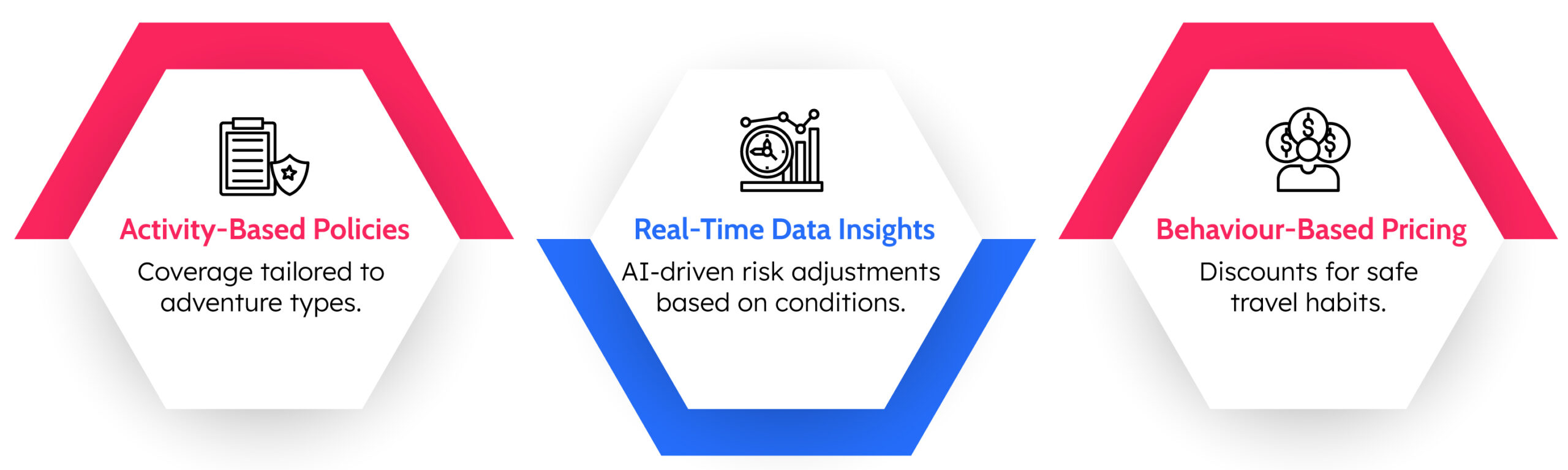

AI-driven personalization enhances traveller’s engagement through:

Benefits for Carriers & InsurTechs

While infusing gamification elements can be one of the biggest advantages for Carriers and Insurtech alike. Not only this will call for an engaging and unique collaboration but also will be unlocking many key benefits.

Here are the top benefits that gamification will be unlocking for Travel Carriers and Insurtech:

Higher Customer Retention – With gamification, the Carriers and insurtechs will gain a strategic advantage of turning mundane ways of offering Travel Insurance into a fun and engaging way of purchasing Adventure insurance for the policyholders. They can actively engage users and renew policies more.

Increased Cross-Selling – With AI in enhancing customer experience, the Carriers will be empowered with AI-driven recommendations to improve coverage uptake. This will be enabling them in increasing Insurance cross-selling.

Better Risk Management – With gamification and AI, the Carriers will be able to streamline educating policyholders about risk awareness and with educating travellers about risk management, Carriers can reduce claims.

Conclusion

By integrating gamification and hyper-personalization, Carriers can create dynamic, tech-driven insurance experiences, boosting engagement, retention, and profitability. This will not be an innovative way of offering Travel Insurance but also will be enabling the Carriers to understand their customers better and offer an enhanced customer experience.

Shrinivas Susarla

Executive Vice President – Strategy and Americas