Imagine placing an order on a food delivery app, only to get it after an hour. Definitely one of the most frustrating experiences. Something similar happens by following an outdated underwriting process. Delayed turnaround time significantly hampers customer experience. If this describes your situation, then don’t worry- you are not alone. In fact, a recent Accenture report highlights that 40% of an insurance underwriter’s time is taken up by non-core activities and administrative tasks.

That’s exactly the reason automated underwriting is gaining momentum. This is not a trend, but a necessity. Keep reading to explore how iNube’s digital helped automate underwriting for India’s largest Life Insurer and streamlined their policy distribution process.

Why Automated Underwriting is A Requirement?

The insurance industry is definitely in the middle of a rapid digital transformation, driven by customer expectations, complex risk profiles, and the pressure to do more while giving minimal effort. In the midst of this dynamic shift, automated underwriting has emerged as a strategic necessity and not just a digital upgrade.

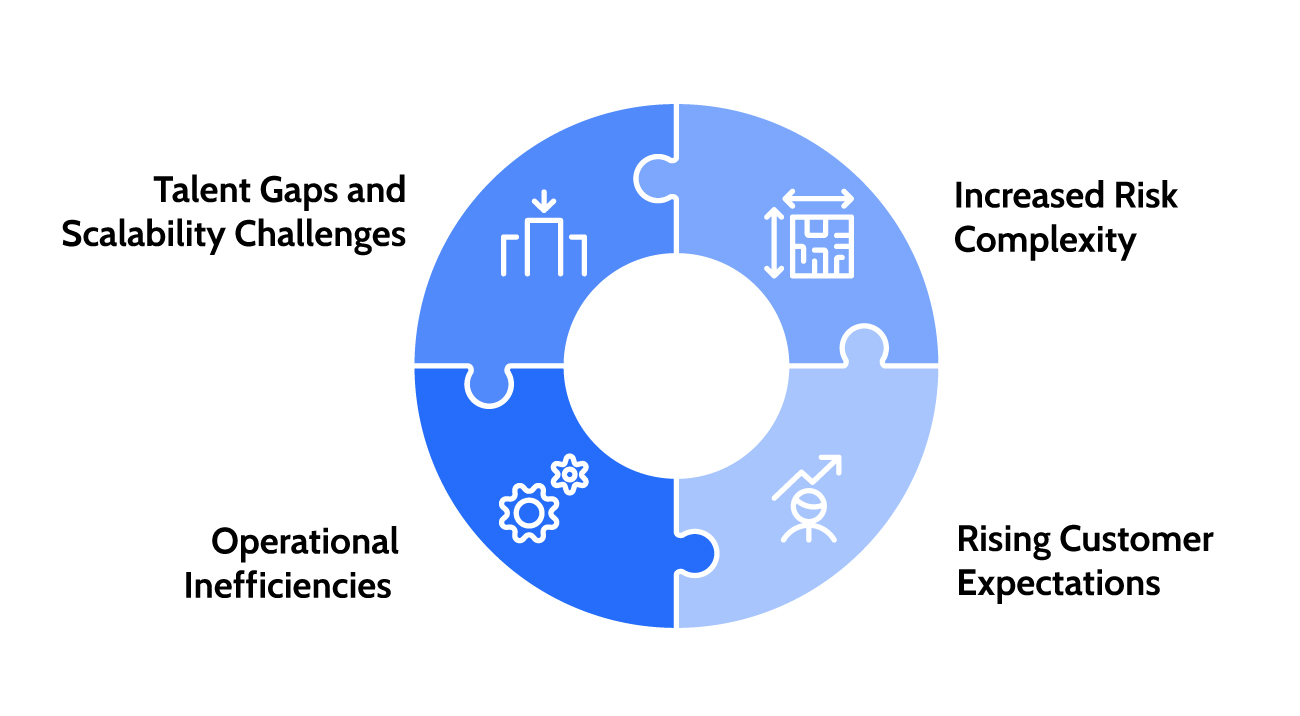

Here’s how automated underwriting is emerging as a strong industry requirement:

Increased Risk Complexity

With more diverse and risk factors which includes health, behavior and IT data among others, the traditional underwriting methods are increasingly lacking the speed and depth to evaluate the risks accurately at scale.

Rising Customer Expectations

Today the policyholders are expecting instant quotes and approvals. With manual underwriting, insurers can’t keep up with the dynamic customer demands which are pivoting towards seamless experience across digital channels.

Operational Inefficiencies

Manual processing is extremely time-consuming, prone to human errors and are heavily reliant on the underwriter’s availability, resulting in slow policy issuance and inflating costs

Talent Gaps and Scalability Changes

The industry lacks a skilled underwriter, and automated underwriting is playing a crucial role in filling this gap. Automation is enabling underwriters to focus on complex cases, while the straight-through-processing handles the rest of the administrative tasks

Why Insurers are Hesitant with Automated Underwriting?

The hesitation to embrace insurance underwriting is not rooted in resistance to change but in the genuine complexity of underwriting judgement and risk. Here’s a brief overview of the top concerns that are deterrent in the full adaptation of automated underwriting:

Trusting in Human Expertise

The underwriters heavily rely on experience and intuition for evaluating the nuanced risks which the algorithms cannot miss. There is a vague belief that

Archismita Mukherjee

Insurance Content Analyst