The insurance industry, which is often perceived as traditional and slow-moving, is in the middle of a profound transformation and credit can largely be attributed to insurance technology. While efficiency and convenience are at the fingertips of insurers, insurance technology has sparked an interesting debate- Is it a battleground that fuels the competitiveness of the insurance industry or a fertile ground for groundbreaking collaboration? The truth which lies here is – with most complex ecosystems in a compelling blend of both.

Why are Technology Collaborations Winning?

The insurance industry is rapidly shifting with technology collaborations taking place at lightning speed. Gone are the days when technology was seen as a threat, rather today it’s that opportunity that insurers can take full advantage of to increase their sustainability in the market. In fact, as per Capgemini, 75% of insurers are collaborating with Insurtech companies to enhance their customer experience, and this is just the beginning.

Interesting enough? Hop onto the next section to explore more.

Unlock the Synergetic Success- Debunk the Benefits of Collaboration

Collaborations when done right can shape a brighter future for the insurance industry, especially when AI is dominating the industry.

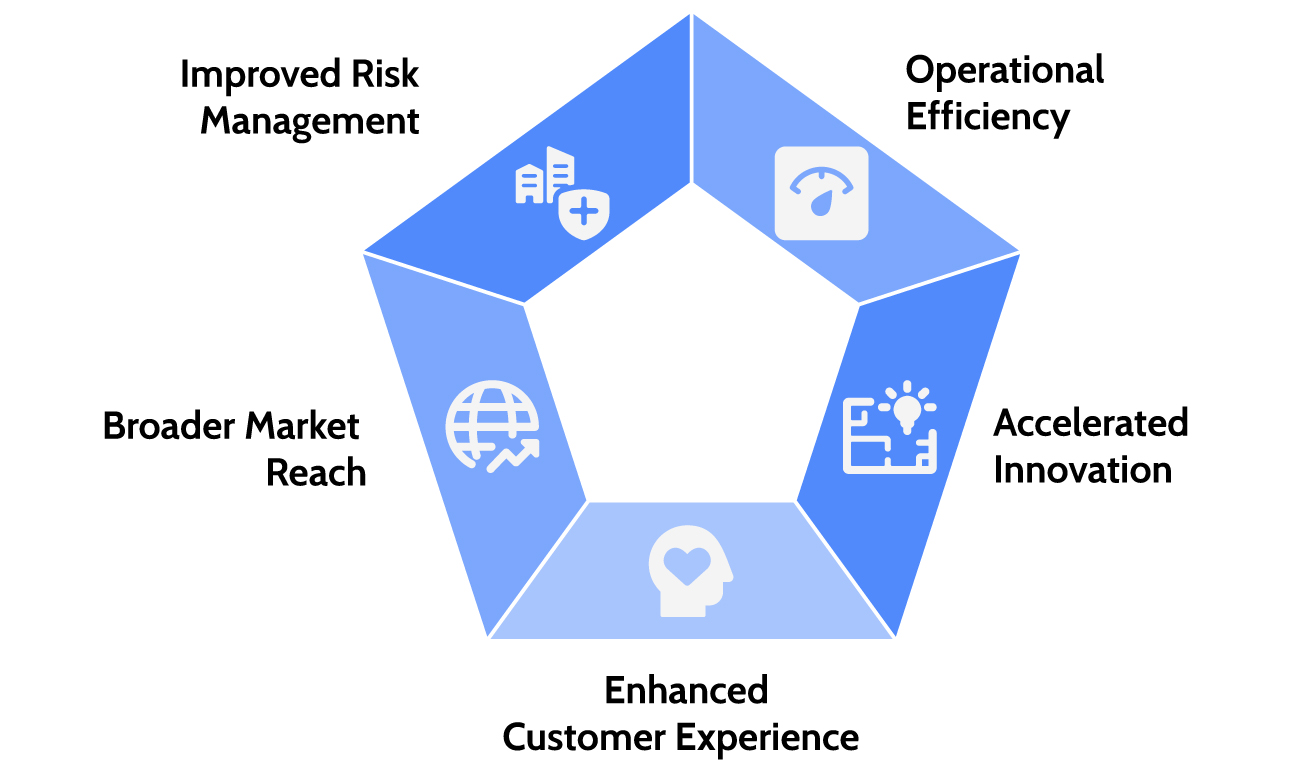

Here, are the top benefits of technology collaboration in insurance:

Operational Efficiency

Collaboration fosters increased operational efficiency. Insurance technology integrated with Artificial Intelligence helps automate manual processes. This includes everything from underwriting to fraud detection, significantly reducing costs and improving accuracy. The biggest advantage is that the underwriters can save a lot of time which they can spend in complex cases, thereby maximizing their expertise.

Accelerated Innovation

By combining insurance technology agility with insurers’ resources, new products and services can be developed and brought to the market faster. Including everything from usage-based insurance (UBI) which is powered by IoT to hyper-personalized policies driven by advanced analytics.

Enhanced Customer Experience

Collaborations lead to seamless digital journeys, personalized interactions, and quicker claims processing. For instance, AI-powered agent assists are offering instant support, and digital platforms are offering tailored policy adjustments in real time.

Broader Market Reach

Scalable technology collaborations help broaden market reach. With collaboration avenues, both insurers and technology providers can tap into new customer segments and expand their offerings, which helps in fostering growth in areas that were previously underserved.

Improved Risk Management

AI and data analytics are often brought to the table by technology providers. These technologies enable insurers to revolutionize risk assessment, allowing for more precise pricing and proactive risk mitigation strategies.

Understanding the Competitive Currents

While collaboration is the key to long-term success, understanding the competitive areas also remains one of the most important areas. Insurers need to understand key areas where insurance technology fosters healthy competition by asking these pivotal questions which focus on these areas:

Customer-centricity

Which player can help deliver the most seamless, intuitive, and personalized customer experience?

Technology Adoption

Who can integrate the most advanced AI effectively?

Data Utilization

Who can best leverage the vast datasets for predictive analytics, risk assessment, and fraud detection?

Speed to Market

How can I rapidly develop and deploy new products and services and remain at the edge of the market?

Understanding the AI-Powered Future- What Lies Ahead?

Artificial Intelligence (AI) is at the heart of this evolving ecosystem. With AI insurers not only automating claims processing but also enhancing fraud detection to enable sophisticated predictive analytics for underwriting- AI is truly turning out to be the game-changer. It essentially thrives on data and the collaborative nature of the insurance technology ecosystem. This allows for a richer and more diverse data set to work with.

AI-driven solutions are not just about harnessing efficiency, but they are about creating a more accurate, personalized, and proactive insurance experience.

The Symbiotic Ecosystem

The insurance market is not just about one facet; it’s about mutual growth and shared success. Instead of building walls, bridges to collaborate and innovate will facilitate the insurers and insurance technology providers to collectively shape a more resilient, efficient, and customer-centric insurance industry. The future of insurance is undoubtedly collaborative, driven by continuous innovation, and powered by intelligent technology integration.