Picture this, you are a Health insurer who is relying upon manual workforce to handle volumes of claims- How do you feel? Overwhelming, isn’t it? That’s how many Insurers feel when they still rely on manual operations for handling volumes of claims. To streamline this, a robust and efficient Policy Administration system can take the center stage.

One of Maldives’ leading Islamic insurers was plagued by the complex challenge of manual operations and iNube’s Policy Administration System played a pivotal role in helping them downsize these challenges. This case study will dive deeper into their issues and how iNube’s technology streamlined their operations.

About the Customer

A leading Islamic insurer in the Maldives, our client is dedicated to delivering exceptional service and quality Shariah-compliant insurance solutions to all stakeholders, aiming to serve the wider community with valuable and forward-thinking services.

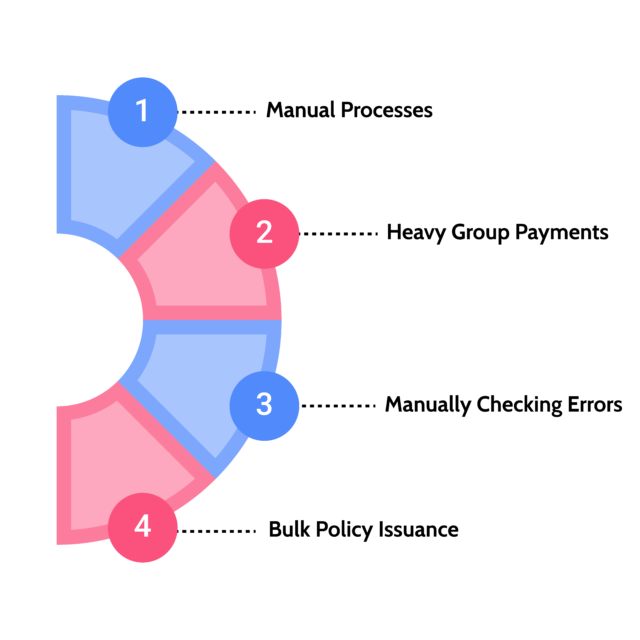

Exploring the Challenges Faced by the Insurer

iNube’s Implementation

Our robust Policy Administration system was implemented that helped the Insurer in achieving their goal of having an end-to-end policy administration system for Group and Retail policies in Health insurance.

Here’s a closer look at the different modules implemented:

User Management Platform

The client utilized a robust platform to customize and manage access for various business users.

Partner Creation Module

Enabled seamless partnerships with group and retail health insurers, accommodating their policy terms and preferences.

Master Policy Creation

The platform allowed the client to efficiently create policies in bulk for their diverse health insurance partners.

COI Creation

Automated the issuance of certificates of insurance for multiple policies without manual intervention.

Endorsement Module

The simple module digitized regulatory and compliance changes, eliminating the need for manual tracking.

Renewal Module

Automated policy renewals, removing the need to manually monitor pending renewals

Reporting and Analytics

Generated reports and enhances visibility into policy issuance, transactions, and other financial details.

View Policy

Increased visibility in claims processing and policy issuance status eliminated manual tracking.

Accounting module

Enabled the tracking and management of policy issuance payments from partners and claim payments for policyholders.

Reinsurance

Automated the distribution of policy risk to reinsurers, eliminating the need for manual risk analysis.

Business Benefits that Bespoke Operational Excellence

- Bulk Policy Issuance

- Automated Reporting

- Enhanced Operational Efficiency