Policy Administration is an important process in the insurance value chain. Relying on outdated technology, data silos, fragmented processes and more such complexities can be a significant challenge to enhancing operational efficiency. Adapting to the modern day, a Policy Administration system that’s equipped to tackle critical challenges is the key to improve operational efficiency. Read on till the end as we decode on how iNube’s Policy Administration System played a pivotal role in helping one of the leading Health Insurers based in Maldives tackle critical operational challenges.

Unraveling the Biggest Fears for Insurers in Policy Administration

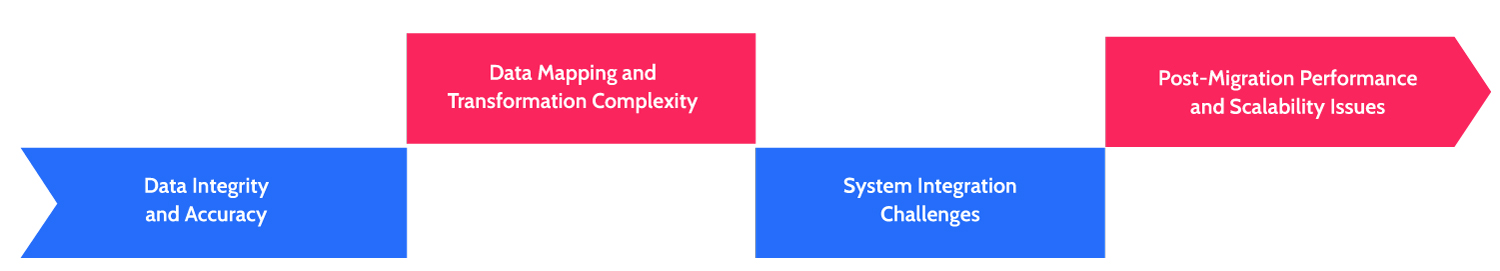

Policy Administration is an important function in the entire insurance value chain. However, the most feared challenge for an insurer concerning a Policy Administration System revolves around data migration and integration. This includes a lot of interconnected concerns which can lead to significant disruptions, financial losses as well as project failures.

Here’s a closer look at the interconnected concerns:

Data Integrity and Accuracy

One of the critical fears concerning a new Policy Administration system is data integrity and accuracy. With an old PAS system, there are vast amounts of data from the legacy systems which will not be migrating more smoothly, and this will result in corrupt, incomplete or inaccurate data in the new PAS.

The Impact:

When dealt with inadequately, it can result in a lot of incorrect policy information, inaccurate billing, flawed claims processing, compliance issues and ultimately a loss of trust from the policyholders and stakeholders. One of the worst nightmares for insurers when dealt with this challenge is sending incorrect renewal notices or denying valid claims because of data errors.

Data Mapping and Transformation Complexity

This is another one of the critical fears which is faced by insurers when they deal with the new Policy administration system. Insurers significantly underestimate the complexity of mapping data field between the old and the new systems. With legacy systems, there are inconsistent naming conventions. The transformation of this data to fit into the new Insurance Policy Administration System can be a monumental as well as an error-prone task.

The Impact:

When this challenge is not dealt adequately, it can lead to significant delays in the implementation timeline, increased costs because of the need for specialized data migration tools and expertise, and this leads to a higher risk of data loss or corruption during the transformation process.

System Integration Challenges

The fear that insurers have when using a new Policy Administration System is integration challenges. The new PAS often has issues with seamless integration into the existing ecosystem of the insurer. This includes CRMs, claims management systems, billing, reinsurance, and regulatory reporting platforms.

The Impact:

With poor integration, insurers can encounter data silos, manual data entry duplication, inefficient workflows, and an ability for getting a holistic view of the business. For instance, if a PAS is unable to integrate well with the claims system, then, the adjusters might be lacking crucial policy details, which can lead to errors and delays.

Post Migration Performance and Scalability Issues

The insurers fear that the newly migrated data volume will negatively impact the performance of PAS. This leads to a slow response time, system crashes, as well as the inability to handle peak loads of growth.

The Impact:

When not death with adequately it can significantly lead to a disruption in the daily operations, frustrate the users, and also hinder the insurer’s ability to scale its business effectively. Take for instance a customer service agent who struggles with a slow system while trying to assist the policyholders.

How can these Challenges be Tackled Smoothly?

These are the Policy Administration challenges that are faced by many insurers today, however, there’s a way in tackling these challenges smoothly. Here’s a closer look at them:

Robust Migration Strategy

One of the important strategies that insurers can put into practice is robust data migration strategies. Insurers can start by analyzing the legacy data, profile its quality, identify inconsistencies, redundancies, and gaps. Additionally, insurers can invest a significant amount of time and resources in detailed data mapping between the source and target systems.

Phased migration is also one of the ways by which insurers can mitigate the problem of inconsistent data migration. Insurers can migrate the data in logical chunks or by line of business for a smoother data migration.

Strategic System Integration

Insurers can start with early integration planning and start by defining the integration requirements early in the project lifecycle. Insurers can identify all the systems which need to be interacted with the new PAS and then understand the data flows.

Additionally, insurers can prioritize an API first approach, it means that they need to prioritize integration through well-documented and robust APIs. This helps in promoting flexibility and also reduces the complexity of point-to-point integrations. In addition to API-first approach, insurers can also prioritize middleware platforms for facilitating communication and data exchange between different systems.

Performance and Scalability Planning

Insurers can take another approach to adequately do performance and scalability planning. Insurers can conduct thorough load and performance testing with realistic data volumes and user concurrency for identifying the potential bottlenecks in the new PAS environment. Insurers can effectively ensure that the underlying infrastructure is appropriately sized and also optimized for supporting the performance requirements of the new PAS and the migrated data.

Additionally, insurers can implement tools for continuously monitoring the performance of the new PAS in production and also proactively address any degradation. Additionally, insurers can have a scalability architecture in place where they can accommodate future growth in the data volume and the user base. The easy way to achieve this is cloud-based PAS.

How iNube Helped One of the Maldives’ Leading Health Insurers?

One of the leading Health insurers based in Maldives faced a crucial challenge of data migration that introduced a lot of operational inefficiencies. Our team minutely analyzed the different problems that the Health Insurer faced. We set up a one-on-one meeting with the Health Insurer to understand their operational challenges briefly.

Here’s a closer look at the challenges that they faced:

Manual Processes- The health insurer heavily relied on manual systems for processing volumes of policies

Heavy Group Payments- they dealt with volumes of policy issuance, followed by bulk transactions

Manual Error Checks- manual checking of errors in documents

Data migration from the Core- legacy systems caused data pockets, inconsistencies, and migration challenges

How iNube Helped Tackle These Challenges?

Here’s a look at the process of our implementation:

A Phased Approach

iNube implemented a robust, modern day Health PAS and involved a phased approach which started with a detailed assessment of their manual processes, heavy group payments, manual error checking, bulk policy issuance, and legacy data challenges which is followed by defining clear objectives and a more comprehensive plan.

Automation and Integration Focus

The next phase was the configuration and the customization of the Health PAS, which especially focused on automating group payments and error checks, followed by developing necessary system integrations.

Planned Data Migration

The next followed was a well-planned data migration with a thorough cleansing, transformation, and validation. There was rigorous testing, including unit, integration, user acceptance, and performance testing was preceded by a carefully managed deployment and go-live.

Post Go-Live Support and Continuous Optimization

Post go-live, there was intense support, and continuous monitoring would be offered, this leads to an ongoing optimization and review for ensuring that our implementation effectively addressed the operational hurdles and achieved the desired efficiency and automation.

Conclusion

iNube’s PAS Health helped this leading Health Insurer from Maldives take the first step towards effortless policy administration with our well-planned and strategic implementation. The Health Insurer unlocked multiple operational benefits that streamlined their way to operational success.

Archismita Mukherjee

Insurance Content Analyst