Insurance underwriters have been playing a crucial role in assessing the risks, setting premiums, and ensuring the financial health of the insurance organizations. What is important here is that a deeper understanding of the risk landscape will help them foster more meaningful insured relationships as well as contribute to significant business growth. However, skill and technical expertise aren’t enough to navigate through the modern risk landscape in insurance. Almost half of all commercial and personal insurance underwriters significantly struggle to meet the growing broker and customer expectations.

That’s where AI, can tap in to offer the underwriter the top spot!

Let’s dive deeper!

The Benefits of AI in Insurance Underwriting

As the role of AI in insurance takes a deeper route, leveraging AI in underwriting can transform the regular process and give way to analyze vast data sets for a more improved insight and much better underwriting decisions.

Here’s a closer look at the benefits of AI in insurance underwriting:

Improved Risk Analysis

The advanced analytics of AI uncover the complex patterns and insights for offering a more accurate and refined risk assessment in underwriting.

Reduced Human Errors

AI-powered systems can effectively reduce human errors by automating data capture.

Boost in Customer Satisfaction

This is another one of the significant benefits of AI in underwriting, the advanced technology enables faster, more accurate service followed by tailored offerings. This helps the underwriters to enhance the overall customer experience with detailed risk analysis and tailored coverage.

Decreased Time to Quote

The AI-enabled systems help in reducing the time to quote by offering personalized quotes and faster turnaround times which leads to higher conversion rates for insurance policies.

Elimination of Manual and Mundane Tasks

AI leverages advanced technology for handling repetitive data processing and administrative duties while freeing up a lot of time for underwriters for a more strategic analysis.

The Power of AI: Transforming Underwriting Process

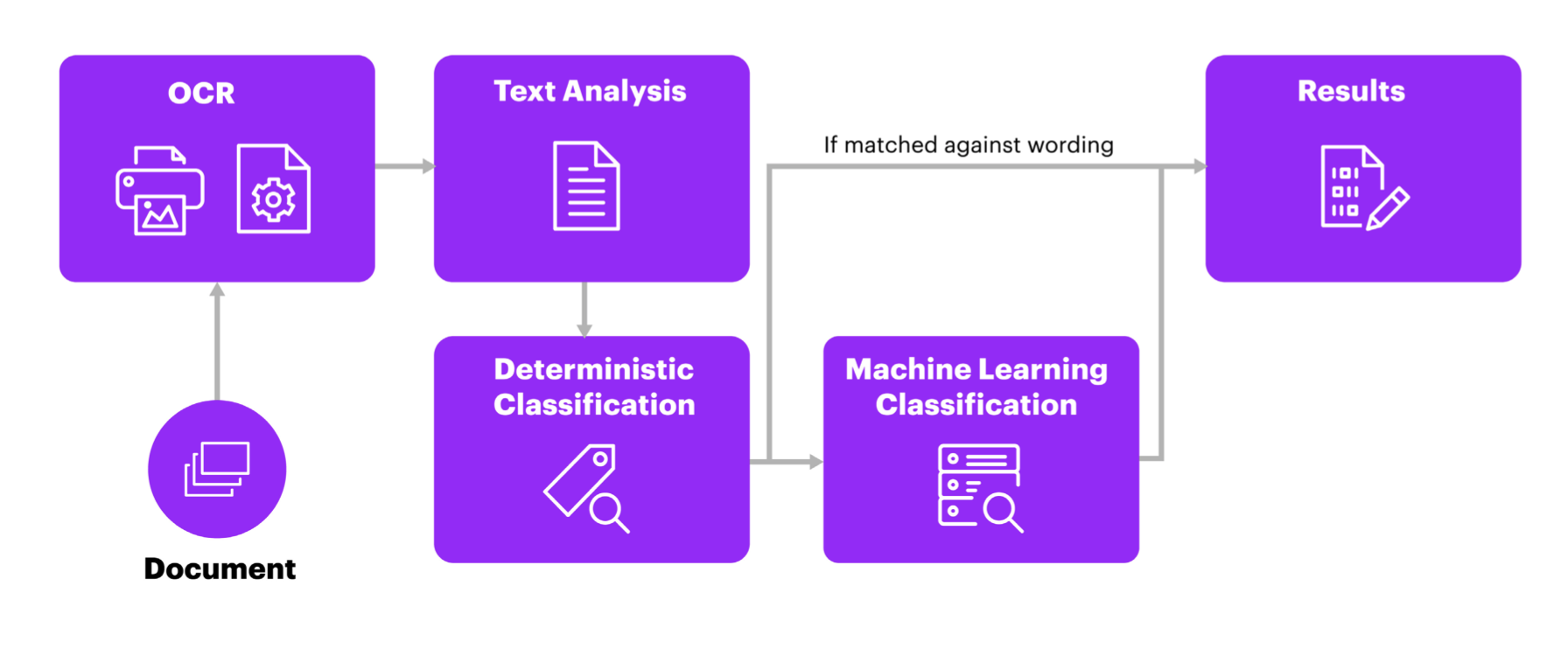

AI technologies such as Natural Language Processing (NLP) and Machine Learning are transforming the regular underwriting process. Apart from underwriting, insurers are leveraging NLP-driven chatbots and Optical Character Recognition (OCR) models for streamlining claims processing as well.

Coming back to insurance underwriting, AI in insurance underwriting primarily thrives on machine learning models that analyze historical data for predicting risk, learning continuously from new data patterns. These models automate risk assessment and machine learning human errors are reduced. This ensures that underwriters have highly accurate and data-backed insights when setting the premiums.

With NLP in insurance underwriting, AI significantly interprets unstructured data from sources such as social media, customer reviews, and claims documents. By significantly extracting insights into customer sentiment and behavioral patterns, these NLP underwriting models will help the underwriters gain a more holistic view of the applicants. This allows the underwriters to enhance their underwriting decisions.

Here’s a brief view of what NLP can do for insurance firms and not just in underwriting:

Source: Accenture

AI Applications in Insurance Underwriting

62% of insurance executives acknowledge AI and machine learning are pivotal for enhancing the underwriting quality and reducing fraud.

Here‘s a quick look at the way AI is transforming the insurance underwriting process:

Fraud Detection

AI-driven algorithms are capable of identifying patterns and anomalies which can indicate any fraudulent activity. This application of AI in the underwriting process will be especially valuable as it will help insurers avoid any costly fraudulent claims. It will do this by flagging any suspicious early data points in the application process. Insurers can leverage AI to analyze the claim histories, transaction patterns, and profile comparisons – by analyzing these vast number of risk factors, insurers can significantly improve profitability and build customer trust through fairer premium pricing.

Risk Profiling

By using advanced data analysis, AI plays a pivotal role in automating the process of categorizing applicants based on their risk levels. This enables the insurers to focus on the underwriter’s expertise in more complex cases while also handling straightforward applications with automated decisions. AI can significantly help evaluate data based on claims history, demographics, and behavioral patterns. With insurance underwriting, AI assigns accurate risk scores and accelerates the process while enhancing decision-making accuracy.

Dynamic Pricing

This is another one of the applications of AI in insurance underwriting. AI enables the insurers to set premium rates more dynamically, while also adjusting them in real life based on a wide range of risk indicators as well as market trends. This AI and insurance underwriting innovation factors such as geographic claim rates, applicant-specific risks, and economic shifts will allow the insurers to stay competitive while also optimizing revenue. One of the prime benefits that AI offers with dynamic pricing is that it ensures that each of the customer’s premiums is based on the updated risk factors, thereby offering a fairer and more transparent pricing model.

Customer Sentiment Analysis

Natural Language Processing (NLP) tools are increasingly being used in insurance underwriting, and the secret by which it empowers the insurers is giving a detailed analysis of understanding the customer feedback and sentiment from the different digital channels which includes social media and customer reviews. NLP can assess customer sentiment and enable the insurers to gain insights into how their services are perceived.

A Scalable Collaboration for Insurance Underwriting

AI in insurance is not for replacing the expertise and skill of underwriters but rather hone it. Its intention is not to replace human underwriters but to augment their capabilities in insurance risk management. While AI can help underwriters enhance their capabilities, human underwriters can focus on maintaining customer relationships in the insurance sector. To effectively leverage AI as the secret weapon, underwriters need to understand the robust capabilities of this technology and leverage it to its fullest potential.

Archismita Mukherjee

Insurance Content Analyst