Do you know what a red flag in insurance operations reliance on legacy systems is? While insurers acknowledge the necessity to modernize legacy systems, it’s important to understand how a minimal disruption process will help in strengthening the end-to-end policy management functions. Hence, it makes a lot of sense that 68% of insurers are actively planning on increasing their investments in application modernization.

Keep reading to dig deeper!

Signs that it’s Time for Core System Upgrade

Acknowledging that your legacy systems are letting you down is one of the first and pivotal steps toward transformation.

Here are the top three signs that are loud and clear for you to understand that it’s time to upgrade to modern-day core systems:

Complex Difficulties in Emerging Distribution Channels

The changes in the Insurance industry increasingly mean that there has to be no reliance on the traditional ecosystem partners for selling and distributing your products. In this scenario, it’s becoming important to implement APIs and digitize the entire policy distribution system.

Being unable to plug seamlessly into the new distribution channels can lead to missing out on a lot of incredible opportunities. Can you guess the result? Fragmented customer experiences and partner integration challenges. The legacy systems are the common culprit for all these issues as they do not offer modern rating engines, open APIs, or digital cloud-based tools which are needed to expand the reach.

Slow Go-To-Market and Expensive Product Development

The risk coverage landscape is rapidly changing and there are multiple opportunities for insurers that are emerging. As the opportunities increase, insurers need to be at the forefront of creating and distributing new products as soon as possible to capture as much of the market as possible. Do you think operating on legacy systems can help you achieve this? Certainly, not! These systems will cause increasing problems for you to launch new products faster across different channels. The underlying issues that manifest themselves include- slow time-to-market, high operational costs stemming from manual processes, product inconsistencies across channels, and limited iteration possibilities.

Legacy systems are often in need of manual product configuration at multiple places to support different channels. Additionally, these do not support a hassle-free process across these products. This includes distribution, underwriting, policy management, the claims process, and more. These are rigid processes and there is hardly any agility in the approach which leads to a much longer time needed to launch products spanning months. The result? Exorbitant amounts of product launch costs!

Deteriorating End-User Experience

One of the major red flags for any insurance company is poor experience. Today we are living in the age of AI, where insurers are actively pacing up to offer personalized services to customers in order to enhance their experience. From getting personalized policy recommendations to getting a quote for making a claim and getting help, the end customers are actively seeking enhanced user experience. In this scenario, legacy systems are a roadblock. With legacy systems, the processes are slow, and the information is not right, and this can introduce delays in information access, leading to a negative user experience. This loss of customers can directly hurt growth and hamper your overall standing in the market.

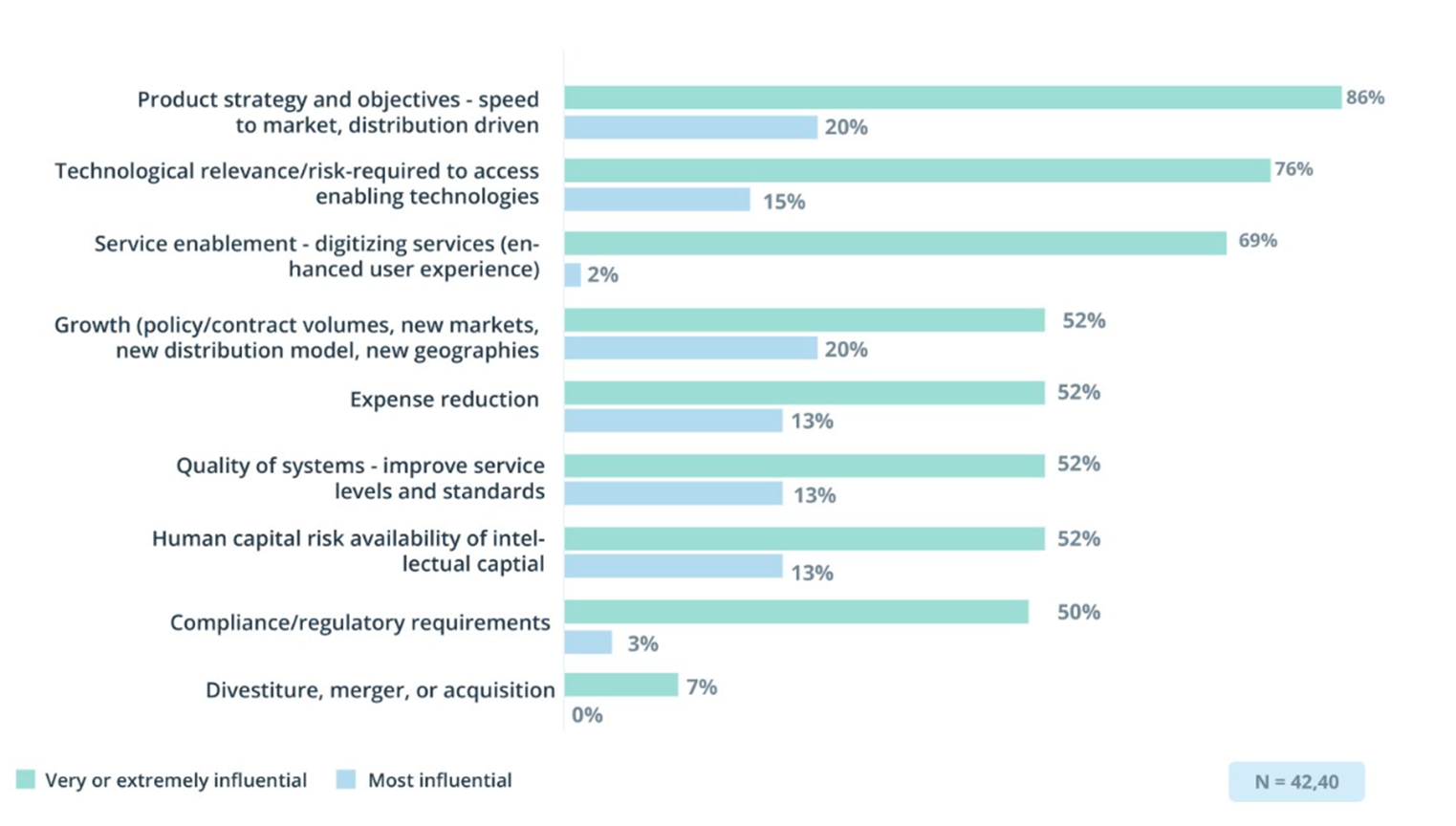

What is the Driver for Technology Investment?

As legacy systems age and advancements in the technology space make their way, modernizing core systems is taking the central focus for insurers. However, the main driver for increasing technology investment is the increasingly competitive operating environment. This is closely related to increasing customer retention.

Here’s a closer at the drivers of technology investment in insurance

Source: Deloitte

How A Minimal Business Disruption Path Look Like in Modernizing Legacy Systems?

The three key approaches that can significantly help in modernizing legacy systems and offer a minimal business disruption path are:

Federated Approach

With a modern-day core system, the responsibilities will be decentralized and distributed across different organizational units.

For Minimal Disruption: Emphasizing strong communication and collaboration between the central IT team and business units to ensure that the modernization strategy aligns with the specific needs and workflows. Thus, allowing for more targeted and less disruptive changes.

Centralized Approach

Modernizing a core system would offer a centralized approach and also there will be minimal disruption. This simply means that modern-day core systems can seamlessly fit and exist with pre-existing systems, with the corporate IT team managing the modernization effort.

For Minimal Disruption: Focusing on well-defined APIs and data exchange protocols for ensuring smooth working between independently modernized systems, thereby minimizing the risk of future integration-related disruptions.

Hybrid Approach

A modern core system effortlessly balances tasks by assigning some responsibilities to the central unit while also giving them to others for different organizational units.

For Minimal Disruption: Clearly defining the responsibilities of the central and distributed teams with the central focus can be shifted to non-disruptive foundational upgrades. Additionally, offering tools and frameworks while the business users can focus on managing the user-facing and process-specific modernizations in a way that minimizes the impact on insurance operations.

Conclusion

Modernizing legacy systems with minimal disruptions can significantly enhance operational efficiency and end-user experience for insurance companies. Strategic adoption of modern core systems is the key to future scalability and growth.