In the dynamic landscape of the insurance industry, Chief Information Officers (CIOs) are crucial in balancing business innovation, IT stabilization, and enterprise-wide scaling. Every digital initiative, from application modernization to workflow automation, eventually passes through the CIO’s desk.

With business function heads relying on the CIO for technology delivery, there is increasing pressure to meet expectations related to cost, timelines, performance, and compliance—without compromising on agility. However, many insurance firms still operate using traditional software procurement models, including off-the-shelf products and custom-built solutions. While these approaches have their place, they often fall short in delivering speed, flexibility, or long-term value.

Low Code No Code platforms offer a powerful alternative. These platforms are designed to simplify application development, reduce reliance on external vendors, and enable business-user collaboration—while meeting the security and compliance requirements of the insurance sector.

The Daily Challenges of an Insurance CIO

A peek into an insurance CIO’s inbox on any given day reveals a flood of diverse, time-sensitive requests from across the organization. Each functional head comes in with a unique need, a new priority, or a system challenge that must be solved—immediately.

- “Can we roll out a new agent onboarding journey by end of this quarter?” – Distribution Head

- “We need a quick fix to automate a manual process in claims. It’s delaying our cycle time.” – Claims Head

- “We’re launching a new rider in health—can IT ensure we go live on time?” – Product Team

- “We’re not meeting the turnaround times promised in underwriting. Can we get visibility into that workflow?” – Operations Lead

- “We’ve identified a new regulation that needs to be complied with. Can the system handle it without a full rebuild?” – Risk & Compliance Team

Each request is valid. Each is urgent. And each depends on the CIO to convert it into a secure, scalable, and integrated digital solution—on time, within budget, and without disrupting existing operations.

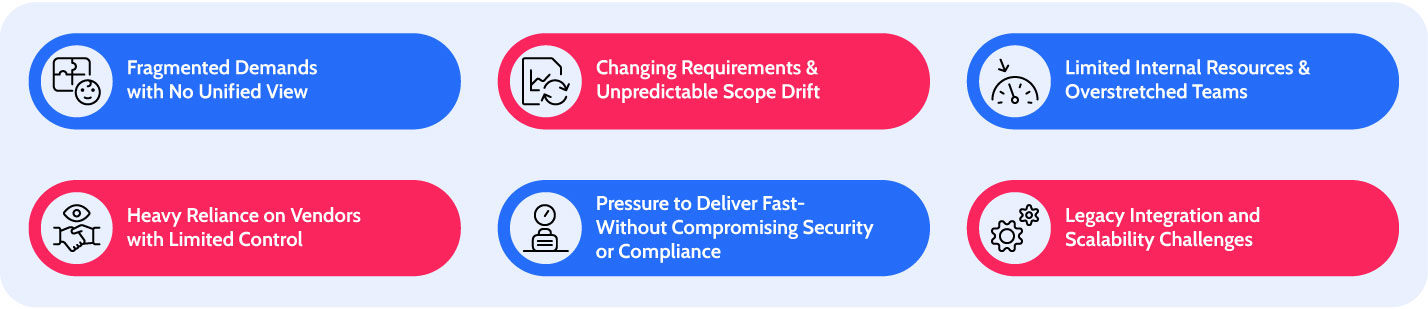

Key Challenges in Meeting These Demands

There are multiple challenges that comes in the way of meeting these demands, here’s a closer look at them:

- Fragmented Demands with No Unified View Requests come from every corner of the organization—claims, underwriting, compliance, distribution—each with different goals, urgency, and user expectations. With no single source of alignment, the CIO is expected to prioritize, negotiate, and deliver on all fronts, often without full context.

- Changing Requirements & Unpredictable Scope Drift In insurance, requirements rarely stay fixed. Products evolve, regulations shift, and internal teams revise expectations mid-cycle. The CIO must account for continuous change while trying to stabilize project delivery—a nearly impossible balance without flexible frameworks.

- Limited Internal Resources & Overstretched Teams Most IT teams are already running at capacity, juggling Business-As-Usual operations with ongoing initiatives. When urgent transformation projects or ad-hoc requests arise, there’s rarely dedicated bandwidth to take them on without trade-offs in quality or timelines.

- Heavy Reliance on Vendors with Limited Control Vendor-led delivery often means slower response times, misinterpretation of requirements, and gaps in quality. While CIOs are accountable for the outcome, they often lack direct control over timelines, dependencies, and cost escalations.

- Pressure to Deliver Fast—Without Compromising Security or Compliance There’s growing pressure to roll out new digital services quickly. But in a heavily regulated industry, security, data privacy, and compliance cannot be sacrificed for speed. CIOs must build governance into every delivery cycle, often slowing execution when using traditional methods.

- Legacy Integration & Scalability Challenges Many insurers still operate legacy systems that are not designed to support rapid innovation. New solutions must integrate seamlessly with these core platforms—without breaking downstream processes or adding technical debt that limits future scalability.

How Low Code No Code Platforms Address These Challenges?

Low Code No Code platforms present an agile, cost-effective, and scalable solution to the above scenarios. These platforms enable rapid application development using visual workflows, drag-and-drop interfaces, reusable components, and pre-built templates—significantly reducing the time, cost, and skill required to bring digital products to life.

By facilitating collaboration between IT teams and business users (citizen developers), LOW CODE NO CODE platforms reduce delivery friction and support continuous innovation. More importantly, they offer governance, security, and integration capability essential to insurance enterprises.

1. Financial Prudence and Scalable Growth Low Code No Code platforms drastically reduce the need for large-scale custom development projects. They allow CIOs to build scalable solutions at a lower cost, leveraging reusable assets and modular design patterns.

Strategic Value:

- Optimize development budgets

- Accelerate ROI from technology investments

- Build once and scale across products, regions, or lines of business

2. Reduced Dependence on External Vendors With, LOW CODE NO CODE platforms, internal IT teams and trained business users can collaboratively build and manage applications. This shift from vendor-led execution to internal empowerment reduces project friction, minimizes delays, and ensures closer alignment with business needs.

Strategic Value:

- Enhance internal ownership and accountability

- Reduce vendor-related dependencies and delays

- Foster cross-functional innovation through citizen development

3. Accelerated Time-to-Market and Business Agility In an industry where responsiveness is critical, LOW CODE NO CODE platforms offer unmatched agility. From customer-facing applications to internal workflow automation, development cycles can be shortened from months to weeks.

Strategic Value:

- Launch digital services faster

- Iterate quickly based on market or regulatory feedback

- Empower teams to innovate without compromising on governance

4. Saves Time and Effort Required for Evaluating Independent Systems By investing time in evaluating and choosing a solid LOW CODE NO CODE platform at the very beginning, CIOs can save a lot of time and effort which is otherwise wasted in shortlisting vendors, taking demonstrations, comparing solutions and their commercials, and then finalizing and on-boarding one for each independent system.

Strategic Value:

- Avoid complexities of managing multiple vendors/suppliers

- Reduce inventory of applications to be managed

- Optimize L1, L2, and L3 supports for systems running on LOW CODE NO CODE platforms

Conclusion: One Platform, Many Solutions

Low Code No Code platforms are more than just a delivery model—they serve as a unified solution for many of the operational, strategic, and technical challenges that insurance CIOs face today.

From enabling faster execution, reducing external dependencies, and bridging the gap between business and technology, to ensuring enterprise-grade security and governance—Low Code No Code platforms offer the flexibility and reliability that modern insurance organizations demand.

For CIOs looking to simplify complexity and accelerate transformation, Low Code No Code platforms can bring closure to many open challenges in their technology landscape. However, it is crucial for insurance CIOs to recognize that not all Low Code No Code platforms are designed to support core insurance operations. While they can effectively handle general horizontal functions like workflow solutions for finance operations or dashboards for underwriters, they may not support core insurance functions such as new product launches or calculation of claw back commissions out-of-the-box.

Therefore, CIOs should choose a Low Code No Code platform that is specifically designed to support the insurance business at its core, ensuring it meets the unique demands and regulatory requirements of the industry.

Ramprasad Sanjeevi

Chief Growth Officer