The life of an insurance agent is a whirlwind. When it comes to doing business, they are known to juggle multiple goals, from lead generation to the constant pressure of closing deals. Every minute counts, and the hours in a day might feel like a lot less. What if there was an easy way out for this? What if insurance agents can reclaim their precious time and, more importantly, accelerate the sales cycle? If you are thinking that working hard is the answer, then you might be wrong. Working smartly is the answer. This is where modern Insurtech solutions come into the picture. That not only helps the insurance agents in their operations but also helps them in closing the deals 5x faster.

Taking A Look at the Traditional Challenges- Why Sales Can Be Slow?

A typical week in an insurance agent’s life looks like a lot. From spending hours in manual data entry to sifting through disorganized email. These are the traditional methods, while familiarity can create a lot of significant bottlenecks in the sales process. Getting leads can be quite tough for an insurance agent, especially when they are under heavy pressure from heavy administrative tasks. Opportunities can significantly slip through the cracks, which can lead to delayed follow-ups. The volumes of manual work can substantially stifle your ability to focus on what truly matters, which is building long-term customer relationships as well as closing the deals.

Technology that Can Help Close Deals 5x Faster

Today, digital tools contribute immensely to transforming the traditional, time-consuming insurance sales process into a seamless, fast-moving experience. It starts with pre-filled client data that is taken from the CRMs, past policies, or public databases. This significantly eliminates manual data entry and also reduces errors.

Automated Underwriting Questions

With automated underwriting, there is a lot of time and effort saved. Automated underwriting questions dynamically help in adjustments which are based on the client responses and allow the agents to gather all the necessary risk information in one conversation without having to follow up.

Instant Quote Generation

Once the data has been collected, instant quote generation kicks in, which increases the live rates from integrated insurer systems and presents the best-fit products in seconds.

Digitizing Agent Proposals

Additionally, leveraging technology for digitizing agent proposals can also save a lot of time for the insurance agents. Agents can customize and share digital proposals on the spot, while with e-signature tools, insurance agents can actively ask customers to sign and bind coverage immediately. This includes no printing, scanning, or mailing.

Auto-Generation of Policy Documents

There are multiple Insurtech platforms that can help insurance agents in auto-generating policy documents. Auto-generation of policy documents and instant shares leads to the completion of the full sales cycle in a streamlined workflow.

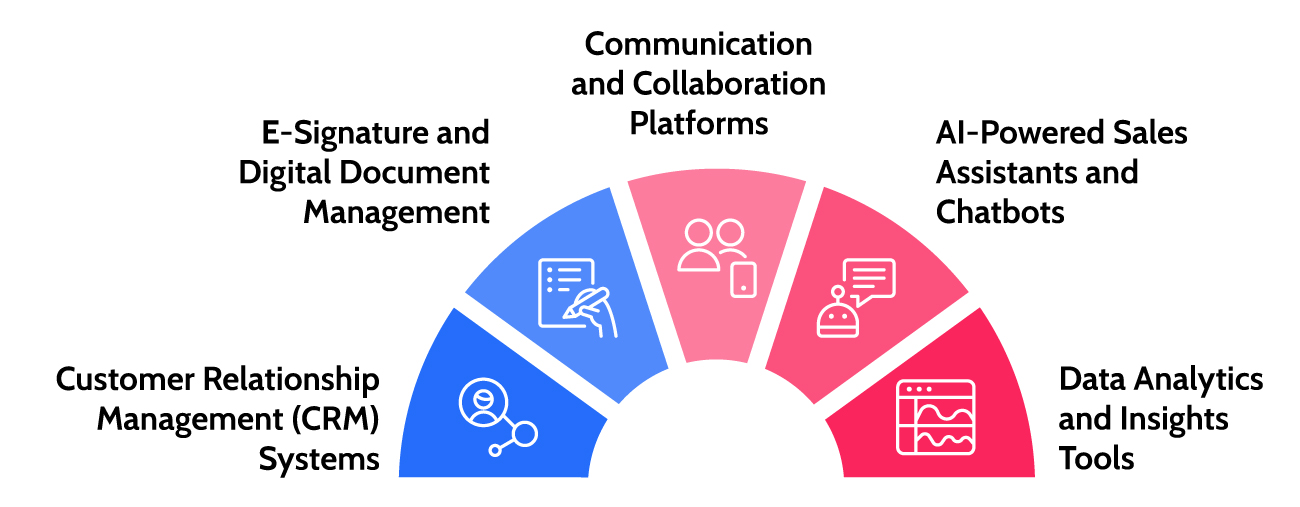

Discovering Specific Technologies and Their Impact

Specific technologies are revolutionizing how insurance agents operate and close deals. Here’s a closer look at them:

Customer Relationship Management (CRM) Systems

You can think of CRMs as the digital hub for all things that are customer related. The modern CRM systems are specifically designed for insurance professionals, which can allow them to effortlessly track leads from initial contact to policy completion. 77% of insurers are focused on developing digital channels to enhance customer interactions and CRMs can significantly help insurers to achieve it. There are multiple features which the modern CRMs offer, including automated follow-up reminders for ensuring no lead goes cold. Additionally, you can visualize your entire sales pipeline and understand where each of the prospects stands and gain valuable insight into your sales process.

You can imagine instantly accessing a customer’s entire history, which includes past interactions and policy details right from before a call.

E-Signature and Digital Document Management

Printing, signing, scanning, and mailing documents are now becoming a thing of the past. With E-signature solutions, insurers can allow customers to securely sign the documents from anywhere and at any time. This significantly eliminates the need for a longer time, which is associated with traditional paperwork.

When coupled with digital document management systems, insurance agents can organize, access, and share policy information instantly, which improves their efficiency and the client experience.

Communication and Collaboration Platforms

Timely communication is the need of the hour in this fast-paced world. Digital tools can significantly allow for instant connection with the clients, whether for virtual consultations or quick questions. This also fosters stronger connections, which are built on responsiveness and convenience, ultimately speeding up the trust-building process, which is essential for the closure of deals.

AI-powered Sales Assistants and Chatbots.

Imagine a virtual assistant that can handle all your initial client inquiries and answer the frequently asked questions, qualify leads, and even schedule appointments. All this while, you focus on the complex tasks. An AI-powered chatbot that is integrated into your website or communication channels can significantly offer instant support to potential customers, capturing their interest and also offering information even outside business hours. This can result in a 36% improvement in efficiency for insurers and also significantly increase customer satisfaction and accelerate the lead-nurturing process.

Data Analytics and Insights Tools

The data analytics tools, which are integrated into your CRM systems or used independently, can offer valuable insights into your sales performance. It’s important for insurance agents to identify their most effective lead sources, understand the customer preferences, and personalize their approach for much better results. By analyzing the data, insurance agents can focus their efforts on the most promising opportunities and refine their sales strategies for maximum impact.

Debunking the Real Impact: Insurance Agents who Have Seen the 5x Boost

A 5x increase might sound ambitious, but you can consider the cumulative impact of these technologies. With these technologies strategically placed in the operational ecosystem, insurers can cut down the time for the document signing process from a week to a day, which helps in instantly qualifying the leads through an AI chatbot and having all the customer information at their fingertips. For insurance agents who will be embracing these digital tools, the results will prove to be transformative as well.

Conclusion

Having the right technology is extremely crucial for insurance agents to streamline and accelerate complex and lengthy processes. By significantly streamlining administrative tasks and optimizing the sales process, insurers can save a significant amount of time and focus on the important functions. This includes building relationships, understanding the customer’s needs, and offering the right insurance coverage.