Today, having an API strategy is not a big deal anymore; it’s leveraged by almost every insurer. From being a differentiator, it has become a table turner. While most insurers have ticked the “API box,” very few have the potential to unlock their full potential.

Because an API on its own is just a connector. But acknowledging the real question is important- What are you connecting to and to what end?

Are you actively empowering the partners to sell personalized products instantly?

Are you responding to real-time customer triggers with automated, intelligent actions?

These are some of the pressing issues that many insurers have to deal with to understand that the API strategy is more than just any tech integration.

Unveiling the Uncomfortable Truth

Having a strong API strategy in place isn’t just about the backend operation, but more about the frontline. Many insurers treat API Strategy like duct tape, which is something to connect systems, and keep the operations running- Valuable and limiting at the same time.

An API strategy in the insurance environment has become a backend enabler. They significantly move data, sync CRMs, and allow for distribution portals to function. This is exactly where insurers need to ask:

Are your API strategies just delivering policies and claims, or are they driving growth?

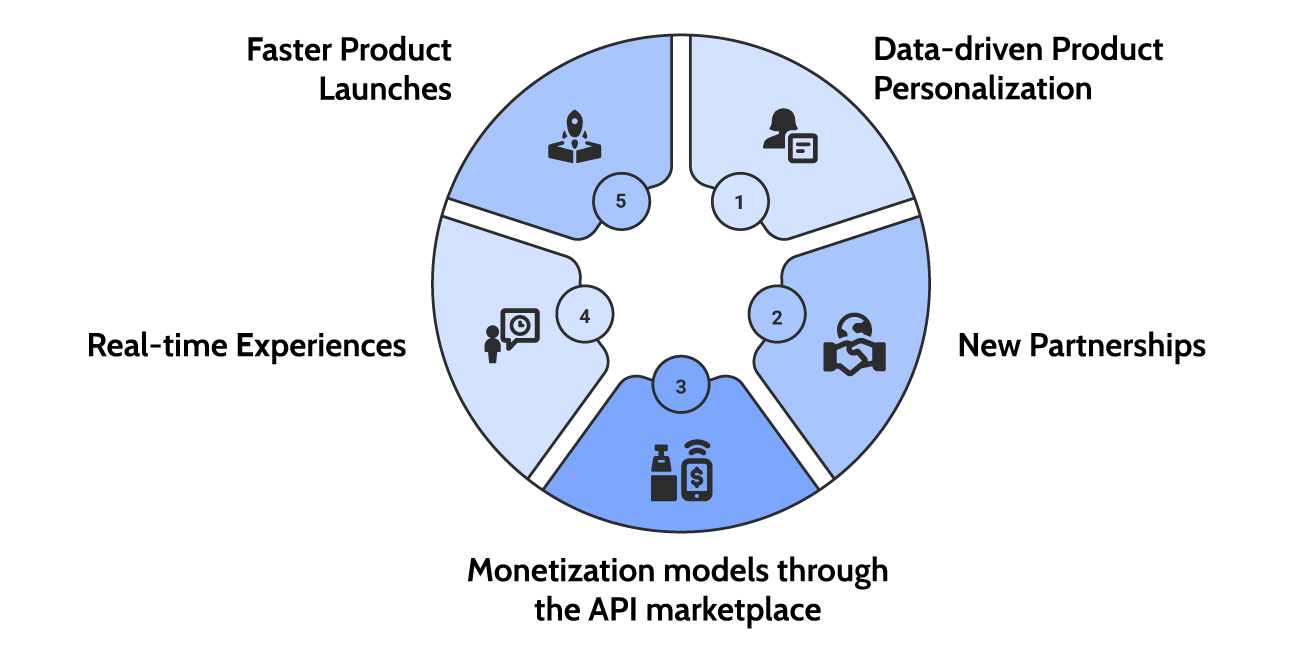

Because, in a real-time embedded, ecosystem-driven world, APIs are not just IT assets, but they are business enablers. When used right, a strong API strategy can unlock:

One of the most powerful advantages of a well-architected API strategy is that it can significantly power up your insurance distribution, elevate your customer experience, and expand your digital footprint.

It’s Time to Flip the Script on APIs

Instead of asking, “What data should we expose”, it’s important to ask: “What experiences do we enable?” Instead of designing API as endpoints, design them as journey triggers. These are the moments that will help in activating trust, conversion, and retention.

A Relatable Success Story

With the market turning its head towards relevant API strategy, one of India’s leading and standalone Health insurers has set its sights on something bold, expanding specifically into Travel insurance to broaden its spectrum of customers. However, with every new product launch came the same old friction. The behind-the-scenes hustle, teams wrestling with disconnected systems, piling up of manual tasks, and operational bottlenecks. What should have been a smooth journey, began to feel like running uphill with the weights strapped on.

Then came a major turning point.

They partnered with us to not just digitize their operations and move beyond the roadblocks but also reimagined their policy management backbone. At the heart of this transformation was our powerful, API- first Policy Administration system designed to orchestrate key policy management functions.

The Result? The processes that once took days to happen were now happening in real-time; a new business line of Travel insurance was seamlessly integrated into a single, unified platform.

But the biggest achievement that our API-first Policy Administration helped them with is the freedom to grow, innovate, and scale without being held back by the complexity of the past.

API first solutions are not just about integration today, but rather a catalyst that will improve sustainability and scalability in the long run.

If this seems relevant, reach out to us to find out more.