The digital disruption in the South African Insurance industry is real and more so with the rising digital expectations, stricter compliance mandates, and also the growing need for instant self-service experiences, Insurers across the region are under constant pressure to evolve and in a much more expedited manner.

However, what’s uncomfortable is that while customer-facing touchpoints are modernizing, the backbone of the industry- policy management system is still stuck in the times of relics.

If this statement stirred up a thought in your mind, then keep reading ahead while we explore the top 5 silent red flags that indicate it’s time for an upgrade.

Top 5 Signs to Upgrade to A Modern Policy Management System

Prevention is better than cure, and the saying holds perfectly true for older policy management systems which downsize the insurer’s capabilities in policy management significantly.

Here are the top 5 signs that you need to acknowledge before upgrading to a modern policy management system:

Still Wrestling and Juggling with Manual Process?

Do you still require a battalion of people to help you with issuing, endorsing, or renewing a policy? This is the silent red flag that you are ignoring. These crucial tasks today are done in minutes. Multiple teams, emails, and spreadsheet gymnastics are not just inefficient but also highly risky.

Manual processes significantly increase the chances of human errors, delays, and compliance breaches. This especially holds for a digital-first market such as South Africa, where even the smaller players are taking up the advantage of a cloud native solution. Amid this transition, using older technology for policy distribution and management causes a significant erosion of customer trust. In fact, in 2023, 60% of insurers cited “manual operations” as the key barrier towards scalability.

Absence of Customer Self-Service and They Are Not Happy About It

Today, every policyholder wants control and that too on their terms. The need for real-time status updates is quite high. Today, the policyholders want to view their policy, make changes to their information, or file claims without having to call a branch or wait in queues.

With outdated policy management systems, these facilities are not available as these technology platforms are not flexible enough to accommodate self-service portals. The policyholders will not get access to mobile responsiveness or real-time access to policy data. This is where the actual threat lies- insurers are losing customer loyalty day by day.

Still Struggling to Launch or Modify Products Quickly

South Africa has a diversified Insurance market- usage-based insurance, agriculture-linked covers, and microinsurance are the growing segments. But there lies one hindrance; legacy policy management systems are not built for speed.

If launching a new product or adapting to an existing one takes months, then your system is strongly working against the business strategy and not enabling it. Only 77% of insurers see the digitization of internal systems as critical for scaling expansion. With the rise of low-code policy platforms, insurers will be able to tweak rules, pricing models, and workflows without touching code. This is where legacy technology can cause real roadblocks.

Workarounds Increasing? That’s Where You Need to Rethink

One of the silent red flags is internal fatigue. Are your underwriters, brokers, or policy admins relying upon personal Excel sheets or offline tools for getting things done? That is the biggest red flag. The modern systems are specifically designed for the end user in mind, right from the insurance agent to the customer. If your teams are frustrated, then, it’s not their resistance to change, but your tech holding them back.

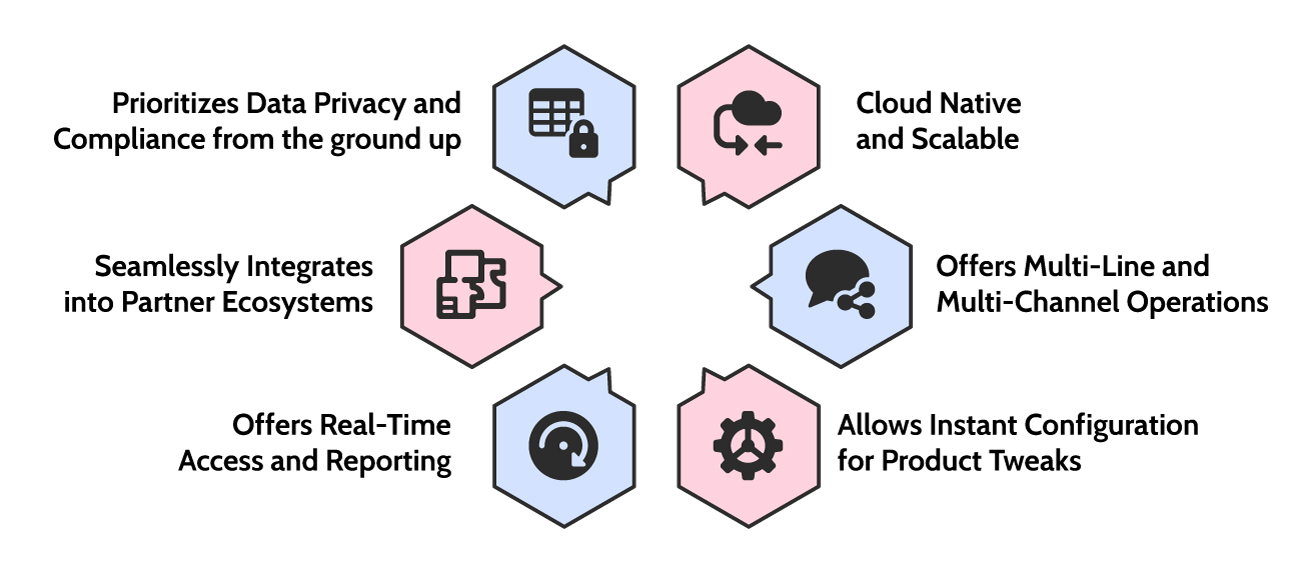

Take a Look at the Modern-Day Policy Management System

Not Just A Tech Upgrade but A Growth Strategy

Policy management systems are not just any tool, but they serve as the engine for innovation, agility, and trust. With digitization taking over the insurance market, legacy thinking will no longer support modern ambition.

If you notice any of these signs, then it’s time to take them seriously. Because customers are already ahead.

Time to not acknowledge the red flags and take action that leads not just nurtures.