Piles of files and paper flying, juggling spreadsheets of policy data, and the teams stretching thin to try to meet the CMA’s compliance timelines. If these scenarios seem familiar to you, then you are likely caught in the loop of outdated policy management systems.

Another uncomfortable truth is that- manual policy administration is holding insurers significantly back. Outdated policy management systems will now take a back seat as newer technology makes its way into the Omani Insurance industry.

Will the upgrade be a cakewalk for insurers who relied on outdated technology for years? Keep reading to decode more.

Technology is Evolving, Are you too?

It’s time to acknowledge the truth- upgrading to a modern policy management system is not just about any tech upgrade, its’ about survival. Customer expectations are taking a rapid turn with rapid regulatory changes. Oman still relies on legacy systems which not only slows down their policy issuance but also exposes them to fraudsters and frustrated policyholders.

This is not a future problem, but it’s an operational bottleneck today. A modern policy management system is not just a “nice-to have” – but it holds the meaning behind scaling confidently or falling behind.

Insurance Virtual Office is More than Just A Necessity in Oman Insurance Market- The Truth

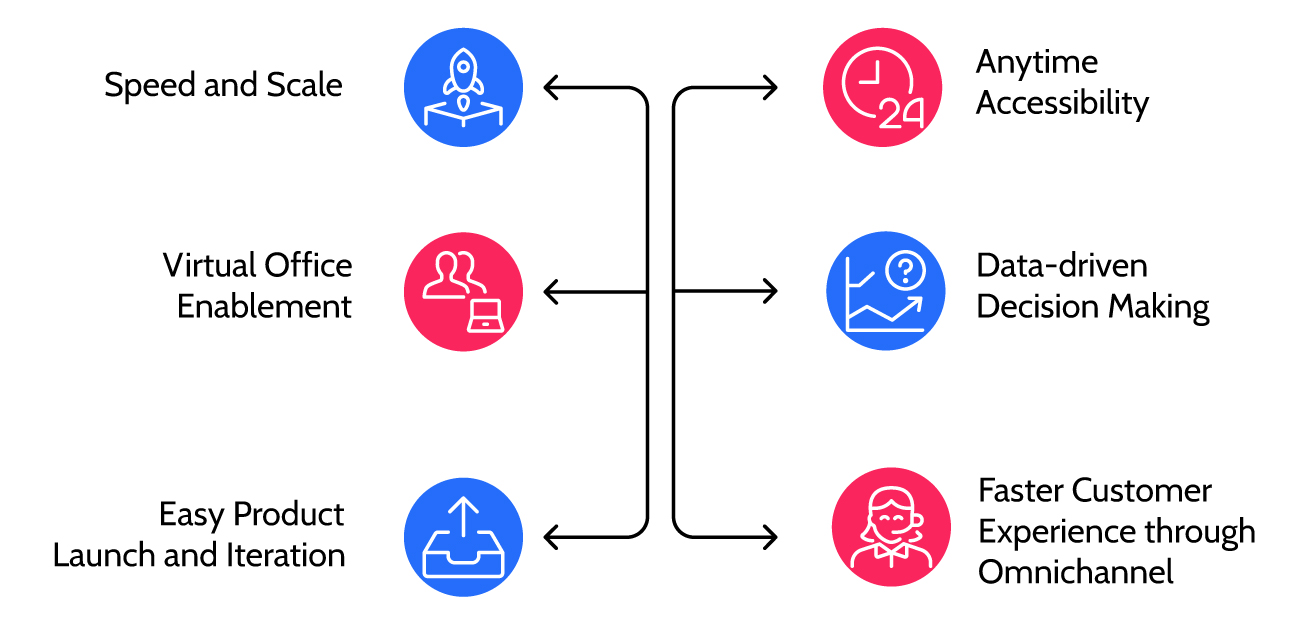

Outdated technology and processes will go for a toss as the insurers acknowledge the growing necessity of modernizing their policy management processes. Here are the key reasons for a more strategic necessity of an upgraded policy management system in Oman:

Speed and Scale

A traditional policy would take hours or even days to process and with an upgraded policy management system in Oman, the insurers can issue policies faster- literally in minutes. This is extremely critical for high-volume segments, which include Motor, Health, and SME.

Anytime Accessibility

Today customers are expecting a more engaged experience via mobile, web, call canters, or agent visits. However, with an omnichannel platform, insurers can ensure that no matter where the policyholder is, they will experience consistency and efficiency.

Virtual Office Enablement

A virtual office solution effortlessly integrates policy management, document generation, payments, and servicing in one interface. This empowers the insurance agents and the distributors with digital tools for selling and servicing policies remotely.

Data-driven Decision Making

An advanced and modern policy management system will enable insurers to get access to real-time analytics and dashboards. This helps in tracking sales performance, policy persistence, and risk exposures. This calls for more critical strategic planning in a more rapidly evolving market like Oman.

Easy Product Launch and Iteration

This is another one of the pivotal reasons that calls for a strategic necessity for an upgraded policy management system in Oman. With a configurable product engine and no-code workflows, insurers can easily roll out new products or tweak the existing ones without having to get months of IT support. This agility will essentially be important for reacting to market shifts and regulatory changes as well.

Faster Customer Experience through Omnichannel

An upgraded policy management system will help enhance customer experience. Whether it is a policy query on WhatsApp a renewal on the mobile app or an in-branch endorsement, an omnichannel platform will ensure that the customers receive consistent and real-time customer service which is essential for retention in a competitive market.

Why Trading with Comfort can Unlock Potential for Omani Insurers?

As the insurance industry becomes more digitized, the insurers need more than just a back-office upgrade. They need a more agile, unified, and connected ecosystem. This is exactly where an insurance virtual office will come into the picture. When an insurance virtual office is integrated with a modern policy management system in Oman, it transforms the way how insurers issue, manage, and service policies across every touchpoint.

Here’s how an insurance virtual office will be adding a strategic value to the insurance industry in Oman:

A Centralized Digital Workplace for Agents & Partners

An insurance virtual office acts as the digital hub for insurance agents, bancassurance partners, brokers, and relationship managers. It acts as the centralized hub for managing quotes, issuing policies, tracking leads, and serving customers – all this from just one login. This essentially eliminates the dependency on physical branches or manual paperwork, this is especially important for a more geographically more diverse market such as that of Oman.

Seamless Integration with the Policy Management System

An insurance virtual office is fully integrated with a modern policy management system, which allows the agents to access real-time policy status, pending renewals, and customer history. This seamless integration will ensure accuracy, faster turnaround times, and reduced work.

Omnichannel Servicing Made Simpler

A modern-day Virtual Office solution supports end-to-end policy operations across multiple channels which include mobile, desktop, and even WhatsApp. This truly makes for an omnichannel platform. It does not matter whether a customer initiates a policy online or walks up to a branch, the experience will remain consistent and frictionless.

Performance Visibility and Sales Enablement

An insurance virtual office offers a smart dashboard and KPIs for tracking sales performance, agent productivity, and renewal pipelines. Managers can easily monitor performance at a regional, individual, and product level. This helps in driving smarter decisions and targeted interventions.

It’s time insurers move past outdated technology and embrace agility with a modern policy management system that is designed not for yesterday but for today, tomorrow and the future.