Imagine waking up one day only to realize that GenAI is the only tool that organizations are leveraging for their day-to-day operations. While this expectation isn’t far, insurers are actively leveraging GenAI to expedite their daily operations. However, there is always a question that lingers in the mind- GenAI is a risk or an opportunity? Insurance CEOs are equally at a crossroads. 49% of CEOs said that GenAI is more of a risk while 51% of them remained hopeful of GenAI as their opportunity. The pressure to remain competitive remains stronger, 77% of industry executives are in favor of the rapid adoption of GenAI to keep pace with their rivals.

Let’s dive deeper and explore more!

What Insurers can Assess to Extract the Maximum Opportunities from GenAI?

Insurers who are leveraging GenAI across their direct, agent, and bank channels are experiencing a significant increase in sales, improvement in customer experiences, and customer acquisition costs. Are you scratching your head to understand what it is that they are leveraging in their GenAI adoption strategy which is improving their operational performance? Here’s a closer at them:

Adopting a Flexible Operating Model

One of the key areas where insurers are adapting GenAI in their operations is by significantly taking help from a flexible operating model. For the insurance companies who are using GenAI, especially GenAI and Customer data, the best possible opportunity that lies ahead of them is not just having one central AI team, or letting the team members independently do their tasks, but the sweet spot lies in mixing and adopting a flexible strategy.

The flexibility that insurers can adopt is to give different departments the power to use AI and also make decentralized decisions while still utilizing the capabilities of a central AI team. The central AI team’s functionality will include setting the rules and offering the main tools that are required to use AI, in other words judiciously act as the central governance to adequately use AI in insurance operations. The insurance companies who are appropriately using the “best of both worlds” approach are experiencing much better results and can launch products faster, getting their jobs done with minimal effort and also enhancing customer experience.

Going Beyond Complexity

One of the complicated hurdles that are being faced by GenAI is the old and complicated tech systems that many insurers are relying upon. These are the systems that lack the agility to integrate and work with new AI while also lacking the amount of clean data that is needed to train AI effectively. The result is that this absence of data significantly slows down the creation of new products. To make GenAI more useful, insurers need AI solutions that can significantly work with their current messy systems while they gradually take a step towards fixing the underlying issues. But there is a requirement for a smart approach that insurers can actively adopt here- the Hybrid design. By adopting a hybrid design, they can adequately reduce technical debt or technical difficulties. This allows for easier to build as well as running new AI-powered services.

Bridging the Technology Gap with Customers

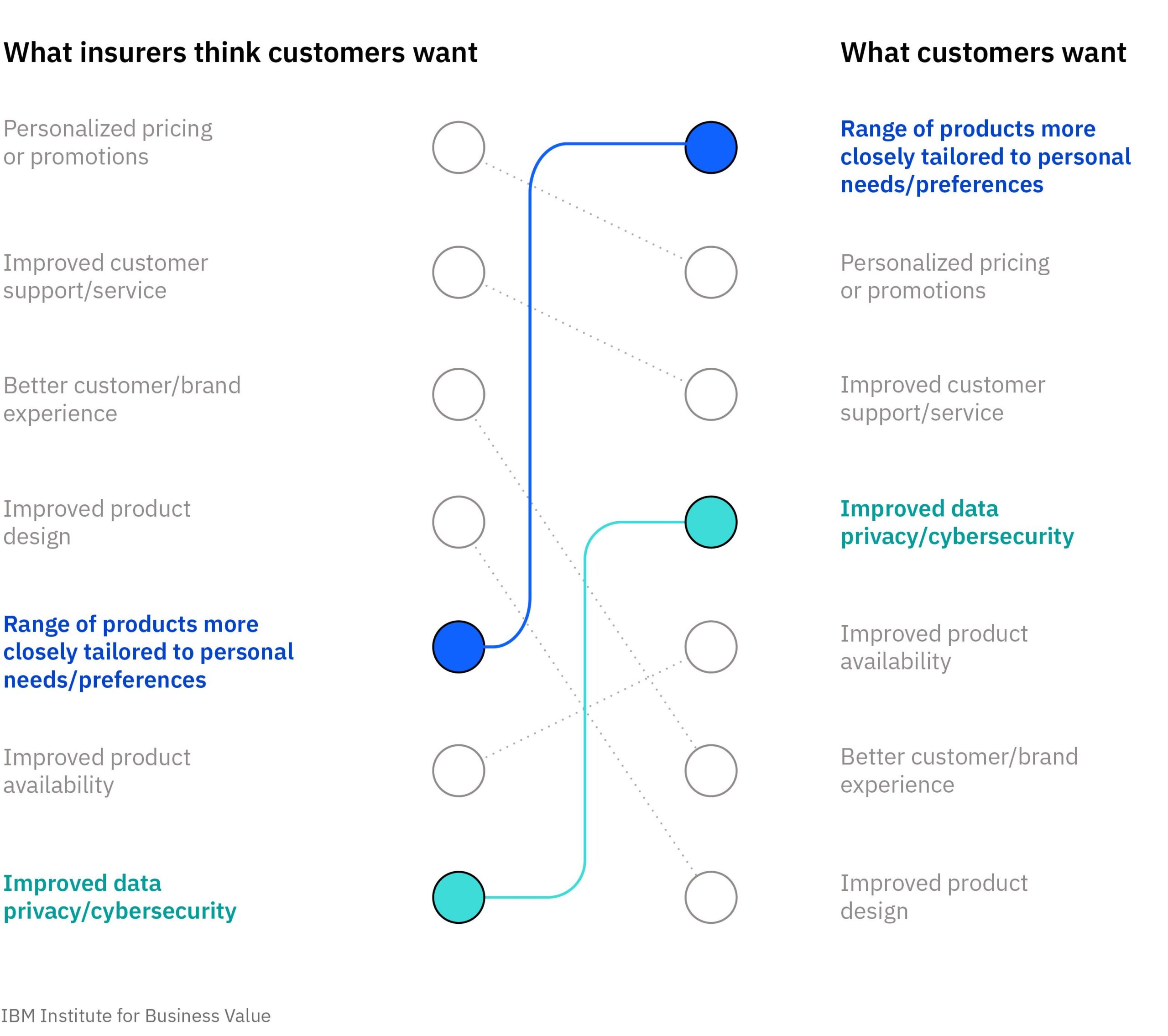

One of the popular applications of AI in the insurance industry today is AI chatbots for service and developers. But there’s a slight twist! Customers are not very excited to use AI for customer service alone, instead, they are focusing on wanting AI to offer better, personalized prices, promotions, and products that are tailored only for them. This also causes worry among customers for data privacy and increases the chance of AI giving them the wrong information. This causes a gap between what the insurers are focusing on and what the customers want. To bridge this gap, insurers can significantly focus on the worries of the customers head-on while also offering the customers what they truly need.

Here’s a clearer representation of this:

Source: IBM

The Road Ahead…

With GenAI, insurers can unlock multiple opportunities when adopted strategically. GenAI is not just the bandwagon for insurers to address business challenges but also adequately address customer pain points. By focusing on real customer needs, insurers can strategically leverage GenAI to create more impactful solutions and also confidently navigate through the evolving landscape. strategically leverage GenAI and create more impactful solutions and also confidently navigate through the evolving landscape.