Cybersecurity and AI insurance address two very different risk landscapes. The global cyber insurance market expanded from $17.8 billion in 2024 to $21.7 billion in 2025, while AI specific premiums—virtually non-existent today—could reach $4.7 billion by 2032. In May 2021, carriers paid out roughly $4.4 million after the Colonial Pipeline ransomware attack, and in late 2024 a UK government AI system for benefits fraud detection was found to exhibit biases against age, disability and nationality. These examples underscore why carriers need distinct underwriting models, policy wordings, and claims workflows for each domain.

A Tale of Two Risks

Cyber Case Study: Colonial Pipeline Ransomware

On May 7, 2021, the Darkside gang held Colonial Pipeline’s billing systems hostage, forcing a six-day shutdown of U.S. East Coast fuel supplies. Carriers ultimately covered a $4.4 million ransom payment, plus remediation costs. That event spurred carriers to refine underwriting questions around multifactor authentication, network segmentation, and incident response readiness—factors now critical to cyber risk assessment.

AI Case Study: UK Benefits Fraud Detection Bias

In December 2024, The Guardian revealed that the U.K. Department for Work and Pensions’ AI driven fraud detection tool disproportionately flagged claimants based on age, disability, marital status and nationality, despite assurances of fairness. This sparked calls for stronger model governance, audit trails, and bias testing protocols—exactly the kind of risk carriers must evaluate when underwriting AI liability products.

Cybersecurity Insurance: Guarding Against External Threats

Defining the Perils

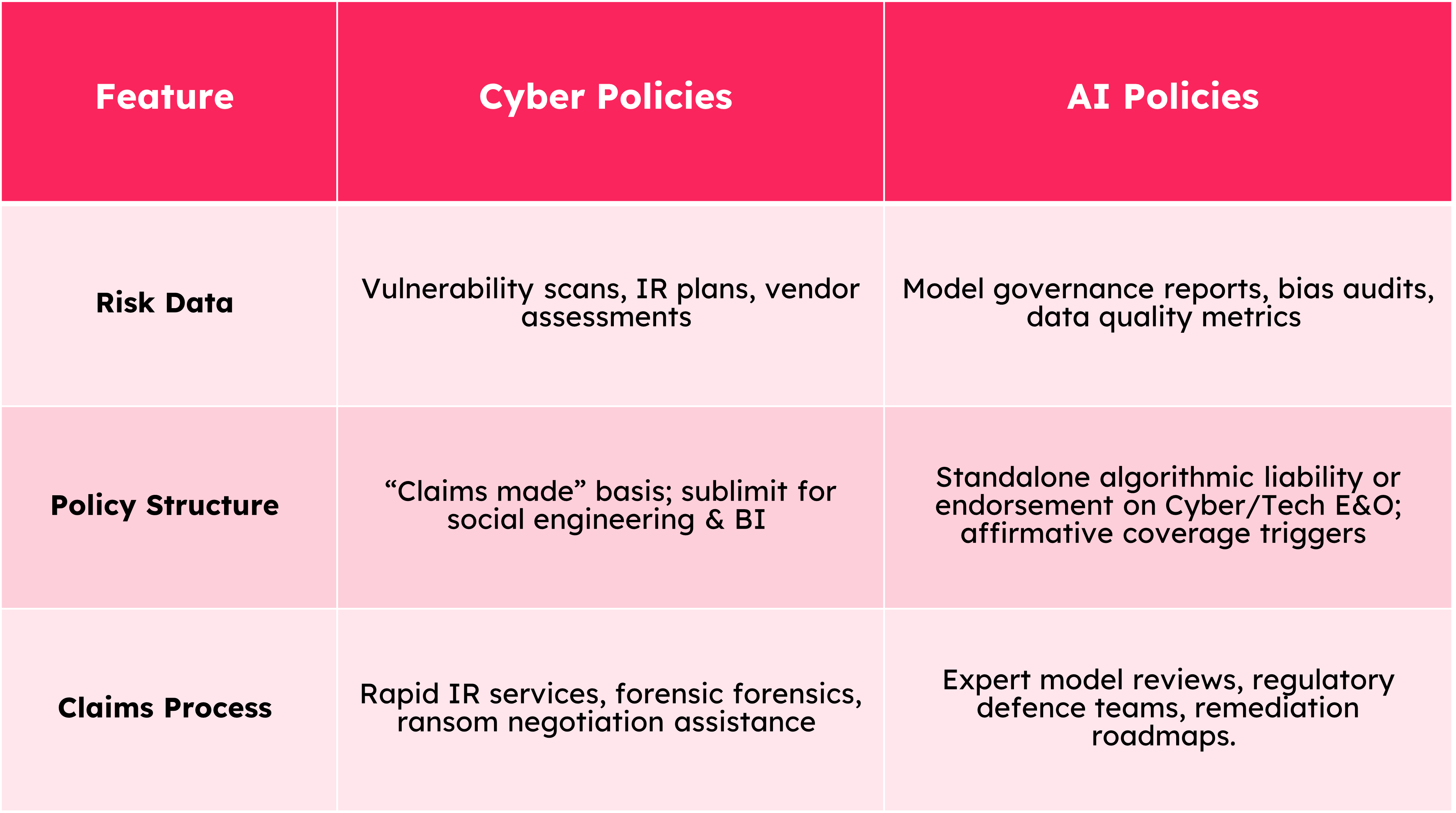

Cyber policies cover data breaches, ransomware, business interruption, regulatory fines, and forensic expenses. Carriers underwrite based on technical controls (encryption, MFA), vendor risk, and historical loss data.

Market Growth & Dynamics

Market Size:

Grew from $17.77 billion in 2024 to $21.67 billion in 2025 (22% YoY).

Premium Volume:

Cyber premiums hit $15.3 billion in 2024, under 1% of global P&C, with North America accounting for $10.6 billion (69% share).

Cost of a Breach:

The average U.S. data breach now costs $9.36 million, while global average rose to $4.88 million in 2024—up 10% year-over-year.

Evolving Claims Trends

Ransomware remains the top driver of cyber losses. Carriers have begun offering pre‑breach risk engineering services, and many now require detailed IR plans before binding coverage.

AI Insurance: Insuring the Algorithmic Frontier

Unpacking Algorithmic Risk

AI insurance (also called “algorithmic liability” or “technology E&O for AI”) covers model failures, biased outcomes, data poisoning attacks, IP infringements, and regulatory defence related to AI systems.

Skyrocketing Premium Potential

Target Premiums:

Could rise from near zero today to $4.7 billion by 2032 (=80% CAGR).

Broader AI in Insurance Market:

Projected to climb from $8.13 billion in 2024 to $141.44 billion by 2034 (=30% CAGR).

Early Adoption & Endorsements

Industry Sentiment:

90% of C-suite executives are optimistic about AI’s benefits, with 68% “strongly in favour” of adoption.

Policy Innovations:

Coalition’s U.S. Surplus & Canada Cyber policies now include an Affirmative AI Endorsement covering AI security failures and deepfake driven fraud

AXA XL introduced a Gen AI endorsement addressing data poisoning, IP infringements and EU AI Act liabilities citeturn4search5.

Deepfake Risks:

A Reuters case in Hong Kong saw criminals use deepfakes to spoof a video conference and steal $25 million—underscoring the need for tailored coverage.

Carrier Spotlight: Distinct Approaches to Cyber vs. AI

Tailoring Underwriting & Claims Handling

Navigating Coverage Strategy

Organizations at the forefront of digital and AI transformation need a dual pillared approach:

- Cyber Coverage to defend against external attackers and technical failures.

- AI Coverage to shield against internal algorithmic missteps and compliance breaches.

Insurance providers who can underwrite on both axes—integrating cybersecurity controls with AI governance frameworks—and ensure their claims handlers are fluent in incident response and algorithmic forensics. Only then can an enterprise safeguard against the full spectrum of digital risks in 2025 and beyond.