For insurers, speed remains an important factor for them to stay competitive in the insurance market. This is exactly where low code no code platforms come into the picture. Implementing low code, no code platforms for insurance is not a necessity but a strategic step which will unlock long-term scalability for insurers. A Gartner report estimates that by the end of 2025, over 70% of new applications will be built using low code no code technology.

Low code no code platforms are not just for the hype, but these platforms deliver measurable Return on Investment across the insurance value chain, from policy administration to claims automation and agent onboarding.

Keep reading to discover how iNube’s Low Code No Code platforms can help drive this tangible ROI for insurers.

Going Beyond the Mileage: Harnessing Speed in Insurance Technology

Today, digital transformation in insurance is not just a reality but a strategic necessity. Right from policy administration to claims automation, insurers are reeling under the constant pressure to modernize legacy systems. Traditional development cycles often span months and if not for years, leaving insurers vulnerable to Insurtech disruptors and changing customer expectations, and a low code no code platform can help make real impact.

Not any Buzzword but A Strategic Necessity

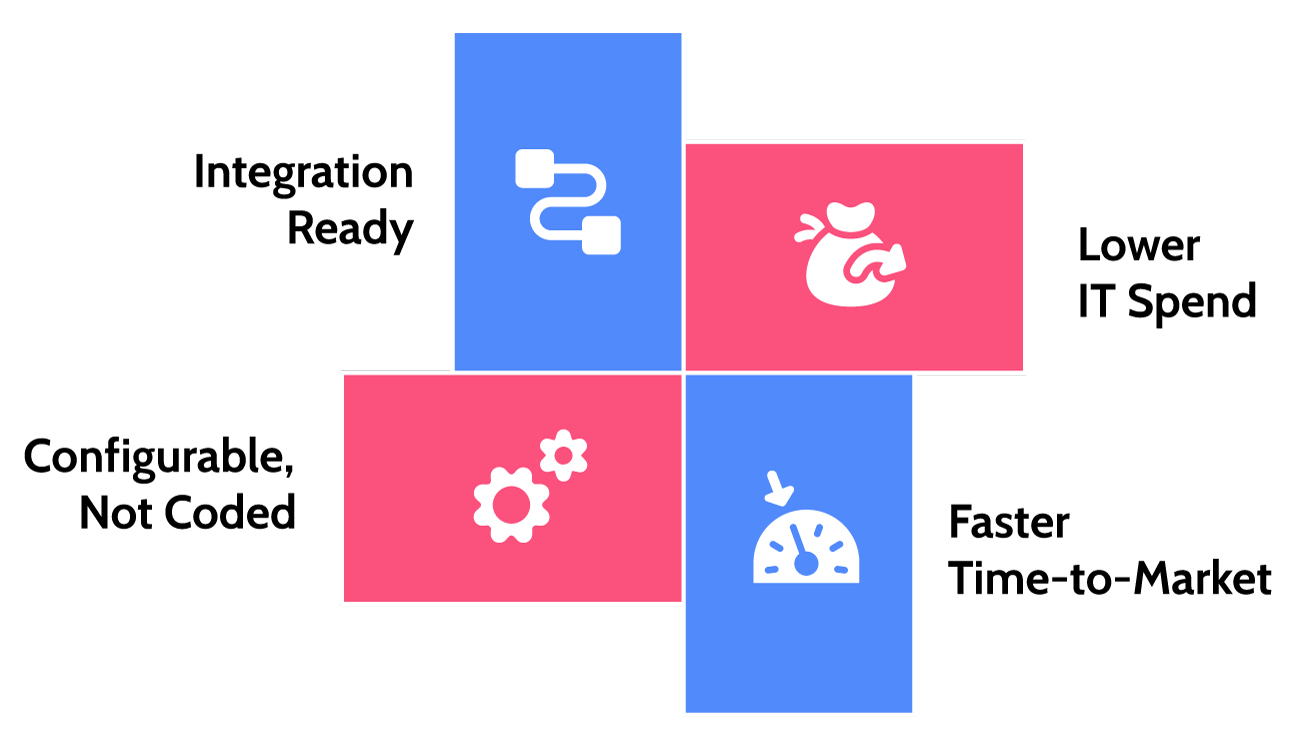

With insurers acknowledging the need for low code platforms in insurance, these platforms are beyond buzzwords turning the narrative to the new reality in insurance. Here’s how low code no code platforms can help insurers gain a strategic advantage, especially in 2025:

Lower IT Spend

Low code no code platforms can help lower IT spend and reduce the dependency on expensive custom development.

Faster Time-to-Market

LCNC platforms facilitates the launch of new products within just a few weeks instead of months

Configurable, Not Coded

These platforms empower business users to make changes without the need for developers.

Integration Ready

A low code no code platform can easily help in connecting with CRMs, policy admin systems or D2C portals via APIs.

Bringing it All Together

The real power of a low code no code insurance platform lies in the ability of it to translate complexity into simplicity, without having to compromise on compliance, scalability or innovation. Whether an insurer is looking to digitize policy administration or streamlining claims processing or building a virtual office for agents, a low code no code technology empowers insurers to do more with less.

How iNube Helped India’s Leading Health Insurer with Future Proof Low Code No Code Platform?

One of India’s standalone health insurers who dealt with critical challenges in scalability and offered a staggering policy issuance journey which proved to be a real roadblock on their way of offering the right policies to the end customers.

Here’s a closer look at the challenges that they faced:

Manual Policy Issuance

The insurer manually conducted policy issuance that required hard labor and consumed a lot of time and efficiency of the insurer

Heavy Group Payments

The health insurer initially managed heavy group payments from the Cash deposit account that led to high transactions and huge volumes of policy issuance

Difficulty in Bulk Policy Issuance

The health insurer faced the issue of bulk policy issuance through rigorous manual operations that posed a threat to their operational efficiency.

The Modern Policy Admin System Built on Low Code No Code Platform that Changed the Game

With a robust power of Low code no code foundation, iNube’s Policy Administration System enabled the health insurer to completely digitize and streamline their policy issuance processes- from individual to group policies while driving a significant operational efficiency. The platform offers a complete policy lifecycle management which has customizable access for business users, seamless partner collaboration, real-time financial transaction handling, and automated customer onboarding workflows.

By supporting bulk issuance, instant endorsements, KYC automation and external integrations, the solution empowered the health insurer to reduce their turnaround times, improve compliance and enhance customer experience, and all this through a scalable, modular system which is specifically tailored for their business needs.

With a low code no code support, the Health insurer not only streamlined operations, but also unlocked a faster, smarter way to do insurance. With greater agility, real-time visibility and seamless customer experiences, they are now better equipped in leading a market which demands speed, flexibility, and innovation.