The insurance industry is undergoing a quiet revolution, with digital initiatives occupying an unprecedented space in insurance operations. Already, multiple insurers in the South African insurance industry are adopting technology initiatives in key areas of the insurance value chain, such as claims processing, underwriting, risk assessment, and fraud detection, among others. Amid this shift, another key area to scale holds immense growth potential, which is Policy management.

However, the deeper question lies- are your agents truly keeping up while tech quietly disrupts the key processes in the insurance industry? That’s exactly where a modern-day policy distribution virtual office app comes into the picture. It’s a digital innovation that is reshaping the way insurance agents operate across the provinces, right from Urban Joburg to rural Mpumalanga.

What is A Virtual Office App?

While the need for adopting digital policy management tools play a crucial role in innovation and growth of the South African Insurance industry, a virtual office app can quietly save a lot of time and effort for agents, thereby expediting policy distribution.

A virtual office app is basically a mobile-first platform that lets insurance agents to fully perform all of their key tasks. This essentially includes quoting, policy issuance, renewals, claims intimation, and customer service.

These platforms can be accessed from multiple devices- from smartphones to tablets. You can think of these platforms as the portable insurance office but without the overheads.

These are the platforms that are built with flexibility in mind, and these platforms often come with virtual office assistance integration in the backend. This allows for real-time access to CRM data, product catalogs, compliance checks, and even digital KYC.

While these platforms are built to enhance the operational capabilities and customer experience, the insurance industry in South Africa needs it more, hop onto the next section to decode.

Why It Matters Specially in the South African Insurance Market?

South Africa has a diverse geography and a socio-economic landscape that is specifically meant for traditional branch-based selling models that no longer gets to serve the large parts of the population effectively. The agents are constantly on the run, and this includes everything from trailing back and forth to the suburbs to the semi-urban regions.

With a virtual office application, this hassle can save a big time.

Here’s a closer look at how a virtual office application will be transforming the South African insurance landscape:

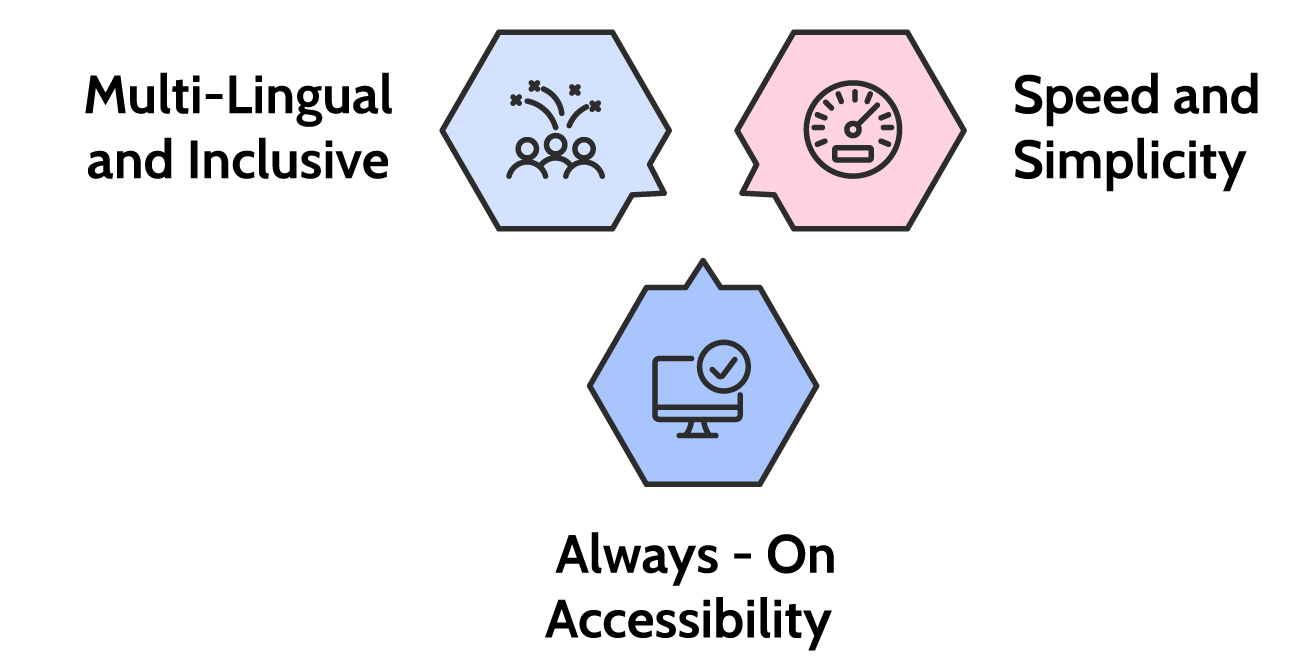

Speed and Simplicity

Right from premium calculation to digital document capture, everything happens in real-time. Earlier, this process used to take days and now it’s just a matter of a few minutes. A virtual office solution significantly reduces turnaround time and improves customer trust.

Always-on Accessibility

With these virtual office apps, the insurance agents need not wait longer hours to finalize a policy. With the offline sync features, the insurance agents can easily operate even in areas with poor internet coverage. This is especially critical in many parts of rural South Africa.

Multi-Lingual and Inclusive

This is one of the most important advantages of deploying virtual office applications. Top virtual office apps support South Africa’s major languages. This enables the insurance agents to significantly engage with the clients in their preferred language, which enhances both trust and clarity.

Are the Current Policy Distribution Operations in South Africa Aligning with the Fast-Moving Future?

Despite the growing digital adoption across multiple sectors, policy distribution in South Africa remains one of the heaviest reliant on traditional and manual processes. There are many insurers, for whom the agent remains the backbone for growth. However, their tools have not evolved at the pace of market expectations. A recent McKinsey report suggests that insurers in South Africa lose up to 30% of potential policy conversions due to manual errors and delayed processing in the field.

Some of the common challenges in the market in South Africa include:

Delayed Turnaround Times (TAT)

Without real-time access to the product rules, documents, and the quote engines, the field agents essentially struggle to close sales during the first interaction.

Manual Proposal Capture

This is another one of the common challenges that the current policy management landscape in South Africa witnesses. There are many agents who still fill out physical proposal forms, which are then re-entered at the branch or the backend, which slows down the policy issuance process.

Limited Mobility

There are many systems that are specifically designed for desktop use, limiting productivity for agents on the move. This is especially for rural and semi-urban areas.

Fragmented Customer Journey

Insurance agents lack a unified platform for tracking leads, submitting proposals, and checking the underwriting status; this allows for receiving instant policy confirmations.

Why It’s Time to Pivot?

These are the inefficiencies that not only slow down operations but also directly impact customer satisfaction, agent retention, and new business acquisition. While this is just one facade of the operational churn, there is a significant impact on customer satisfaction, agent retention, and new business acquisition. In a more competitive, mobile-first environment, agents need more than just a CRM or a static portal- they need a true mobile command center. That’s exactly where a virtual office app will truly make a difference. It will significantly bridge the gap between outdated systems and agile field force execution.

If your insurance agents are still buried under paperwork, then who is chasing growth? The time to think and act is now!