Despite sophisticated underwriting and marketing efforts, U.S. P&C Carriers face an average annual churn rate of 16 percent, meaning nearly one in six policyholders choose to leave at renewal time—a loss that compounds year over year into hundreds of millions in forgone premiums each cycle. Meanwhile, 41 percent of insured households actively shopped their policies at least once in 2023, driven by rate hikes and easier digital comparison tools.

This churn translates into steep acquisition costs—PwC estimates winning a new customer costs five times more than retaining an existing one—and puts constant pressure on combined ratios and profitability.

From Fire-Drill to Foresight: The AI Promise

Imagine swapping that last-minute reminder email for a precise, AI-driven signal:

- “Marshall, your homeowners policy shows a 75 percent risk of non-renewal next month.”

- “Let’s offer you a tailored bundling deal now—before you even start shopping around.”

That’s the power of predictive analytics. By harnessing historical policy data, claims patterns, and even external signals (e.g., local property-risk indices), AI models can score each customer’s churn risk and recommend the optimal intervention—days or weeks ahead of renewal.

Proven Accuracy of AI Models

- A recent hyperparameter-tuned AI strategy achieved 98 percent prediction accuracy on churn data, outperforming traditional statistical methods.

- Cutting-edge neural architectures like CCP-Net deliver 95.87 percent precision on insurance-sector churn datasets, demonstrating robust feature extraction and prediction capabilities.

These results aren’t lab curiosities—they translate into real world retention lifts. Guidewire reports that best-in-class carriers leveraging predictive analytics see “dramatic improvements” in retention and prime-growth opportunities.

From Prediction to Proactive Engagement

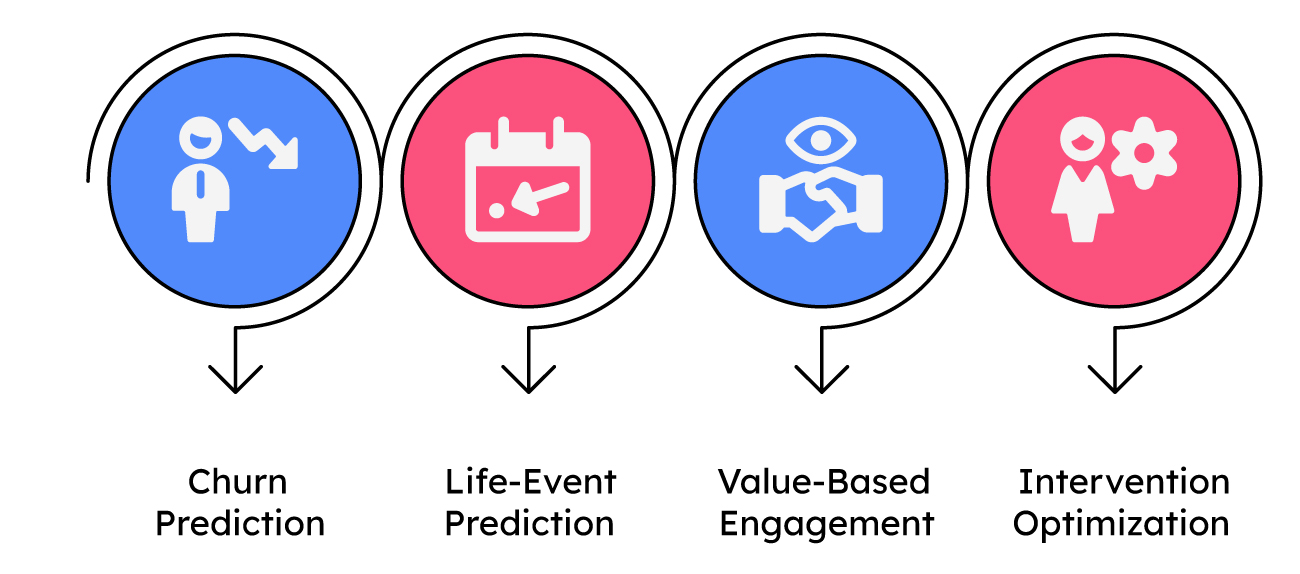

Predicting churn is only half the battle—what matters is when and how you act. Modern AI platforms enable several proactive engagement strategies:

Churn Prediction: Flag customers at high risk of non-renewal.

Life-Event Prediction: Anticipate major milestones (e.g., home purchase) that trigger coverage reviews.

Value-Based Engagement: Prioritize outreach to high-value policyholders.

Intervention Optimization: Pinpoint the best channel and timing for each customer.

For example, a carrier might deploy a tailored video walkthrough of coverage options to a high-risk auto policyholder two weeks before renewal—rather than bombarding every customer with generic notices.

Integrating AI into Legacy Renewal Workflows

Many carriers worry about the complexity of integrating AI:

Legacy Estate Age: The median insurer’s core systems are 18 years old, creating data silos and integration hurdles.

Data Governance & Compliance: AI models must be transparent, auditable, and adhere to state and federal insurance regulations—particularly around automated decision-making.

Yet, leading Carriers are overcoming these challenges by using modular AI platforms that wrap around existing policy systems, ingest data via APIs, and deploy models as microservices—minimizing disruption while unlocking predictive power.

Implementation Challenges for AI-Driven Renewal

While AI offers transformative potential, carriers must navigate several implementation hurdles to realize its full value:

- Data Quality and Completeness

Inconsistent or missing policy and claims records can undermine model training and lead to unreliable churn predictions. - Model Explainability and Trust

Regulatory bodies and internal stakeholders demand transparent AI decisions; black-box models must be supplemented with explainable AI tools to ensure auditability. - Integration Complexity

Embedding AI into monolithic policy administration systems often requires extensive refactoring, interface development, and change management. - Regulatory and Ethical Compliance

Automated interventions—such as dynamic pricing or targeted offers—must comply with state laws on discrimination, privacy (e.g., GDPR-equivalent U.S. statutes), and fair treatment of consumers. - Talent and Skill Gaps

Securing data scientists, ML engineers, and domain experts with insurance acumen remains a challenge, slowing project timelines and increasing costs. - Model Drift and Ongoing Maintenance

External factors—market shifts, new products, evolving customer behaviours—can degrade model accuracy over time, necessitating continuous monitoring and retraining. - Change Management and Cultural Adoption

Underwriting, sales, and customer service teams must embrace AI-driven insights; without proper training and governance, adoption can stall, limiting ROI.

Rethinking Renewal: The Strategic Imperative

Renewals are no longer just operational checkpoints—they’re strategic touchpoints. The data is clear: churn is costly, and customer expectations are evolving fast. Carriers that invest in AI-driven renewal strategies gain a competitive edge—not only in retention, but in operational efficiency, customer experience, and long-term profitability.

By embedding predictive models into legacy systems and designing proactive engagement paths, carriers can shift from reacting at the 11th hour to anticipating at the right moment. This is more than technology adoption—it’s a mindset shift toward customer-centric foresight.

As AI maturity accelerates across the insurance landscape, renewal transformation will no longer be optional—it will be a baseline expectation.

The question isn’t whether AI belongs in the renewal process. It’s how soon your organization will make it core to its retention strategy.