The urgency to be tech-adaptive is quite clear among almost every insurer globally. Already, insurers who are equipped with more sophisticated IT capabilities have an obvious advantage when it comes to agility, growth, and cost ratios. They will be better able to match the increased need for digital offerings. That’s where insurers who have market-leading analytical capabilities have a five-year revenue CAGR which is four times higher than their competitors.

The right insurance technology platform can unlock multiple opportunities for traditional insurers, and this blog will give a comprehensive guide to choosing the right fit for your organization.

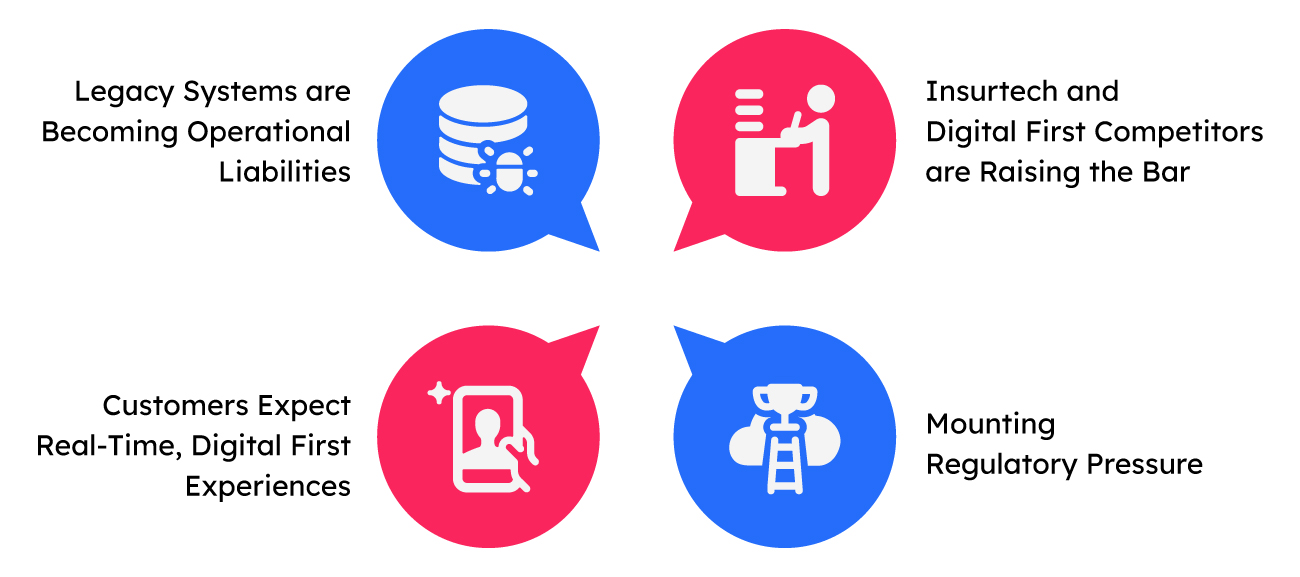

Why are Stakes Higher Than Ever?

Legacy systems, which were once the backbone of insurance operations, have now taken a backseat in insurance operations. These limit speed, flexibility, and integration, which are the three pillars of digital competitiveness.

Here’s how legacy systems are slowing you down:

Legacy Systems are Becoming Operational

Legacy core systems are built upon stability and not agility. While these were the systems that offered robust transactional capabilities, they will now be struggling to meet the demands that digital experiences are bringing. With legacy systems, one of the critical challenges is that these systems are monolithic, hard-coded, and require a long development cycle for implementing even small changes.

These legacy systems result in product launches getting delayed, agent operations becoming clunky, and customer journeys becoming fragmented. This significantly impacts the insurers in smooth scalability, iteration on offerings or even competing with the digitally native challengers.

Customers Expect Real-Time, Digital First Experiences

With digital transformation in insurance rapidly growing today, customers in insurance expect mobile-savvy, comparison-driven services followed by speed, seamlessness, and personalization. It includes either buying a policy, filing a claim, or even updating the information- digital convenience is non-negotiable.

Instant gratification is the new norm, and when it comes to insurance, this is expected on higher terms. The comparisons are drawn clearly. If e-commerce platforms can give instant confirmations, policy issuance delays feel archaic.

Insurtech and Digital First Competitors are Raising the Bar

Insurtech is fueled by cloud-native tech and VC capital, which redefines what ‘fast and easy insurance’ looks like. These platforms are increasingly built upon modern architectures, API integrations, and automation-first logic. This significantly allows us to launch new products in weeks and personalize our experiences on a scale.

Mounting Regulatory Pressure

With changing regulations, legacy platforms are pulling insurers back to stay competitive in the market. With the shift becoming more instantaneous, these platforms curb insurers to maintain real-time audit trails, ensuring data protection and transparency, and supporting digital KYC and e-signature workflows. These legacy systems often require frequent updates and result in higher compliance costs and audit risks.

Growth is All About Product Today

Today, the ability to scale not only depends on having a great insurance product but equally depends on the platform on which it is delivered. This translates to the efficiency, speed, flexibility, and consistency with which the product is bought on the market, how it’s distributed across different channels, and serviced across its lifecycle. This is where the right technology platform will come into the picture.

Here’s how the right technology platform can help insurers:

Instant Agent Onboarding

A platform that enables the ecosystem significantly helps in empowering the agents and the intermediaries to facilitate seamless digital customer onboarding with automated KYC, verification, and training modules. With the right technology platform, you will get access to digital tools, pre-approved sales kits, and quote generation instantly. These platforms enable smooth sales right from day one without waiting for weeks for backend approvals.

Insurers need to understand that these technology platforms reduce onboarding friction, help in the expansion of the distribution network rapidly, and also help in improving the time-to-revenue for new agents.

API-Driven Bancassurance Distribution

With the API-driven ecosystems taking center stage, their demand will increase further in the financial sector including banks, fintech, and digital marketplaces. The demand for API-driven connectivity is increasing with these financial services acknowledging the demand for integrating insurance into their ecosystems.

With the right technology platform, the insurers will be able to expose product catalogs via secure APIs, enable quote-to-bind journeys within the partner apps or portals, and push to offer real-time policy and claims data to partners.

These platforms are of high significance for insurers as these platforms empower the insurers to tap into high-volume digital channels with minimal integration delays thereby enabling seamless scalability in B2B2C models.

Real-Time Data Capture for Underwriting

With the right technology platform, you will easily be able to collect and process customer, lifestyle, and behavioral data at the point of sale automatically.

With the right technology platform, insurers can make instant decisions on policies based on the rules or the AI/ML models, offer dynamic pricing or personalization based on the customer segments, and also immediate risk evaluation with no paperwork delays. These technology platforms also help improve underwriting accuracy and customer conversion rates while reducing the turnaround time.

Expansion into Business Lines with Modular Digital Platforms

With legacy systems, launching a new product line or entering into a new market is slow and costly. With a modern technology platform, insurers can offer product configurators to define rules and benefits without recoding, offering localization for regional languages, regulations, and pricing models, along with a plug-and-play architecture for fast deployment. With the right technology platform, insurers can drive agile business expansion without having any proportional IT investments.

The Way Forward……..

In the past, insurers operated upon outdated technology especially in areas where they needed to make an impact which includes product innovation, pricing, and distribution reach. Today, these technologies are just a large part of the haystack. However, the real differentiator is how this technology can seamlessly and intelligently empower insurers to deliver those products across a connected and more digital ecosystem.

Archismita Mukherjee

Insurance Content Analyst