Modernization remains at the forefront of the insurance industry today. Additionally, cloud computing has emerged as the foundational driver of innovation as well as efficiency. However, not all cloud strategies are treated equally. The true value of it lies in the effective optimization for the three S’s which are Security, Scalability, and Speed. This is extremely essential for the long-term success of the digital insurance ecosystem. 90% of insurers have a formal, long-term technology innovation plan that includes cloud.

Wondering how it will ensure security, scalability, and speed? Keep reading to decode!

Security is Beyond Just Compliance

We are living in an era where insurers handle volumes of sensitive policyholder information, which includes policyholder data. In this scenario, cloud adoption is not just optional but an essential necessity. In fact, leading insurers are now turning to cloud-native frameworks that offer real-time threat detection, data encryption, and secured identity management.

It’s imperative for insurers to choose vertical-specific cloud solutions that are well-equipped with insurance-grade compliance requirements.

Scaling the Digital Infrastructure as the Risks Evolve

While insurers need to know the importance of understanding the specific regulatory compliance for cloud-based solutions, scalability remains another crucial aspect for its effective adoption.

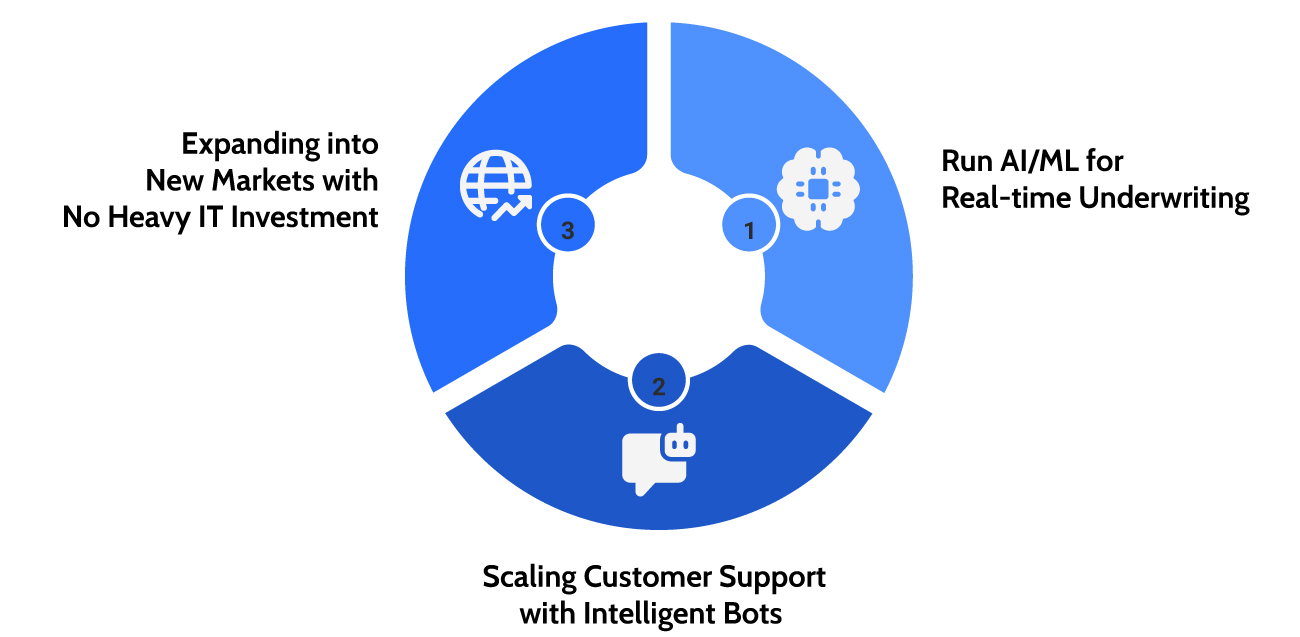

Right from handling the spikes in claims processing post-disasters to onboarding the new digital channels, scalability is the backbone for agile insurance operations. One of the important things to note here is that with the power of elastic computing power, insurers can:

Run the AI/ML Models for Real-Time Underwriting

The cloud platforms essentially offer on-demand compute power for processing vast amounts of datasets which enable dynamic pricing, and also instant quote generation which will be based on real-time risks.

Scaling Customer Support with Intelligent Bots

The cloud-native chatbots are well-equipped to handle higher volumes of customer queries across different channels, including offering round-the-clock customer service with much-reduced reliance on human agents.

Expansion into New Markets without Any Heavy IT Investment

Cloud adoption essentially eliminates the need for local infrastructure which allows insurers to rapidly launch digital operations in new geographies at much lower costs.

Understanding Speed- Accelerating Innovation and Claims

Speed in the cloud is not just about performance, but it’s also about the time-to-market. Insurers who are actively using Saas platforms can launch new products much faster shooting up to 60 percent. This is way faster than those with legacy systems. The cloud’s low code no code capabilities essentially empower business users to configure products, workflows, and journeys without having any deep IT dependencies.

While discussing speed, speed in faster claims management cannot be ignored. With cloud-powered automation and AI, insurers can significantly shorten the claims cycle from days to minutes. For instance, image recognition for motor damage or AI-led FNOL (First Notice of Loss) significantly reduces human intervention, allowing real-time triage as well as faster claims settlements. This step plays a pivotal role in improving customer satisfaction while also reducing claims leakage and operational overhead.

Speed and cloud architecture play an immensely important role in allowing insurers to access real-time data, for instance through mobile apps for surveyors. The insurers will be able to make instant policy changes and dynamic workflow routing which will help them ensure faster approvals and with much fewer delays.

Understanding the Strategic Advantages of Cloud Insurance

It’s important for insurers to understand that Security, Scalability, and Speed are the technical pillars that insurers need to be aware of, but apart from these technical pillars, there are also some strategic advantages that insurers cannot ignore. Here’s a closer look at them:

Smarter Decision Making

One of the most strategic advantages that insurers can reap is by prioritizing cloud adoption. Cloud technology enables the integration of structured and unstructured data from multiple sources- policyholder behavior, IoT devices, and claims history into a unified view. This significantly empowers the underwriters and actuaries to make faster, and more accurate decisions by using real-time insights.

Reduced Dependency on Legacy Systems

Outdated core systems are extremely costly and inflexible. However, with cloud modernization, there is a significant reduction in technical debt, allowing for much smoother upgrades, and also supports interoperability with modern digital tools via APIs

Predictable IT and Lower Operational Costs

Cloud technology significantly eliminates upfront capital expenditures. Instead, the insurers will be paying for usage-based computing, which essentially leads to much more predictable operating expenses and much better budget control.

Faster Global Expansion

Cloud technology significantly allows insurers to enter new markets much faster by spinning up digital operations, which includes web portals, CRM systems, or quote engines without having the need for setting up physical IT infrastructure.

Resilience and Business Continuity

Cloud infrastructure comes with an in-built disaster recovery, automatic backups, and global redundancy. This essentially ensures that insurers can significantly maintain service continuity even during outages or localized disruptions.

Cloud Adoption- Not Just a Tool but A Competitive Edge

From weighing the fears of cloud technology to maximizing the value of cloud adoption. Today, in 2025 cloud adoption is not just a tech trend but more- It’s about creating a secure, scalable foundation for the digital-first customer experiences, powering up real-time underwriting, claims, and fraud prevention, accelerating product innovation without any infrastructure constraints and building regulatory-ready systems with built-in compliance and also enables seamless collaboration across agents, partners and ecosystems. The bottom line is that in a world where insurance operations are defined by speed and uncertainty, clouds are not an option. It’s all about taking advantage of the race to relevance.