Here’s a situation that most of the insurers in 2025 face- imagine getting a brilliant idea for a new insurance product, it could be embedded coverage for travel, usage-based motor insurance, or any other product. You and your team are excited for the launch. The market is quite ripe too but six months later, you experience something that you did not expect. You are still tangled in approvals, legacy system IT troubles, and siloed workflows. Did this strike the right chord?

Well, if so, then, it’s not the idea that is broken but the system that you are building upon.

Let’s unpack how SaaS solutions can help in reshaping product development for insurers while also slashing the time-to-market, enabling real-time personalization, and giving insurers the agility they need to compete in a digital-first world.

It’s Time to Break Free from Traditional Product Development

Imagine a situation where your product team will be identifying an opportunity for launching a microinsurance product that is tailored for gig economy workers. The idea is quite strong which is backed by data and demand, however, by the time your IT team will be scoping the requirements, configuring the policy rules, and integrating it to the core system, and going through the compliance- it will already have been 9 months.

The market today has shifted significantly; chances are that the competitor has launched something similar already. Your team is back in square one. Unfortunately, this is the sad reality for many insurers which are filled with slow, rigid product development pipelines that just keep up with evolving customer needs and market trends.

How Can Insurance Software Solutions Help Build Insurance Inside Out?

Today, insurance software solutions are not just a part of the innovation strategy, but they are the reality. These solutions offer cloud-based, modular, and API-first solutions which significantly allow the insurers to design, test, and launch products much faster, and that too without being weighed down by the legacy core systems.

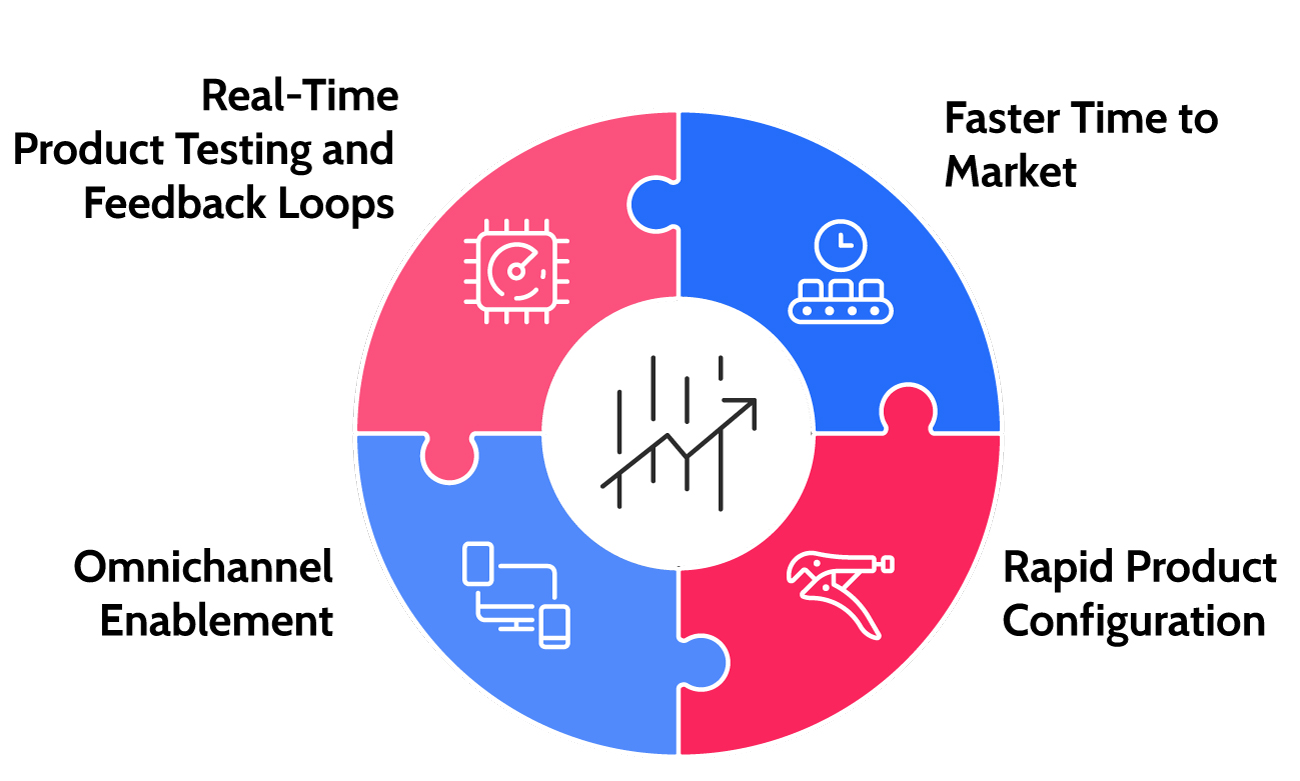

Here’s how these solutions can help reinvent insurance inside out:

Faster Time to Market

In an era where there is a short attention span and high competition, speed is crucial for survival. With SaaS insurance solutions, insurers can launch products much faster in weeks- be it cyber insurance, travel add-ons, or wellness-linked health plans.

Rapid Product Configuration

Forget months of development, with insurance software solutions product teams can easily configure coverages, pricing models, and underwriting rules in a matter of days, using intuitive drag and drop interfaces, no-code engines, and reusable templates.

Omnichannel Enablement

With API and microservices, the new products can be instantly distributed across digital channels, agent portals, partner platforms, and embedded insurance ecosystems which can all be given under one single unified platform.

Real-Time Product Testing and Feedback Loops

With modern insurance software solutions, insurers can easily test a new pricing strategy or modify a feature based on customer feedback. With modern-day agile SaaS insurance solutions, iteration becomes a living process and not a post-mortem exercise.

What is Fueling the Rapid Adoption of Software-as-A-Service?

The rapid adoption of SaaS solutions is being fueled by the transformative industry trends that are shaping insurance today. Here are the trends in brief:

Digital-First Customer Expectations

Today the customers expect and want personalized products, instant quotes, and seamless claims. SaaS software solutions allow insurers to meet these demands through real-time personalization and integrated digital journeys.

Cloud-First Strategies

As most of the insurers will be migrating core functions to the cloud, SaaS solutions easily become the natural choice for agility, scalability, and cost-effectiveness.

Insurance and Technology Collaboration

Many SaaS insurance platforms are specifically designed to work in tandem with Insurtech partners, which enables rapid innovation through a plug-and-play ecosystem.

The Future is Modular and Insurance SaaS-Driven

The next frontier in Insurance is not just about policies but about platforms. As the insurers face pressure to innovate and adapt, insurance SaaS software solutions enable a shift from ‘Projects’ to ‘Products’, which essentially translates from slow launches to continuous delivery models.

It does not matter whether you are building embedded insurance solutions, parametric products, or real-time engines; a SaaS-based architecture is your ultimate launchpad. Well, the best part about it is that you don’t need to rip and replace. Most of the modern SaaS platforms integrate seamlessly with legacy systems, which enables co-existence models to deliver value right from day one.

Are you Building Past or the Future?

Insurance is a highly disruptive market, and the customers are constantly demanding more every day, which must make them ask- Are we building products the old way or the smart way? The insurance SaaS solutions specifically give you the tools, speed, and flexibility to create products that aren’t just competitive but also truly customer centric.

It is not just about technology, but it is about a shift in mindset. A path to agility and also a gateway to insurance innovation.