The Life Insurance sector has traditionally relied on extensive agent networks and face-to-face interactions which is undergoing a profound transformation. As the digital transformation in the insurance industry slowly grasps a larger part of the whole market, the Direct-to-Consumer (D2C) distribution is no longer an emerging trend, rather it’s a strategic necessity. Today, policy isn’t just an assurance but a way for insurers and policyholders to build a lasting relationship that is more human, and value-driven.

However, multiple challenges lurk in the D2C distribution of Life Insurance, and iNube’s robust D2C integration helped one of India’s largest Life Insurers tackle these challenges seamlessly.

Diving into the Complexities of Life Insurance Distribution

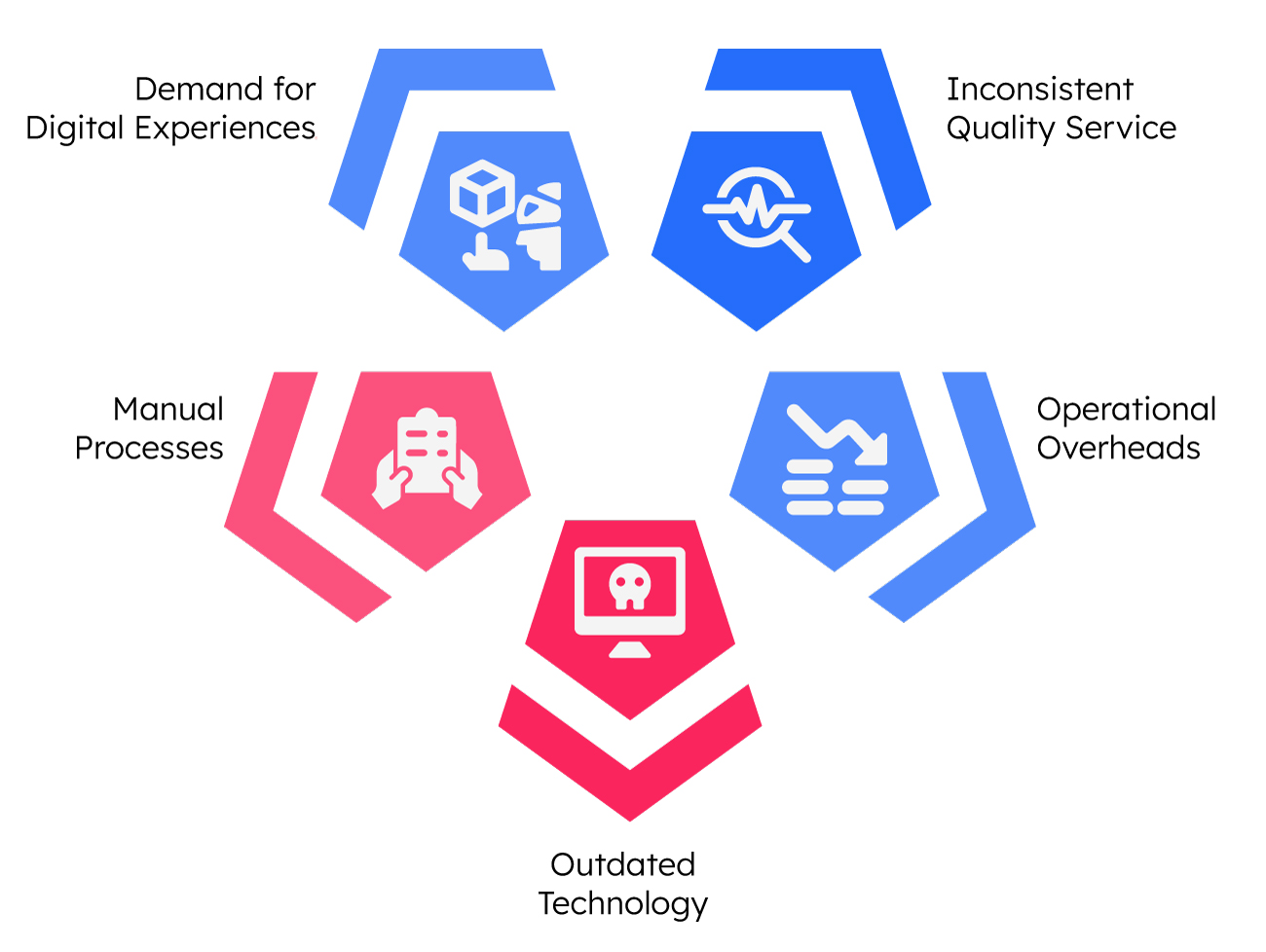

Life insurance is an intangible and often complex product, which has historically faced a lot of challenges in its distribution. Here’s a closer look at these challenges:

Inconsistent Quality Service

The quality of service which is offered in a non-digital Life insurance distribution is quite inconsistent. It varies significantly between individual agents, which leads to potential miss-selling and erosion of trust.

Operational Overheads

One of the most critical challenges that comes in the way for traditional Life Insurance distribution involves a huge amount of administrative costs that comes from managing a large agent network.

Outdated Technology

Outdated technology poses a significant threat to the smooth distribution of Life Insurance products. 74% of Life Insurers use legacy systems for critical functions such as pricing, rating, and underwriting.

Manual Processes

While reliance on legacy systems is a significant challenge, manual intervention in crucial operations of distribution processes such as from quoting to underwriting, still involves a significant amount of manual intervention which leads to errors and delays.

Demand for Digital Experiences

As the insurance industry rapidly keeps pace with increasing technology adoption, modern policyholders are accustomed to seamless digital experiences that would save their time and effort significantly.

Why D2C Platforms Hold Importance in the Life Insurance Sector?

D2C (Direct-to-Customer) integration is not just an alternative, rather it is a strategic step towards crafting the seamless policy distribution journey. With a D2C integration, insurers can slash acquisition costs and deliver superior 24/7 customer experience with personalization and simplified digital journeys. These policy distribution channels significantly help in offering first-party data for product innovation and also boost customer retention.

Additionally, a D2C platform helps in driving operational efficiency via automation enables faster product launches and also helps in market expansion for reaching digital-first customers, and ensures sustainable growth.

How iNube Helped India’s Largest Life Insurers?

India’s largest Life Insurers acknowledged their need to chart a superior policy distribution journey for the customers by upgrading their existing policy management systems. However, they were plagued by multiple pivotal operational challenges which caused a significant hindrance on the way to the fulfillment of their need. Here are the challenges that they faced:

High Processing Time

The Life insurer despite having a technology infrastructure, relied on manual operations which increased the delays through the policy management stages and its processing.

Operational Inefficiencies

The insurer had fragmented operations at all stages which led to slow policy creation.

Customer Dissatisfaction

The insurer dealt with higher policy durations which resulted in poor customer experience via the agents.

Scalability Challenges

In addition to reliance on manual operations, the Life insurer faced serious scalability issues. Their existing infrastructure could not efficiently handle the growing volumes of policies and customer data.

How iNube Tackled the Challenge in Under 150 days?

To address the challenges, iNube implemented a robust POLICY SUITE, that offered a comprehensive digital platform that seamlessly integrated into the policy administration system for all stakeholders. This included a Virtual Office for Agents and a crucial Digital Onboarding platform for Direct-to-Customer (D2C) web customers.

The solution automated the workflows from quote generation and underwriting decisions (STP/NSTP) claims to Pre-insurance video verification for D2C journeys, thereby significantly cutting down on policy issuance time. In addition to crafting a smooth customer journey, our solution enhanced the administrative tasks of the insurance agents while ensuring data security with agent confidentiality reports and consent forms.

The critical integrations for CKYC and payment integrations reduced the turnaround times. With customized portals for agents, customers, and bancassurance partners along with self-service options for customers and real-time dashboards, iNube significantly played a pivotal role in ensuring user-friendly, efficient, and transparent policy issuance channels across all channels.

As the days progressed, the Life Insurers could visibly see a transformation in their operations. iNube crafted a seamless customer journey and helped the insurer connect better with policyholders, all while harnessing the benefits of modern-day insurance technology.