Imagine being a commercial underwriter and saying, “There’s just not enough hours in a day.” Well, rightly so, the adage resonates with the commercial underwriters as they have to deal with surmounting amounts of competition, limited visibility into risk factors as well as resource constraints which essentially hinders the comprehensive exposure analysis. These are the challenges which increasingly persist as insurers and program administrators/ managing general agents (MGAs) strive to enhance risk assessment capacity and proficiency. That’s where Gen-AI advancements offer solutions and relief which enables underwriting teams to alleviate capacity constraints as well as improve operational efficiency.

Keep reading to decode more about the role of AI in commercial underwriting!

A Quick Glimpse of How Gen-AI is Making Waves in the Insurance Industry

Before hopping onto the role of AI in commercial underwriting, it’s important to understand in brief its role in the insurance industry. 67% of executives believe that AI will be helping in improving customer service with automated and personalized support. Gen-AI is actively making waves in the insurance industry by automating repetitive tasks, extracting insights from the documents, and also supporting critical functions such as fraud detection, risk evaluation, and claim adjudication. This next evolution of technology which is offering reasoning and self-learning AI assistants increasingly promises to revolutionize commercial underwriting.

Additionally, Agentic AI in the form of cognitive, persona-based assistants can easily be tailored to the specific roles. This automates workflows and executes complex tasks with precision. By increasingly functioning as digital co-workers, these Agentic AI empowers the underwriters in focusing on high-value activities while gaining data-driven AI assistant support to manage essential responsibilities such as classification, risk appetite determination, and portfolio management.

Transforming the Commercial Underwriting Landscape with AI

The Commercial underwriting landscape has increasingly been plagued by unique challenges such as economic instability, technological disruption, cost reduction pressure, data management among others. While these challenges hamper underwriting, AI can cut through the noise and streamline processes.

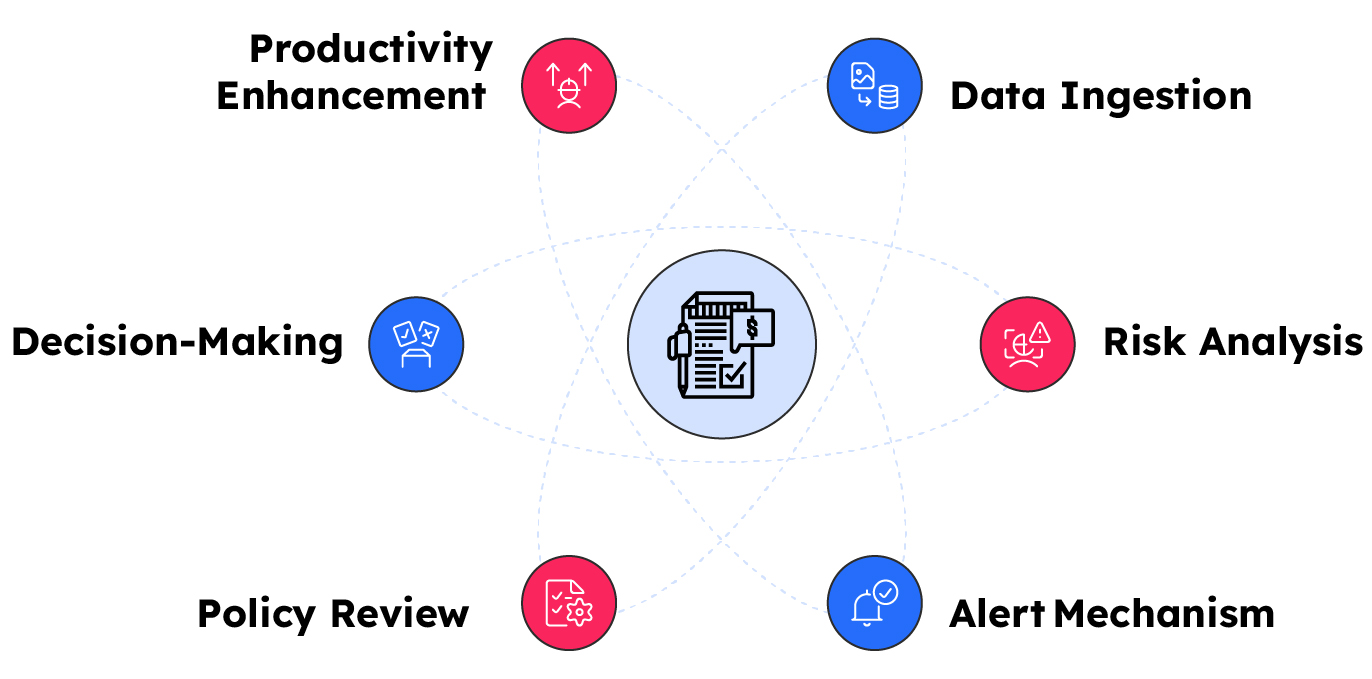

Here’s a closer look at how AI will be helping in transforming Commercial underwriting:

Data Ingestion

AI assistants effectively gather and process underwriting guidelines and real-time occupancy data for offering accurate insights

Risk Analysis

The AI assistant evaluates tenant occupancy data for identifying potential risks, such as high-risk tenants.

Alert Mechanism

When a high-risk tenant is detected, the AI assistant will immediately notify underwriters for timely policy reviews.

Policy Review

Underwriters review the property owner’s policy and adjacent tenant policies based on the alerts from the AI assistant.

Decision Making

Underwriters use the risk assessment insights which are offered by the AI assistant for making informed coverage and risk mitigation decisions.

Productivity Enhancement

AI assistants streamline the assessment of SMB policy submissions, and this ensures that they align with the risk appetite and addresses queries efficiently.

How Can AI Help in Strengthening the Premium Audit Processes?

Beyond underwriting, AI assistants are actively helping in optimizing various processes and also ensuring accurate coverage and price based on actual exposures.

Here’s how AI is helping in strengthening the premium audit processes:

Optimizing Premium Audits

One of the keyways that AI is helping in optimizing premium audits is by streamlining the audits for ensuring that there is accurate coverage and pricing which are based on actual exposures

Assessing Business Exposures

This is another one of the ways that AI is helping in strengthening the premium audit process. AI automates evaluating the business exposures and this is especially when operational changes occur rapidly

Automating Audit Tasks

This is another one of the keyways that AI is helping in strengthening the premium audit process. AI assistants automate tasks such as applying the insurer guidelines and also state-specific guidelines for submission of documents

Identifying the Information Gaps

AI assistants significantly detect missing or incomplete information, and this ensures compliance with the standards.

Enhancing Customer Experience

AI introduces accuracy and speed in operations which helps in expediting the processes.

How AI is Helping in Driving Enterprise Level Growth?

AI integration has been significant in driving enterprise level growth. One of the significant ways by which AI integration is driving growth in insurance is through redefining the regular operational processes and infusing efficiency and steadfastness into them.

Here’s a closer look:

Process Optimization

AI assistants effectively streamline underwriting and audits which accelerates the workflows and reduces costs significantly.

Enhanced Risk Evaluation

This is another one of the significant ways by which AI has been driving enterprise level growth. AI improves risk assessment accuracy and offers real-time insights for better decision-making capabilities.

Cross-Functional Unity

AI significantly fosters collaboration between departments, and this creates a cohesive and efficient operational ecosystem

Competitive Advantage

GenAI significantly empowers insurers to navigate through the complexities of the market, this enhances agility and also customer value.

Conclusion

As Gen-AI continues to make an impact across the insurance value chain, it will be helping a great deal for commercial underwriters to transform their regular operational processes and drive operational efficiency.