Travel is no longer journey anymore- it has become a meaningful experience. Around 68.6 million individuals in Gen Z and millennials travellers are reshaping the future of the travel industry. Imagine you’re about to begin your adventure when a single message changes everything: flight cancelled. The rising unexpected events such as flight delays, lost luggage and cancelled reservation have paved a way for a smart insurance covering uncertainty

Picture this: you are booking your dream trip- but this time your insurance adjusts to you. That’s what Gen Z and Millennials are inclining towards. Whether it is a weekend holiday or a month remote work, youngsters prefer modified coverages. Instead of buying a comprehensive insurance, they want to opt for add-ons based on their priorities The one stop solution for them is- user based insurance

The Evolution of User Based Travel Insurance: Why Usage-Based Models are Gaining Popularity

Gone are those days of one size-fit for all policies covering everyone. Just like how Spotify creates a unique and crafted list as per your choice, travel insurers are moving towards the similar trend. Now meet Sneha who is planning for trip to Europe. Her insurer offers her a customised coverage protecting her luggage, cancellations due to strikes and even for medical emergencies. A smarter, situational and aligns with how she travels

It is the User-based Insurance – an adaptative shift from a one size policy to offering flexible coverages for short trips, digitised services and tailored options exactly meeting the needs of youngsters

Here is how it works

1. Coverages are priced on the number of days that the traveller have travelled

2. Whether you are bungee jumping in South Africa or Scuba diving in Australia, based on your activities coverages changes

3. Heading to high-risk areas like disaster-stricken areas or with political instabilities, UBI adjusts your premium accordingly

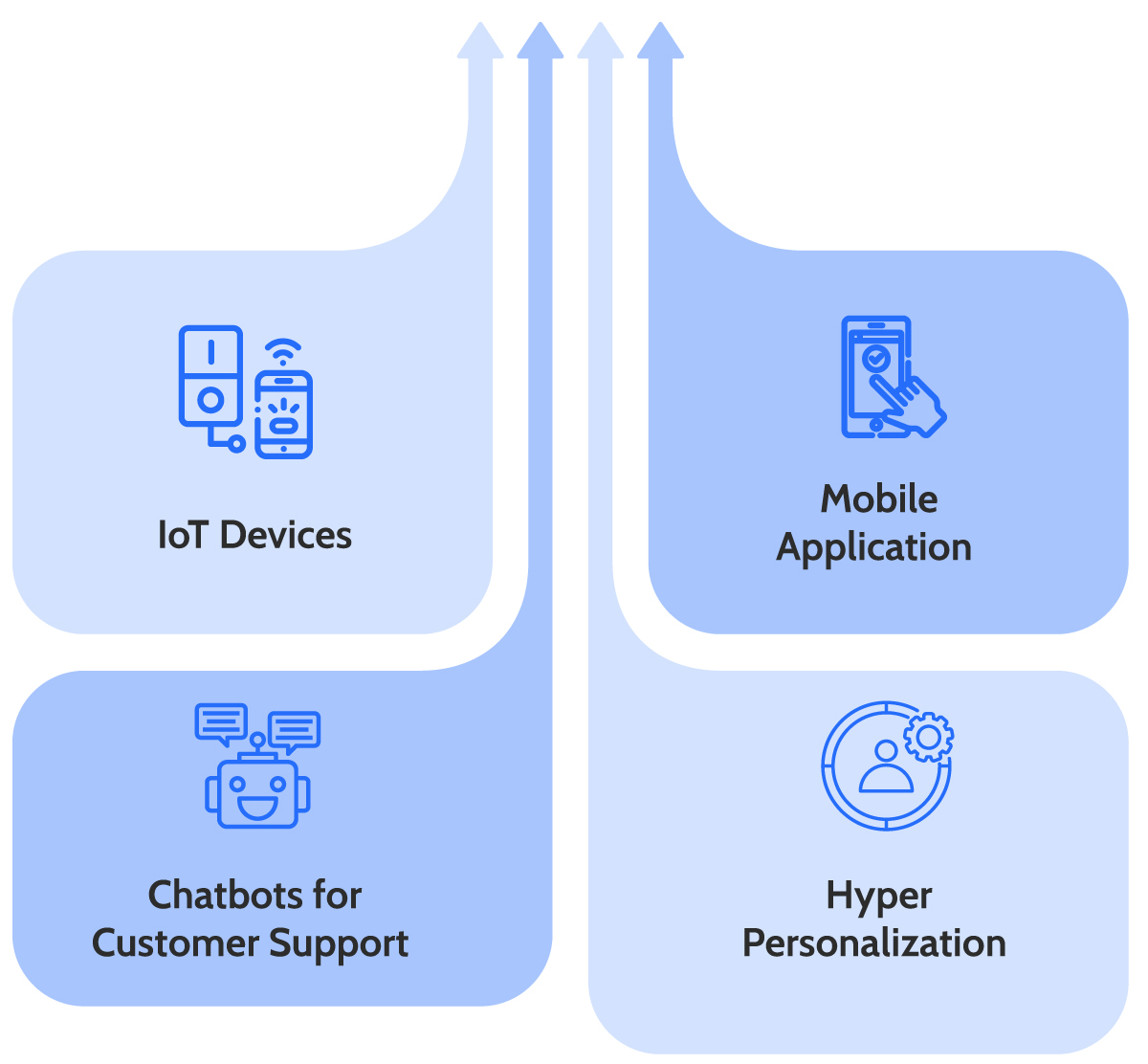

How Gen Z & Millennials Are Embracing Tech-Driven Travel Insurance

Travel isn’t just about reaching your designation for Gen Z- it’s about a hassle-free journey. No more endless forms or complicated insurance rules. Seamless digital integration has the burden off traveller’s shoulders.

Picture this- You’re on a trip, and technology is quietly working in the background, making adjustments for you as you go.

1. IOT Devices: Your smart wearables are the perfect companion, monitoring your heart rate and sleep patterns, allowing insurers to track your health and adjust premiums accordingly. Even while hiking on Everest, you can rest easy.

2. Mobile Application: Riya, an adventure enthusiast sets off a solo hiking trip in Alps with her smart watch connected with the travel insurance mobile app. As she entered higher altitude, her vitals spiked because of fatigue and an automatic message sent to her insurer. Her coverage got adjusted. All because of user based insurance

3. Chat Bots for customer support: Imagine you are prepared for your dream hiking trek when a snowstorm hit. You opened your insurance app, asked the AI chatbots about your coverages and settle your claims within minutes. It’s fast, stress-free, and exactly what you need when things don’t go as planned.

4. Hyper-Personalization: Anna, an avid hiker, is preparing for a trek in the Swiss Alps. Using AI Enabled User Based Insurance ,the system checks her past hiking trips and recommends the best coverage for her adventure.

The Digital-First Generation: What Millennials and Gen Z Expect from Travel Coverage

Travel insurance is evolving to match the fast-paced, experience-driven lifestyle of Gen Z and Millennials. With smarter, more flexible options, protection is no longer a burden—it’s a travel essential that moves with you.

Embedded Insurance: Sophie, a Gen Z traveller, decides to book a spontaneous trip to Bali without worrying about extra efforts for coverage. Thanks to Embedded Insurance, she’s covered instantly, with double protection in a single plan. Combining two or more insurance under a single roof has makes it cost effective for budget conscious people just like Sophie

Micro Duration Policies: Heading to a weekend festival or a short getaway? Micro Duration Policies offer on-demand coverage for just the days you need. No long-term commitments, just smart, flexible protection that fits your fast-moving lifestyle

Gamification: Imagine you log into a travel insurance app before your Europe trip, expecting the usual buying a policy. Instead, you are welcomed with fun challenges, discounts and offers. It has created interest among youngsters to learn more about the coverage making insurance feel less boring.

Taking A Closer Look at the Real-Life Success Stories

Allianz Partners USA has integrated AI technology into its Universal Claims Portal, enhancing the efficiency and user-friendliness of the travel insurance claims process. The AI system automates and accelerates claims processing, ensuring quicker responses and resolutions for customers.

Improved Claims Process:

1. Streamlined Filing: The revamped portal makes filing claims easier with features like live chat support for real-time assistance and enhanced document-upload functionality.

2. Real-Time Updates: A dynamic claims status bar provides real-time updates, allowing customers to track the progress of their claims from start to finish.

3. SMS/Email Notifications: Customers receive timely alerts and updates via SMS or email, keeping them informed throughout the claims process.

The Future Ahead

As the travel landscape is evolving, insurers are inclining towards providing flexible and customised coverages as per Gen Z and millennials needs. Whether it’s based on their trip duration, activities or their health data- user based insurance have got them covered. By embracing technology like AI, chatbots, IoT devices, and embedded insurance, these tech-savvy generations are empowered to travel with peace of mind, knowing that their protection evolves alongside their journey. Are you ready to embrace a travel experience where your insurance adapts to your journey, from trip duration to activities and health data?

Reechel Mahapatra

Growth Specialist