One of the keyways to stay competitive in today’s time is to maintain a claims management system which is updated and also effortlessly strives to maintain efficiency and accuracy in processes. As the insurance industry is becoming increasingly data-driven, outdated software plays a pivotal role in slowing down your business and also creating significant risks. From frequent numbers of system crashes to integration issues, an outdated claims system usually looks like this, but there are more!

Keep reading to decode more!

The Importance of Claims Management Software

Claims management is an important function in the insurance value chain. Imagine, dealing with volumes of claims and that too manually! It’s not only tedious but also a fearful imagination for an insurer. That’s where claims management software comes into the picture!

Here’s how a claims management software helps insurers:

1. Enhanced Customer Experience

2. Reduced Fraud and Compliance Risks

3. Improved Efficiency and productivity

4. Data-driven Insights and Analytics

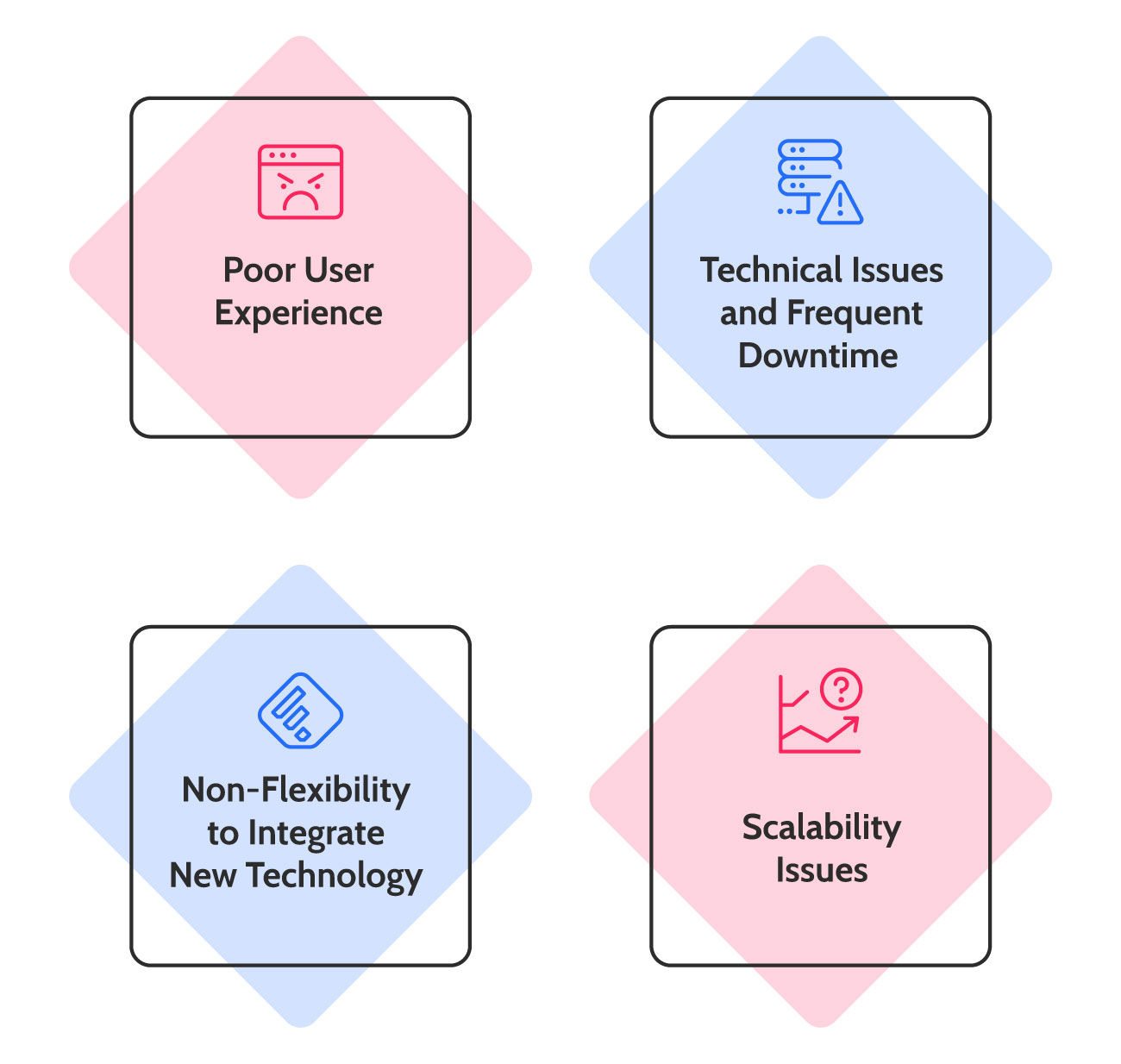

Top 4 Signs to Spot an Outdated Claims System

Are you looking to understand when you need a claims transformation, if yes? Then, look out for these 5 warning signs to know that your claims system is outdated:

Technical Issues and Frequent Downtime

One of the early warning signs to lookout for when understanding the need for claims transformation is frequent technical error and downtimes. The frequent crashes as well as the downtime frequently cause disruption and lead to a loss of a lot of valuable resources. Not just operations are affected, but also a lot of extra operational cost is bore upon an insurance organization

Non-Flexibility to Integrate New Technology

Technological evolution has called for new technology integration. However, insurers with outdated systems are struggling to connect with innovative solutions such as AI powered analytics or mobile apps. This disconnection has resulted in data silos as well as extra manual work for the claims management team. However, with modern claims systems, insurers can get access to real-time data insights as well as efficiencies which could help in driving decision-making much faster.

A modern claims management system effortlessly integrates and empowers your team with accurate as well as updated information.

Poor User Experience

Another warning sign that an insurer needs to acknowledge before thoroughly understanding the need for claims transformation is poor user experience. Outdated systems often have clunky interfaces that can be frustrating to work with and additionally, it also leads to higher workaround time and also leads to a lack of enthusiasm for using the system.

However, with modern claims management systems there are intuitive designs which can help in higher engagement for using the system.

Scalability Issues

Outdated claims systems often have scalability issues. As the insurance service firms grow, so will the volumes of claims, data and client interactions. While business expansion and growth is a positive aspect for any organization, the outdated claims system will not be able to keep up with this growth.

However, on the other hand, a modern claims management system holds the capability of growing as and when your business expands. These are the systems which use cloud-based infrastructure that is capable of dynamically adjusting to the business needs and also allows for handling higher volumes of claims. Additionally, with cloud scalability, you can easily process more claims faster without being held back by the physical limitations of older, on-premises systems.

What Insurers Need to do?

If you are experiencing these warning signs in your claims system, then, here’s what insurers can do:

Investing in Modern and Robust Claims Management System

One of the most important actions that insurers need to take is to invest in modern, robust claims management. These modern claims management software are built on modern architecture, offering stability, reliability and significantly reduced downtime. Additionally, to overcome scalability issues, insurers need to adopt to a more cloud-based claims management system which can dynamically scale resources based on the different business needs, enabling more efficient handling of increasing volumes of claims and data without facing the limitations of outdated systems.

Focusing on Customer Experience with Digital Tools

Insurers need to focus on enhancing customer experience by investing in digital tools. This includes self-service portals where the policyholders can track their claims, upload documents, and also receive updates in real-time. In addition to this, mobile apps can further be helpful in streamlining the claims process which allows the insurers to initiate claims, submit evidence (photos, videos) and communicate with the adjusters conveniently. When insurers focus on giving a positive digital experience, it helps them in becoming a distinguished insurer.

Cloud-Based Infrastructure

Cloud based infrastructure can help insurers strengthen their technology infrastructure and achieve beyond just scalability. A cloud-based infrastructure offers enhanced security features, automated backups and faster disaster recovery capabilities, thereby ensuring data integrity and business resilience.

In addition to this, lower upfront costs and a pay-as-you-go model optimizes IT spending when compared to maintaining the on-premises hardware. Additionally, cloud platforms also facilitate easier collaboration and data sharing across different teams and locations.

Empowering Agent and Adjuster

Modern Claims system should effectively focus on empowering agents and adjusters with the right tools and the information. These integrated dashboards offer a 360-degree view of the customer and the claim. Additionally, when coupled with mobile access can offer relevant data and communication tools which significantly helps in improving their efficiency and effectiveness.

It helps them in offering a faster and more informed service which leads to higher job satisfaction and better customer outcomes.

Conclusion

Insurers can adopt these measures to get past the challenge of outdated systems and enhance claims management. The key to swift adaptation of these measures is faster acknowledgement of the top warning signs for outdated claims management system.