If you are operating on a legacy system, then you are doing more harm than you think. While clinging to a legacy system might feel comfortable like an old familiar chair, it poses a lot of hidden operational threats. It significantly impacts a business’ bottom line impact and can be a hurdle for businesses to gain a competitive advantage.

Keep reading to decode more!

Behind the Familiarity- What Lies with A Legacy System?

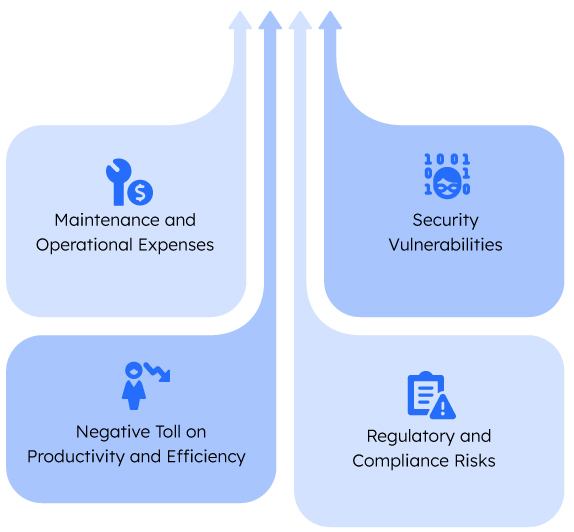

68% of insurers are planning to increase their investment in application modernization. As application modernization takes up a pivotal place in the growth strategy of an insurer, here’s a look at the threat that lies with using legacy systems:

Maintenance and Operational Expenses

One of the challenges of using legacy systems is that they rely on outdated hardware and software. This makes it hard for maintenance and thereby increases the maintenance costs. In addition to this, finding specialists who are skilled in maintaining legacy systems becomes quite hard and expensive as technology evolves.

Legacy systems are old, and these require more manual intervention, which leads to more operational costs and also increases the chance of human errors. For instance, manually processing a claim involves a lot of data entry, paperwork, and physical routing, which is a time-consuming affair and could be better allocated.

Security Vulnerabilities

After significant threat that legacy systems bring are security vulnerabilities. Outdated technology is the prime target for cybercriminals and these are the systems which often lack the latest security patches and protocols. This creates vulnerabilities which can be easily exploited. Legacy systems significantly lead to financial losses, regulatory fines and irreplaceable damage to the company’s reputation.

Negative Toll on Productivity and Efficiency

Today, we are living in a fast-paced world, and in this fast-paced world, efficiency plays a pivotal role. With legacy systems, there are cumbersome interfaces and manual processes which as one of the major bottlenecks to productivity. The employees spend valuable time navigating the outdated screens, dealing with multiple system limitations and manually transferring the data between disparate systems.

It not only slows down the claims processing process but also frustrates the employees and also hinders their ability to focus on the more strategic tasks. You can take for instance, a claim adjuster who uses a legacy system.

With these legacy systems they might have access to multiple screens and will also be manually re-enter information, whereas the modern systems would be offering a more unified view and will be automating much of the work.

>Regulatory and Compliance Risk

With legacy systems there is a significant hurdle when it comes to regulatory compliance as well. Since legacy systems are designed in a different era, it does not support the modern regulatory requirements. This can cost insurers penalties and legal complications.

To tackle these challenges, modernization plays a pivotal role especially when the insurance industry is witnessing a dynamic change.

Top 3 Benefits of Legacy Modernization

Here are the top benefits of legacy modernization in insurance:

Reduced Operational Costs and Improved Efficiency

One of the top benefits of legacy modernization is that they significantly reduce operational costs and improve efficiency. The modern systems automate many of the pivotal processes which significantly reduces the need for manual labor, minimizing the administrative overhead and lowers the processing costs per claim. This significantly frees up the staff’s focus on more complex and strategic activities.

Improved Customer Satisfaction and Retention

Today, customers expect seamless and efficient service, and legacy systems often lead to slower processing times, a lack of transparency, and frustrating communication. Modern systems come with multiple features such as online claim submission, real-time status updates, and integrated communication channels such as emails, chatbots, and SMS. This significantly empowers the policyholders with greater control and visibility, which leads to a more positive and transparent operational process.

Accelerated and Accurate Claims Processing

Time plays a pivotal role when a claim is filed. Modern systems leverage automation and intelligent workflows for accelerating every stage of the claims lifecycle. From the initial reporting stage to the final claims settlement, the tasks are streamlined, and the bottlenecks are eliminated. This significantly reduces the risk of human error. For instance, AI can significantly help in assisting in the initial claim assessment, verifying the policy coverage, and also flagging the potential issues early on. This leads to faster and more accurate processing, which improves customer satisfaction and also reduces the overall cycle time of claims, which leads to faster payout and also lowers the administrative costs.

The Way Forward…

These are the top benefits of legacy modernization, and insurers need to be steadfast in understanding and acknowledging these benefits to actively integrate them in their existing ecosystem. Legacy modernization is not just a goal but a necessity to keep pace with the dynamic insurance industry.