Gen Z is emerging as one of the most dominant forces in the insurance industry, and Insurtech is playing a pivotal role in meeting its expectations for speed, simplicity, and personalization. As these customer expectations rapidly shape the Indian insurance industry, insurance technology will play a pivotal role in helping Gen Z get the right products. Keep reading to understand how Insurtech can help Gen Z get a superior customer experience, and insurers can offer better experiences.

How is Gen Z Running in the Purchase of Term Insurance?

In one of the recent studies which is conducted by TATA AIA Life Insurance, it was revealed that Gen Z is taking up Term Insurance with a pragmatic approach and the study closely focused on their stance in financial planning.

The study specifically works for individuals aged 21-28 and has uncovered how this set population is embracing Term Insurance, not as a backup, but as a necessity and a foundation of their financial wellness strategy.

Gen Z’s Financial Planning- An Overview

This recent survey has also shed light on the importance of term insurance and how it is one of the preferred choices among the Gen Z population. As per the survey, 31% of respondents are planning to buy term insurance, which is one of the highest among the available Life insurance options. In addition, Gen Z is increasingly focusing on early retirement, which is fueling the focus on long-term financial planning, 18% of Gen Zs are considering retirement and pension plans.

Additionally, health-related benefits influence financial decisions, with 60% of respondents prioritizing them when they are choosing Life Insurance. As digitization takes over, one of the things that remains constant is trust. That’s where using the right Insurtech solution will be coming into the picture.

The Expanding Role of Insurtech in Gen Z’s Financial Planning

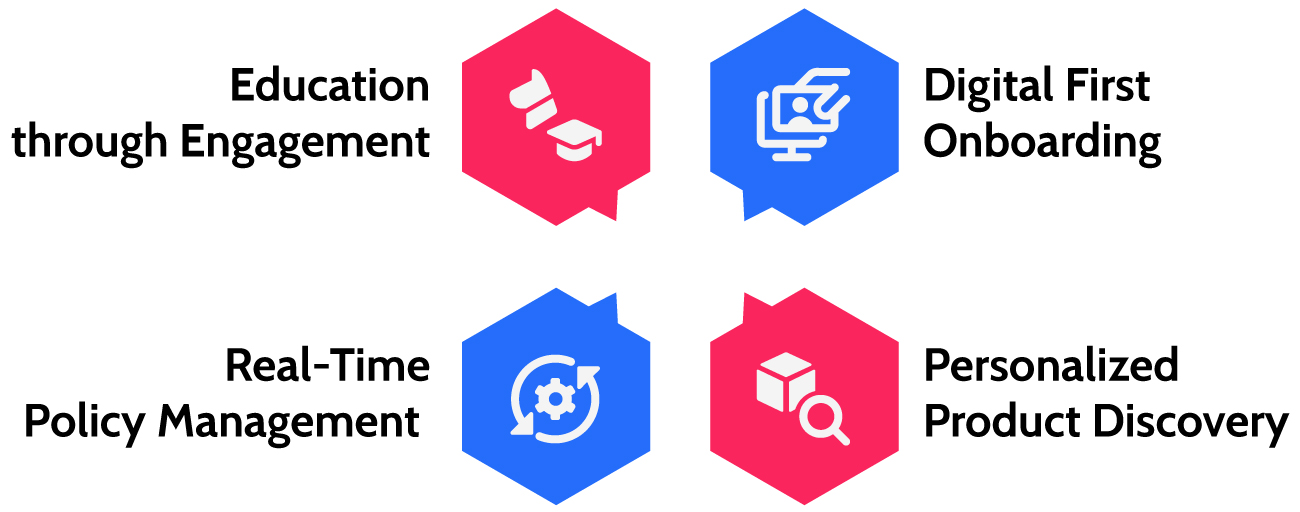

Here’s how the insurers can cater to the tech-first generation with insurance technology:

Digital First Onboarding

Insurers can leverage insurance technology to offer digital first onboarding, and with eKYC, instant document upload, and digital signatures, they can provide seamless customer onboarding journeys. These Insurtech platforms can streamline policy buying in just a few clicks. This makes it easier for the Gen Z population to act on their financial goals without any friction.

Personalized Product Discovery

This is another one of the pivotal ways in which Insurtech can cater to Gen Zs. Advanced Algorithms and AI can help match the users with the most relevant term insurance and investment-linked policies which are based on goals, lifestyle, and risk appetite. This is something that the traditional models struggle to keep up with.

Real-Time Policy Management

Insurtech can empower insurers to offer Gen Z real-time policy management data through mobile apps and self-service portals. The policyholders can engage the users to manage policies, file claims, or adjust the coverage time without any kind of lengthy paperwork or agent follow-ups.

Future-Proofing Insurtech with Innovation

The expectation of Gen Z won’t stay static, and they are most likely to demand even more integrated, intelligent, and ethical financial products shortly. As the needs evolve, Insurtech will be playing a pivotal role in catering to these dynamic market needs:

Embedded Insurance

Insurtech is rapidly driving the shift towards context-aware, event-triggered insurance. These are the ones that you will find embedded in fintech apps or micro-coverage, which is offered during the last purchases. The benefit of this is that it effortlessly aligns with Gen Z’s preferences for on-demand and contextual services.

AI-driven Personal Advisors

While chatbots are the reality, their evolution will now be transformed to a better version- which is AI-driven personal advisors. These AI-driven personal advisors will expertly guide users through complex decisions based on real-time financial behavior and life events.

Cross-Platform Operability

With open APIs and interoperable tech stacks, Insurtech can enable seamless migration of policies and data across platforms. This results in giving Gen Z full control over their financial ecosystem.

Bottom Line

Insurance technology is not just modernizing the insurance industry, but it’s redefining its role in the lives of younger customers. The Gen Z population expects a more personalized, instant, and transparent experience, and Insurtech offers just that. It enables the insurers to become more relevant and more trusted, offering more value across the entire customer journey from discovery to claim. As the Gen Z population takes over the insurance industry, the insurers who build technology first experience Insurtech at their core.