The Insurer’s Guide to Policy Administration

Insurance Policy Administration systems are the reality of Insurance today! Insurance is a dynamic business, and the adoption of a Policy Administration system is not just a technological upgrade but it’s also a strategic necessity.

The evolution of Policy Administration system has stood the test of time by integrating advanced features and also AI. Before understanding the capabilities of Policy admin system, it’s important to understand the meaning of a Policy admin system.

What is A Policy Admin System?

A Policy admin system is a software platform which is used by Insurance companies in order to manage all the aspects of their insurance policies throughout their policy management lifecycle. A PAS essentially includes functionalities such as policy quoting, issuance, billing, underwriting, endorsements, renewals as well as claims processing.

These are the systems which basically serve as the central hub for insurers to store, retrieve and also update policy related information that enables efficient management as well as policy administration of Insurance policies. A modern PAS essentially helps insurers in automating various processes, improving operational efficiency, enhancing customer service as well as ensuring regulatory compliance.

The importance of Policy admin system includes:

Streamlines Operations and Improves Efficiency:

A modern-day PAS efficiently automates multiple policy management tasks such as policy issuance, renewals, and claim handling. This reduces manual intervention and errors.

The automation of the crucial policy management tasks leads to faster policy processing, allows for quicker responses to customer needs and also improves efficiency. Automation and streamlined processes reduce the operational costs by minimizing manual work and errors. Additionally, PAS helps in consolidating data from various sources and offers a single source of truth for policy information.

Enhancing Customer Experience

The efficient Policy Administration System helps in faster policy processing and also gives access to real-time data. With this the insurance companies can provide better customer service. PAS allows for more personalized product offerings and also tailors customer experiences based on their individual needs. Modern PAS offers self-service portals which empower the customers to manage their policies as well as giving them access to information independently.

Enables Market Responsiveness and Innovation

A Modern PAS is designed flexibly and is scalable enough to allow the insurance companies to quickly adapt to market changes and regulatory requirements.

PAS enables faster product launch and also helps in product launch, allowing the insurers to respond quickly to emerging trends and customer demands. A Policy Administration System also helps in real-time data insights and analytics, which empowers the insurance companies to make more informed decisions and also optimize their operations.

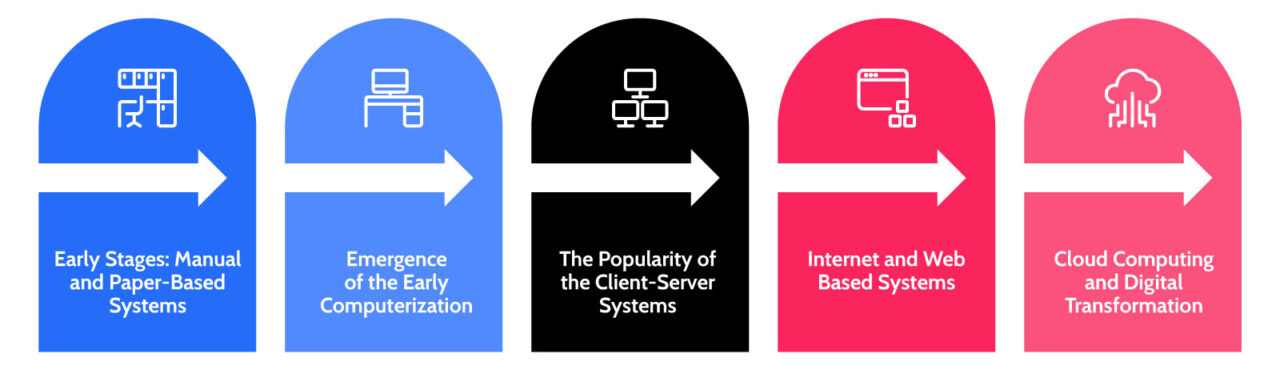

The Evolution of PAS

The Insurance Policy Administration Systems has dramatically evolved over the last few years, becoming more dynamic and flexible. Modern technologies have revolutionized the user experience and have made it quite easier for businesses to onboard and maintain innovative insurance products.

The evolution of PAS from cumbersome, monolithic systems to flexible and adaptive solutions is definitely changing the way the insurance industry works inside and outside.

Taking a closer look at it:

Early Stages: Manual and Paper-Based Systems

A decade back, insurance operations heavily relied on manual processes as well as paper-based records. Insurers manually had to carry out policy administration tasks such as extensive paperwork, manual calculations, and also physical storage of documents. This was the time when policy administration was heavily characterized by slow processing times, high error rates and limited amount of data accessibility.

Challenges Faced in the Early Stages:

Increased Error Rates

One of the challenges is that insurers operating on manual data entry and calculations are prone to human error. This leads to introducing inaccuracies in the policy documents, premiums and claims payouts.

Limited Data Accessibility

This is another one of the significant challenges that are faced by manual and paper-based systems. Information gets locked within the physical files which makes it difficult to retrieve, analyze and share the data across different departments. Generating reports is definitely a laborious task which involves manual compilation of information.

Slow Processing Times

Each of the stages in the policy lifecycle is time-consuming when done manually. It often takes days or even weeks to complete. There are approvals which are required for physical signatures and inter-departmental mail.

Scalability Issues

This is another one of the significant challenges that older Policy Admin Systems causes to the insurer. These systems are not well-equipped in handling increased volumes of documents and data, and this results in allowance of a larger work force for manual processing, which causes hindrance to the road to scalability.

Customer Frustration

Another one of the significant challenges with a legacy system is that it causes long turnaround times and also inaccuracies which often leads to customer dissatisfaction.

Emergence of the Early Computerization

However, the situation turned around from heavy manual processes to somewhat specialized with computerization being introduced in the early years. With the introduction of computers, insurers began to automate administrative tasks. The early Policy admin systems were mainly mainframe-based, which were designed for batch processing and data storage. These were the systems which improved efficiency and also reduced manual errors. However, these systems were often rigid and difficult to modify.

Challenges Faced by the Insurer During this Stage:

Batch Processing

One of the significant challenges that was brought about with computerization is batch processing. The batch-oriented process significantly meant that the updates and processing are not in real-time. Information might be getting entered into the systems during the day and will not be processed until the evening.

Rigidity and Complexity

Another one of the significant challenges with the main frame systems is that they are too complex to modify. Making the changes to accommodate new products or regulations requires specialized programming skills as well as lengthy development cycles.

Data Silos

This is another one of the challenges which are introduced with mainframe systems. While data was primarily electronic, it is often resided in isolated systems which makes it extremely challenging to integrate information across the different functional areas.

Limited User Interface

These are the systems which typically have text-based interfaces which are not very user-friendly and require specialized training to operate.

The Popularity of the Client-Server Systems

Slowly, there was an increased popularity of the client server systems. The client server significantly increased flexibility and accessibility to insurance operations. During this time, the Policy admin system became more user-friendly, with graphical interfaces and improved data management capabilities. This is also the era which saw the rise of specialized PAS which could handle various insurance lines.

The Challenges Faced by the Insurer:

Integration Issues

One of the significant challenges faced by the insurer is integration issues. Integration of different client-server applications can significantly cause data silos.

Infrastructure Costs

With client server systems, there can be significant amount of maintenance, which is required, and this can be quite expensive

Limited Remote Access

Accessing the client server systems often requires being physically connected to the local network.

Scalability Challenges

Even with client server systems, there are significant amounts of scalability challenges which are quite complex and require frequent hardware upgrades.

Internet and Web-Based Systems

Then, came the internet revolution which shook the world. The internet revolution significantly transformed the insurance industry while enabling online policy administration and customer self-service. During this time, there was a significant shift towards greater customer engagement and digital transformation.

Challenges Faced by the Insurer:

Integration of Legacy Systems

One of the significant challenges that are faced by the insurer during the era of internet and web-based systems is integration of legacy systems. This posed as one of the biggest hurdles where insurers had to make efforts in connecting to the existing systems which are often outdated and complex legacy systems. These are the older systems which were not designed for internet connectivity and require complex middleware that would act as a glue.

Scalability and Performance

The initial web-based systems sometimes struggled in handling the huge volumes of online transactions and the user traffic which led to increased performance issues and also impacted the user experience.

Customer Adoption

During this stage, insurers had to increasingly encourage the customers for adoption of online self-service options, and this required addressing the concerns about trust, security and the varying levels of digital literacy and understanding of their customer base.

Developing Online Functionality

This is another one of the significant challenges that insurers face during this era of evolution of the Policy Administration System. There was a significant amount of investment which was required in terms of building user-friendly and comprehensive online portals for policy administration, quoting and claims.

Data Consistency

Another one of challenges that insurers face is maintaining data consistency. Ensuring data consistency and accuracy across the legacy systems and the new web-based interfaces was completely a complex task. This was prone to errors and also requires a robust data synchronization mechanism.

Cloud Computing and Digital Transformation

After the internet revolution took over, the cloud computing and digital transformation era came in. With cloud-based PAS solutions, insurers were able to offer increased scalability, flexibility and cost-effectiveness. In addition to this, modern PAS solutions incorporate advanced technologies such as AI and machine learning for risk assessment and fraud detection, data analytics for personalized customer experiences. APIs and microservices for seamless integration with other systems. The focus is on real-time data access, automation as well as enhanced customer experience.

Challenges Faced by the Insurer:

Legacy Systems and their Integration

One of the significant challenges which were faced by the insurers during this time of the evolution of PAS are legacy systems and integration challenges. Most of the insurers were overwhelmed by the complex and outdated core systems. Additionally, integrating these into the new cloud-based PAS solutions and the other modern technologies proved to be one of the major challenges. In addition to this, this also includes a significant amount of time, effort and cost which further aggravates the existing challenge.

Skill Gap

This is another one of the pivotal challenges that insurers faced when there was cloud computing and digital transformation in the evolution of PAS. The rapid shift towards cloud computing and digital transformation significantly required newer and much better skill sets within the insurance workforce. This posed to be a serious challenge as individuals having knowledge in cloud technology, data analytics, AI/ML and API integration was less. The existing employees often required extensive training and upskilling

Data Security and Privacy Concerns

While retaining and discovering talented individuals with an advanced knowledge in AI/ML, data analytics and cloud technology was a challenge, what followed was a threat to data security and privacy concerns. Insurers had to increasingly ensure complying with the regulations and build robust security measures for protecting against any kind of data breaches and cyber threats. One of the prime concerns for clouds is to offer data protection and enhanced privacy concerns.

Cost Management and ROI Justification

This is one of the biggest operational challenges that insurers face when it comes to cloud computing and digital transformation in policy administration systems. Cloud solutions usually promise cost-effectiveness in the longer run. However, the initial investment in migration along with the new system set up could be significantly high. Insurers need to significantly put out efforts for managing these costs as well as demonstrate a clear return on the investment (ROI) for justifying the digital transformation initiatives.

Vendor Dependency

This is another one of the challenges which are faced by the insurers. One of the critical decisions for insurers is to choose the right vendors. While doing this , insurers need to be mindful in understanding the potential vendor lock-in and also ensure that they maintain the agility and the control over their data and systems.

Business Continuity and Reliability

While cloud computing and digital transformation bought efficiency and transparency, there was another roadblock which the insurers encountered, core operations significantly shifted to cloud platforms, and this meant that there is an increased improvement which was required for high availability, business continuity, and disaster recovery which became more critical. In addition to this, insurers need more robust service level agreements (SLAs) with their cloud providers and well-defined recovery plans.

Features of Policy admin systems

Here, are the unique features of a modern Policy Admin System:

Policy Lifecycle Management

Effective Policy Administration Systems effectively manage the entire policy lifecycle, right from policy creation to expiration. This essentially involves policy processing, underwriting, policy issuance, renewals as well as cancellations. There is a workflow automation in modern PAS, which is essentially for reducing manual intervention, improving operational efficiency and also ensuring that there is policy related information that is being processed accurately, which leads to customer satisfaction.

Underwriting Process Support

The underwriting process is an extremely crucial component of insurance operations. Advanced Insurance Policy Administration Systems offer a rule-based engine that essentially automates risk assessment and premium determination. This also reduces manual tasks, speeds up the entire policy processing, and also allows insurers to respond to the market demands more effectively.

Claim Processing Integration

A Policy admin system comes with a claim processing module integrated. The Policy Administration Software enhances data security and offers a unified view of policy data across the system. This essential integration streamlines operations and also improves customer experience by enabling much faster claims resolutions, and this boosts customer satisfaction.

Billing and Payments

Policy admin systems seamlessly integrate with accounting systems for managing billing and payment processes. This essentially ensures that there are accurate financial transactions that contribute to the financial stability of the insurance company.

Customer and Agent Portals

In order to meet the modern customer demands, a modern PAS should essentially offer digital transformation tools like self-service portals for customers and agents. These are the portals which enable users to manage their insurance policies, make payments and file claims more independently. This enhances customer experience and also reduces the workload on customer support teams.

Data Analytics and Reporting

Insurance systems need live data tools for giving glance at the trends, customer actions, and risks. Additionally, this allows them to make smarter decisions, price policies accurately and also adapt to the market changes faster.

Scalability and Flexibility

Insurance companies are in need of scalable Policy Administration Systems which can effortlessly handle loads of data and also can change quickly. Policy Administration Systems such as iNube effectively help in scalability and are flexible enough for integration with the insurer’s existing systems.

How Policy Administration Systems Help in Life Insurance?

Policy Administration systems are central in managing a diverse set of Life insurance policies, which includes Term, Whole Life and Universal Life Insurance. These serve as the hub for policy creation, premium collection, and policyholder data management. With Policy Administration Systems, Life insurers can automate transaction processing, ensure compliant values, and also simplify reporting needs. Efficient claims processing is facilitated by benefitting the policyholders, beneficiaries, and carriers. Policy administration systems aid underwriting decisions by supplying crucial data for risk assessments and premium calculations.

Annuity Policy Administration Systems form the backbone of managing complex financial contracts, this begins with the meticulous policy issuance and definition of contract terms, these are the systems which precisely outline payout options, beneficiary details and specific riders that ensures accuracy from the outset. By automating the annuity payments, PAS minimizes human errors and also guarantees timely reimbursements, this helps in fostering trust and reliability with the policyholders. Additionally, these systems facilitate efficient contract modifications, which allows adjustments to beneficiary information, payout schedules, or withdrawals.

This accommodates the evolving policyholder needs. Annuity Policy Administration systems are important for regulatory compliance, handling complex tax and financial reporting. This ensures adherence to payout guarantees and also maintains a detailed record for audits. This also streamlines operations and also enhances the overall experience for both insurers and policyholders who are looking to manage regulatory complexities efficiently.

Benefits of Policy Administration in Life Insurance

A modern PAS can significantly accelerate the policy issuance process and also help in automating tedious policy administration tasks such as data entry, while ensuring that there are minimal errors. In addition to this, it also helps in streamlining the generation of policy documents, from initial applications to final contracts. This allows for rapid deployment of coverage.

Within underwriting, a modern Policy Admin system offers a powerful tool for enabling accurate risk assessment. Not only that, but it also consolidates applicant information. It also automates the application of underwriting rules and in addition to this, also facilitates the calculation of appropriate policy pricing. This type of automation not only helps in speeding up the process but also ensures that there is consistent and reliable evaluation which is pivotal for maintaining the insurer’s financial stability.

There are multiple benefits of Policy Administration System in Life Insurance:

End-to-End Policy Management

The modern Policy Admin System acts as the central nervous system for policy management. This offers for a unified platform which oversees every aspect of a policy’s life. It additionally stores and also organizes all policy-related data, from policyholder demographics to more intricate coverage details and payment histories. This is centralized access which empowers the insurers to efficiently manage policy modifications, renewals as well as cancellations. With a comprehensive view of each of the policies, insurers can look forward to making more informed decisions, responding quickly to the customer’s needs and also maintain accurate records throughout a policy’s duration.

Simplifying Premiums and Payments

One of the significant benefits of using PAS is that it will help in effortlessly simplifying premiums and payments. An efficient PAS helps in serving as a financial assistant to the insurer. It automatically generates invoices and also processes payments with laser-like accuracy. With a modern Policy Admin System, premiums and payments can easily be kept on track.

Handles Claims Management in an Expert Way!

Claims management is a tedious task. However, with a modern PAS this can go for a toss. A modern PAS effortlessly guides claims management with efficiency and speed. Right from submission to settlement, every step is automated, and this ensures accuracy while also minimizing delays. The benefit of this is that customers can easily get their claims and also faster. This way insurers can focus on what truly matters to them.

Customer Service Support that is Accurate

With a modular PAS, you will be able to get 24/7 availability when it comes to customer service. That is the level of service which PAS essentially enables. In addition to this, it empowers the customer service representatives with instant access to your policy details. Additionally, a modular PAS can seamlessly integrate self-service options which insurers can control. Not only that, but a modern PAS also helps in delivering an experience which is not only efficient but also truly exceptional.

Smarter Data Management

A modular PAS not just facilitates transactions, but also data management. It is equipped with robust capabilities for unlocking valuable insights about your customers and your business. It offers tools which seamlessly analyze vast amounts of data, identifies trends and also makes smarter decisions. In addition to this, it’s also about leveraging information for creating better products, improving services and also staying ahead of the competition.

How Policy Administration Systems Help in Health Insurance?

In Health Insurance, Policy Administration Systems significantly enhance operational efficiency, this is primarily through automated claim processing. These systems primarily expedite reimbursements by reducing manual intervention, verifying patient eligibility in real-time for preventing fraud, and also seamlessly facilitates data exchange with healthcare providers via EDI. This automation not only helps in accelerating claim settlements but also minimizes errors which leads to a more improved patient and provider satisfaction.

Additionally, these systems streamline policy management by handling intricate policy details such as deductibles and co-pays and support diverse health plan types. These also empower policyholders with online enrollment, self-service options, and easy policy updates which play a pivotal role in enhancing the overall customer experience.

Essentially, Policy Administration systems ensure regulatory compliance by adhering to healthcare mandates such as HIPAA and ACA. This mitigates compliance risks and also simplifies the complex reporting obligations. Additionally, these systems offer customer service representatives with easy access to policy and claims information, which enables them to deliver fast and accurate service.

Taking a closer look at how Policy Administration Systems can help in Health Insurance:

Policy Issuance and Enrollment

A robust PAS significantly plays a part in streamlining policy issuance and enrollment process. The robust capabilities help in capturing efficiently data and also validates applicant data, which ensures complete accuracy from the outset. Right from automating generation of policy documents, from ID cards to detailed coverage summaries. It eliminates manual errors and significantly accelerates the policy issuance process. In addition to this, PAS automates the entire enrollment workflow which seamlessly integrates with the eligibility verification and provider automation. Not only this, it also leads to a much faster policy activation and a positive initial experience for new members.

Member Data Management

Member data management is the crucial point in health insurance operations. A robust PAS can significantly serve as a central repository. This significantly maintains comprehensive member profiles which encompasses demographics, coverage specifics, and also medical histories. This single, unified view allows for more efficient data updates and maintenance, which ensures that information remains current. Essentially, PAS plays a pivotal role in prioritizing data security and implements rigorous control to protect sensitive information and comply with the data protection regulations.

Premium Billing and Collection

One of the important ways that PAS plays a pivotal role in Health insurance is by maintaining a steady revenue stream for insurers. An efficient and end-to-end PAS efficiently automates premium billing cycles and also generates accurate invoices while supporting diverse payment options for member/the Insured’s convenience. It also diligently tracks payments and also reconciles accounts, all this while significantly minimizing any discrepancy. In addition to this, the system also helps in automating delinquency management and sends timely reminders and initiates collection procedures. This also reduces the premium leakage and significantly bolsters financial stability.

Efficient Claim Submission

An efficient Policy Administration System significantly transforms claims processing from a cumbersome task to a more streamlined operational process. Additionally, it also supports electronic claims submission. This accelerates adjudication by automating the coverage rule application. With automated payment generation, there is a timely and accurate settlement which helps in enhancing the provider and member satisfaction. Not only this, a modern-day policy admin system, also incorporates fraud detection tools, while safeguarding against financial losses and also while maintaining integrity of the claims process.

Benefits Administration

A robust Policy Admin System empowers the insurers to configure a diverse range of plans. Not only do these systems help in configuring accommodating deductibles, co-pays and also various coverage options. In addition to this, the system also meticulously tracks benefit utilization while ensuring accurate application of coverage rules and limits. This prevents both overpayment as well as underpayment. Additionally, it also facilitates provider network management, which ensures claims are processed in accordance with the network agreements, while optimizing costs control and member access.

Policy Renewals and Endorsements

A modular Policy Admin System efficiently automates the renewal process, while also generating timely notices and processing payments efficiently. Additionally, it also simplifies policy administration tasks such as policy amendments, which includes coverage changes or any beneficiary updates and ensures that all the modifications are adequately documented and processed. This is a proactive management of the policy lifecycle which contributes to a higher retention rate and also customer satisfaction.

Reporting and Analytics

A modern Policy Admin system offers invaluable insights through comprehensive reporting and analytics dynamics. It also generates standard and custom reports on policy data, claims activity, and also financial performance. Data visualization and dashboarding facilitates in allowing for more data-driven decision making, which further enables the insurers to identify trends, optimize processes, and also improve the overall performance.

Customer Service Support

Another one of the most significant ways that a modular Policy Admin System helps is by offering customer service support. These systems empower the customer service representatives with real-time access to policy information. This allows for offering more accurate and also ensures timely support across the various channels of communication. In addition to this, it also facilitates efficient resolution of claims and billing inquiries, thereby enhancing the customer experience. In addition to offering a comprehensive view of member interactions, a Policy Admin System significantly helps in improving service quality and also builds stronger customer relationships.

How Policy Administration Systems Help in Motor Insurance?

In Motor Insurance, PAS plays a pivotal role in simplifying the policy issuance process and is one of the most important functions of a Policy Administration System in Motor Insurance. It enables insurers to quickly access client data and generate policy documentation. Premiums are determined based on the risk factors such as vehicle type or driving history. With a Policy admin system, PAS automates the entire process, and it eliminates manual data entry while reducing errors. It significantly cuts down on the time that is needed to issue a new policy.

In addition to this, it processes payments and bills efficiently. Monthly, quarterly, or annual payment plans are frequently available for Motor Insurance. PAS efficiently bills the premiums in accordance with the selected plan. In addition to this, PAS significantly manages payments, keeps track of the unpaid amounts and effectively sends out automated reminders to the clients. The automated feature in PAS lessens much of the insurer’s team’s administrative workload and also guarantees that the payments are applied accurately.

Policy admin systems significantly streamline both the claim and renewals for Motor Insurance. They automate the entire claims process right from reporting to settlement and also efficiently handle policy renewals with automatic reminders and premium adjustments based on updated risk factors. PAS significantly helps in facilitating easy policy changes, such as adding information for drivers and vehicles which reduces a lot of manual work and also improves customer service.

Here’s how a modern Policy Administration System helps in Motor Insurance:

Speeding up Policy Activation

Policy issuance is more than just a process; efficient and accelerated policy coverage will not just be helping the customer experience but also retention. That’s where a modern PAS comes into the picture!

End-to-End Policy Management

One of the prime benefits of a modern digital core is that it helps in catering to end-to-end policy management. With a robust capability of storing vast amounts of data, PAS can significantly help in offering important details such as for vehicles, drivers, and coverage is stored and managed. This includes everything from policy modifications to renewals, everything will be streamlined and accessible. This is a centralized hub which ensures that there is data accuracy, simplifies policy management, and gives control of the insurance information.

Smoother Transactions

Navigating the payments space is not a bumpy road but can be a smooth lane with modern PAS. Modern PAS efficiently creates a smooth payment space which automates billing and offers convenient payment options. Whether you are looking for online payments or direct debits, then, a modern PAS offers seamless and hassle-free transactions. Automated reminders and notifications keep you on track, and this ensures insurers can seamlessly process transactions.

Accelerated Claims Processing

A modern PAS offers capabilities which can significantly accelerate claims processing. A modern and efficient PAS is not only for easing out the entire claims processing process. It automates verification, coverage checks, and payment calculations, thereby speeding up the settlement times. With digital tools infused, PAS helps in effective fraud detection and additionally ensures fairness and accuracy and makes you go on the road quicker.

Effortlessly and Seamless Connects to Customer

Modern PAS offers instant access to support, which is essential. The PAS acts as an efficient customer connection channel and offers real-time access to policy and claims information. A modular PAS also helps in policy and claims management on the go! Not only that, but it also helps in tracking status online through online portals and mobile apps.

Data Dashboard

A modern PAS system is beyond just a system. Infact, it offers a powerful data dashboard. Additionally, it also collects and analyzes valuable data on policies, claims and customer interactions. These are the insights which empower insurers to make more informed decisions, optimize their operations, and shape the future of their business. This includes everything from pricing strategies to product development, data-driven decisions and ensures that you get the best possible coverage and service.

How does PAS Help in End-to-End Insurance Policy Lifecycle Management?

A Policy Administration System that is efficient helps in end-to-end policy management. Modular Policy Administration system is equipped with lot of features which streamlines pivotal tasks right from centralizing data to ultimately enhancing customer service, a modular Core system facilitates end-to-end policy management tasks. Beginning with the initial quoting and underwriting phases, PAS platforms accurately generate quotes which are based upon intricate risk assessments as well as automates the evaluation of applications and ensures that there is efficiency and preciseness in policy eligibility determinations.

This is a seamless transition which extends to policy issuance, where PAS streamlines the creation and distribution of policy documents, and it meticulously manages coverage details, premium structures as well as contractual terms. Throughout the active period of a policy, PAS facilitates robust policy servicing and helps in managing modifications such as address or beneficiary updates and also handles premium payments with automated billing and collections. Additionally, these systems empower customer service by providing instant access to policy information, enhancing responsiveness and satisfaction.

Infact, throughout the active period of a policy, PAS acts as the active custodian of policy data, and also the system efficiently to manage customer information, coverage details and premium calculations. The Policy admin system efficiently handles the dynamic nature of insurance, while seamlessly processing policy changes such as endorsements, renewals, and cancellations. PAS efficiently helps in automated billing and premium calculation functionalities which minimizes administrative overhead and also ensures timely payments.

While not just in the entire policy issuance process, these systems also play an active role in customer service. PAS serves as the critical tool for customer service, thereby offerig representatives with instant access to comprehensive policy information and also enables them to address inquiries promptly as well as accurately. The Modern Policy Administration system seamlessly integrates self-service portals which empower policyholders to conveniently access their policy details, make payments and manage certain aspects of their coverage independently.

During the time of a claim, a modern-day PAS can seamlessly integrate with claims management system and plays a pivotal role in streamlining the process from claim intimation to claim settlement. PAS seamlessly facilitates the tracking of claims, automates payment calculations and also generates detailed claim reports, while ensuring transparency and efficiency.

A Policy admin system serves more than just benefitting in operations. It also plays a pivotal role as an analytical tool. Additionally, it generates comprehensive reports on policy performance, premium revenue, and other critical metrics, and offers insurers valuable insights into their business. PAS infused with advanced analytics tools can significantly help in identifying trends, predicting future performance, and making data-driven decisions that optimize profitability and mitigate risk. In addition to this, PAS plays a crucial role in ensuring regulatory compliance as well. By automating compliance related tasks and maintaining meticulous records, it also helps the insurers to navigate through complex regulatory landscape and avoid costly penalties.

In summary, PAS acts as the intelligent centralized platform which helps in driving efficiency, accuracy and customer satisfaction while enabling data-driven decision-making throughout the entire policy lifecycle. It is the digital backbone which allows insurers to operate with flexibility, precision and confidence in today’s competitive market.

What can A Modular and Robust PAS Mean for Insurance companies?

One of the most important aspects of adapting to a robust Policy Admin solution is that it no longer serves as a back-office necessity for insurers. But it’s definitely more! In fact, it’s becoming quite strategic for insurers to adapt to a modern PAS and channelize efficiency, growth and also customer engagement. With the right Policy Admin solution, insurers can inevitably unlock multiple opportunities and navigate through the evolving insurance landscape with much greater agility and confidence.

Let’s take a more detailed look at how these operational processes will be streamlined with a modern-day Policy Administration System:

Enhanced Operational Efficiency and Automation

One of the important ways by which PAS will make a difference is that it will be acting as a central hub for all policy-related activities, while streamlining workflows and also automating previously tedious and manual processes. This has multiple other benefits which add up to enhancing the overall operational efficiency of the insurer.

Here’s a closer look at them:

Reduced Administrative Overhead

One of the significant ways by which a modern Policy Administration System can help is by reducing the administrative overhead. Automation of tasks such as premium billing, collection and disbursement minimizes the need for any kind of manual intervention, freeing up a lot of staff to focus on more strategic activities like customer relationship management and product innovation.

Accelerated Policy Lifecycle Management

From initial quote to policy issuance, endorsements, renewals and cancellations. A robust and modern PAS can effortlessly automate each stage while reducing turnaround times and also minimizes errors. You can take it for instance, automated underwriting rules within the Policy Admin System which can help in accelerating the risk assessment process and this leads to a much quicker policy issuance

Data Accuracy and Improvement in Consistency

One of the most important benefits that a modern-day PAS is that a centralized PAS can effortlessly ensure data consistency across all policy related processes. This includes reducing data silos and also improving the accuracy of reporting and analytics. This is one of the most important truths that every insurer needs to know in order to make more informed decisions.

Scalability and Flexibility

This is another one of the significant benefits that a modern PAS would be helping. A modern-day policy admin system and especially a cloud based one will be helping in offering scalability for handling business growth volumes and adapt rapidly to the changing market demands without any significant infrastructure overhauls. This flexibility also allows the insurers to launch new products and enter new markets more easily and rapidly.

Enhanced Customer Experience and Engagement

We are living in a customer-centric world and the modern Policy Admin System can significantly help in playing a pivotal role in delivering exceptional customer experiences. Here’s a closer look at them:

Personalized Communication and Product Offerings

Another significant way by which a modern Policy Admin System can help insurers is by offering personalized communication and product offerings. The vast amount of customer data which is stored in PAS can significantly be leveraged for personalized communication and tailored product recommendations. Insurers can gain robust number of data-driven insights into customer needs and preferences, thereby enabling them to offer more relevant products at the right time. This enhances customer loyalty and cross-selling opportunities. PAS can effortlessly identify a Life Insurance customer who is reaching a milestone like marriage or childbirth. Then the system can trigger an offer for more increased coverage or for a new related product.

Accelerated and Transparent Claims Processing

One of the most underrated benefits of having a modern Policy Admin System is that it can significantly accelerate the claims processing process. A modern PAS effortlessly streamlines the claims process which includes everything from initial reporting to settlement. Automated workflows, digital document management, and also offers real-time status updates enhances transparency and reduces the time. This way it reduces the time to process claims, which is one of the critical factors in customer satisfaction.

Omni-Channel Delivery

A modern Policy Admin System allows for seamless customer interactions across a diverse range of channels. This includes everything from mobile apps to website portals and customer agents to call centers. Customers can significantly access policy information, make changes as well as take the step to initiate claims through their preferred channels, which will further lead to a more convenient and satisfied experience for customers. For instance, a customer might be able to start a claim online and they will follow up via a phone call.

Self-Service Capabilities

This is another one of the significant ways by which PAS can help insurers to scale. A modern-day Policy Admin System includes customer facing portals and also mobile apps which empower policyholders to manage their policies more independently. Additionally, this also includes tasks such as updating the contact information, viewing policy documents, making premium payments and tracking claims status. The result is that it reduces the need for direct interaction with customer service and it also improves efficiency.

Data-Driven Insights and Decision Making

One of the most important aspects of a robust PAS is that it serves as a centralized hub for data management for insurers to gain valuable insights for a more strategic decision-making process.

Here’s a closer look at how PAS can significantly help:

Improved Risk Assessment and Underwriting

A detailed policy and customer data within PAS can be used for refining the risk models and also improve the underwriting accuracy. By analyzing all these historical data on claims and policy characteristics, insurers can significantly access risk and price policies more effectively.

Fraud Detection and Prevention

Another one of the most significant benefits of PAS is that it can incorporate fraud detection capabilities and thereby flagging suspicious activities and patterns in the policy applications and claims process. This additionally helps the insurers to minimize losses due to fraudulent activities.

Regulatory Compliance

This is another one of the significant impressions that a robust Policy Admin System can make. A well-designed PAS can significantly help in complying with the evolving regulatory requirements which are offered by providing audit trails, maintaining data integrity, and also generating necessary reports. This helps in significantly reducing the risk of penalties and also ensures adherence to the industry standards.

Flexibility and Innovation

A robust Policy Admin System can help insurers to be more agile and innovative in response to market changes and customer demands. Taking a closer look at how these systems contribute to agility and innovation:

Effortless Integration with Other Systems

A modern Policy Admin System is effortlessly designed to seamlessly integrate into the core insurance systems. This includes systems like CRM, claims management and accounting systems along with an external data source and Insurtech solutions. This interoperability significantly creates a more connected ecosystem that plays a pivotal role in enhancing efficiency and enables innovation.

Accelerated Product Development and Launch

This is another one of the ways that PAS helps insurers to unlock operational benefits. A modern-day Policy Admin System with a flexible product configuration capability can help in allowing the insurers to design and launch new insurance products even more quickly. This flexibility is extremely crucial in a rapidly evolving market where the customer needs and competitive pressure are constantly changing.

Rapid Adoption of the Emerging Technologies

A modern day and future-ready PAS will be helpful for insurers to rapidly adopt to emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML) and Robotic Process Automation (RPA). These are the technologies which can seamlessly be integrated into the existing core systems for further automating the processes, enhance customer interactions and gain a deeper insight into the data. For example, AI powered chatbots can significantly handle routine customer inquiries, while the ML algorithms can significantly help in personalizing product recommendations.

Cloud Adoption and Modernization

We are living in the age of AI and digital transformation, and cloud adoption and computing is definitely making a difference, especially in Insurance. Insurers are rapidly moving towards cloud-based PAS solutions. Cloud facilitates in offering benefits like scalability, cost-effectiveness as well as enhanced security. This helps with easier access to updates and new features that foster greater flexibility and innovation.

The Top Trends in Policy Administration System

Here, are the top trends in Policy Administration System that are taking over the insurance market in 2025:

AI and ML Automation

One of the significant trends in the Policy Administration system is the infusion of automation within these core systems. AI and ML have deeply been integrated into insurance policy admin systems. This enables the insurers to take full advantage of automation and leverage it in expediting critical functions like claims processing, underwriting, and fraud detection. For instance, AI algorithms can easily analyze the vast amounts of data for easily assessing the risk more accurately during the policy issuance process, while the ML models have the capability of detecting of anomalies which may indicate the presence of fraudulent claims.

In addition to this, insurers can seamlessly use predictive analytics for foreseeing the customer’s behavior which includes lapse risks or any kind of potential upselling. This is the kind of intelligence which effortlessly streamlines operations, reduces human errors and improves the policy issuance turnaround time and this leads to a more profitable decision making.

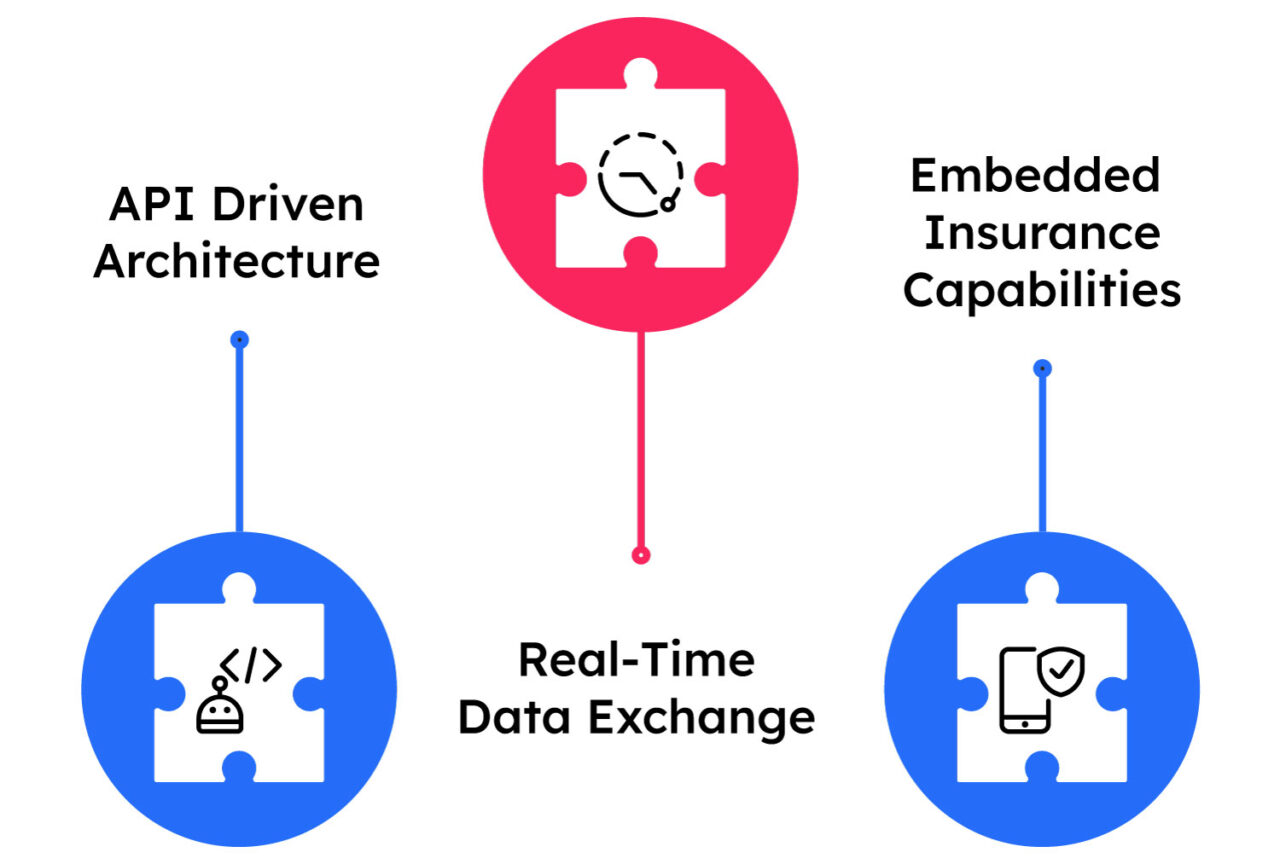

Cloud- Native, API-first Architectures

This is another one of the significant trends in Policy Administration System, which insurers are widely adopting. Especially in 2025, insurers are increasingly prioritizing cloud-native and API-first architecture for their PAS systems. These are modern systems which are widely built using microservices and are also hosted on scalable cloud platforms such as Azure or AWS.

This effortlessly allows the insurers to deploy the updates continuously, scale operations effortlessly and also reduce the infrastructure costs. The API first approach essentially means that these are the systems which are designed for seamlessly integrating third-party applications. This further enables better collaboration across the insurance ecosystem. With this cloud-first approach, insurers can leverage their Policy Administration systems to ensure agility and also ensure faster Go-to-market as it offers a resilient infrastructure for innovation and long-term digital transformation.

Omnichannel and Self-Service Enablement

This is one of the pivotal trends in the Policy Administration System in 2025. Modern policy holders can significantly demand control and convenience. The Policy Admin Systems today are primarily designed to support the omnichannel experience across the different channels such as mobile apps, web portals, emails, chatbots and contact centers.

With omnichannel and self-service enablement in PAS, customers can easily purchase policies, submit claims, make changes, and also keep track of the policy status across any of the devices or platform. This is the level of accessibility which reduces the dependency on call centers, enhances the services speed and also increases customer satisfaction. In addition to empowering the users through self-service options, insurers will be getting a golden opportunity to improve their customer service experience and also optimize their operational efficiency.

Hyper-Personalization

One of the advantageous trends in Policy Administration System is hyper personalization. Customers in 2025 are increasingly expecting to get tailored insurance products and experiences. The PAS platforms can significantly leverage data from wearables, health apps and analyze the digital footprints for offering more tailored coverage details, policy recommendations and also targeted communications.

By using AI-driven data analytics, insurers can significantly and efficiently segment customers on a real-time basis and also adjust the offerings in order to suit their individual needs. You can take the example of a health-conscious policyholder who uses a fitness tracker who will be receiving dynamic discounts on Life insurance premiums. One of the best things about using the hyper-personalized approach is that it significantly strengthens customer loyalty, improves engagement and also differentiates insurers in a more competitive marketplace.

Integrations that are Ecosystem Ready

This is a trend in the Policy Administration System which has gained popularity in recent years. As today, insurance is beyond just a standalone service and is proving to be part of a larger ecosystem which includes health insurance platforms, financial institutions, travel agencies as well as e-commerce companies. Today, Policy Admin Systems are built upon technology, which is ecosystem ready, meaning that they can seamlessly integrate with any third-party platform and this they can do by using APIs and event-driven architecture.

This also allows the insurers to offer embedded insurance, partner with the Insurtech startups or pull in real-time data for better underwriting and servicing. These are the systems which are open and interoperable, PAS platforms can significantly enable the insurers to deliver more value and expand their reach beyond just the traditional channels.

Low Code No Code Platforms

Low Code No code platforms are definitely proving to be a game-changer in the insurance technology space. In order to keep pace with the fast-changing customer needs and the regulatory demands, insurers need a flexible approach in launching and modifying their products.

The low code no code platforms enable seamless accessibility without having to be equipped with vast technical knowledge. This includes product managers and underwriters who can easily access the low code no code platforms for designing and configuring policies, rules and workflows without having to write any code. These platforms also offer intuitive interfaces which makes it easy for reducing the development cycles and allows the insurers to roll out their products faster into the market. With this democratization of the system, it helps in configuring and fostering faster product innovation, this reduces the IT bottleneck and helps in keeping the insurers competitive in a much dynamic market such as insurance.

Real-Time Policy Servicing

As the customer demands are moving to personalized experiences, real time policy servicing is becoming increasingly popular and is also becoming a necessity. In fact, real-time policy servicing is becoming a baseline expectation. The Policy Admin Systems are specifically designed to facilitate instant transactions like endorsements, renewals, policy issuance, and even claims adjudication. This has been possible through real-time data processing and by leveraging AI-powered decision engines, and integrated customer communication tools.

It does not matter whether it is a chatbot approving a policy update or a mobile app which displays real-time claim status, the customer is no longer anticipating having to wait for hours. Primary benefits if real-time servicing includes enhanced transparency, improved satisfaction and ultimately establishes one of the most important things which is building trust between insurers and policyholders.

How to Strategically Use the Top Policy Administration System Trends in 2025?

While adopting the top trends in Policy Administration is beyond just a wish for insurers in 2025, what will stand out is how strategically insurers can adopt these trends.

Here’s how:

Accelerate Innovation and Go-to Market with Cloud Native, API-First Architectures

While the race to adopt cloud native based and API first architecture is quite high, insurers cannot go with a hasty approach, especially when it comes to API-first architecture or any technology-based trend adoption. Instead, they need to strategically align their business goals with the need for cloud-based adoption. One of the most important benefits with cloud native platforms is that they help in ensuring high availability, scalability as well as performance. While with API first design, there is a seamless integration with the third-party systems such as reinsurers, payment providers as well as digital health platforms. This helps in establishing an ecosystem which supports faster product innovation and enhances customer experiences.

Streamlining Operations with AI and ML Type of Automation

One of the significant ways to adopt to the top trends in Policy Administration is understanding the need to streamline operations with AI and ML type of automation. Right from automating underwriting to effectively detecting fraudulent claims, these are the technologies which streamline high volume processes as well as reduce human error. With machine learning the insurers can significantly predict customer churn rate and also assess the risk more accurately and also optimize claims adjudication.

Infact, strategic application of AI or ML in the areas where there is more complexity and huge data volumes and complexity allows the insurers to drive efficiency, reduce costs, and deliver quicker decisions with much greater accuracy.

Enhancing Engagement and Retention through Hyper-Personalization

This is another one of the significant ways of adopting the top trends in Policy Administration in 2025. Today, the policyholders are expecting products and services which will be tailored to offer more hyper-personalized experiences at a scale. What this means is that customized policy bundles, adaptive pricing models and communication will be tailored to individual preferences. A more personalized approach will not only help in improving customer engagement and also satisfaction but also the insurers can increase their conversion and retention rates. This will help in maximizing the long-term value of the insurer.

Omni-Self Service Platforms for Delivering On-Experiences

Another prominent strategy to adapt when looking to adopt to the top trends in Policy Admin system is understanding how omni self-service platforms will be helping in delivering on-experiences. Today, the Modern policy administration systems effortlessly integrate omnichannel integrations. This enables the customers to offer engagement via mobile apps, web portals, call centers or chatbots. This happens with a consistent experience across all touchpoints. By offering self-service options for tasks such as policy issuance, updates, renewals, and claims submission. There is empowerment for the customers while reducing the insurer’s operational burden.

Enabling Real-Time Analytics and Insights

One of the most important ways that insurers can leverage Policy Administration systems is by leveraging these admin systems for ensuring faster data accessibility. The modern Policy Administration systems are now built with analytics engines for powering up decision-making. The insurance providers can significantly leverage data driven policy decisions for refining products, personalizing offerings and also streamlining operations.

This comes from efficient tracking of policy conversion rates to the prediction of lapse risk. These real-time analytics help the insurers to stay ahead of customer expectations and also market changes. One of the benefits of strategically choosing policy admin systems is, the insurers can integrate them seamlessly with the external data enrichment tools that provide even more context about risk, behavior, and preferences.

Offering A Unified Digital Experience

Another one of the key strategies for adopting policy admin systems is by offering a unified digital experience. Today, customers expect seamless, mobile-first experiences where they are demanding easy access to the digital policy management tools which includes self-service insurance portals, and in this process insurance mobile apps play a crucial part. These are extremely important for delivering an unparallel customer expectation.

One of the keyways by which an insurer can empower the customers is by offering them the benefit of self-service portals. With these self-service portals, insurers can help in initiating renew policies, endorsements and downloading new documents. All these without having any kind of human support, all digital. By offering a unified digital experience, customers across the web, mobile and agent assisted channels is now getting a defined competitive factor.

What Lies Ahead for Insurers in Policy Administration in 2025?

While the insurers pace up by strategically adapting to the policy administration trends in 2025, what lies ahead for insurers as the year progresses is quite bright.

Here’s what lies ahead for the insurers as the year further progresses:

Artificial Intelligence and Hyper Automation will be at the Centre

In 2025, hyper automation which is a combination of RPA, AI and low code technologies will be the power player. They will be helping turbo-charging different functions such as automated policy issuance, AI-driven customer support for endorsements or renewals. There will also be smart alerts for compliance or lifecycle events. One of the things that insurers need to understand is that AI will not just be assisting but it will be helping in leading pivotal tasks. Now, insurers will heavily be relying upon decision intelligence for refining policy rules as well as personalizing the offerings in real-time.

Legacy Systems will NO More be Increasing Value

One of another things which lies ahead for insurers as the year progresses is that legacy systems are now becoming inflexible. Insurers are increasingly shifting from the monolithic legacy systems to a cloud native, modular policy administration system. These core systems will be helping in supporting faster policy configuration and launch, enable real-time data access and updates and also will be contributing a great deal in underwriting and decisioning. As the year further progresses, insurers can expect to see a wide adoption of intelligent policy administration systems which can seamlessly incorporate predictive analytics, AI based workflow automation and machine learning for creating dynamic adjustments.

Embedded and Usage Based Insurance will be Redefining Insurance Distribution

Another important thing that insurers can rely upon when they are adapting to the key policy admin system trends is that embedded, and usage-based insurance will be rewriting the way insurance distribution works. In 2025, the modern PAS will be helping insurers to offer contextual policies during the time of purchase, this can include travel, EV platforms among others. In addition to this, there will be dynamic pricing models which will be based on real-time behavior, and this is especially when it comes to Auto and Health insurance.

In addition to this, there will be plug and play APIs that will help in enabling instant policy creation across the digital ecosystems. The modern Policy Admin systems will be helping the insurers to support multiple micro-duration products, modular coverage options as well as real-time premium adjustments.

Ecosystem Readiness

As the policy admin trends keep evolving, the future of insurance is becoming interconnected. Today, the modern PAS platforms are expected to effortlessly integrate into third party platforms which includes vehicle telematics, wellness apps and home sensors and more. These modern PAS systems effortlessly participate in the ecosystems such as Bima Sugam (India), NHCX, and open insurance frameworks. These ecosystems will be complying with the global and the regional data for data sharing regulations securely.

Insurers can now expect the API first platforms to become the new reality and also will be enabling collaboration with banks, fintech and OEMs along with wellness providers.

Increased Personalization

Another one of the things that lies ahead for insurers is increased demand for personalization. Today, customers are expecting personalized policies and not a one size fits all concept, that was traditionally been deployed by the insurers. With real-time data and behavioral analytics and AI. With this advanced feature, insurers can offer tailor made coverages which will be based on lifestyle, dynamic adjust limits or terms for circumstance changes. Insurers can offer bundled, value-added services which can enhance customer experience. One of the underlying advantages is that policy admin systems will not just be looked at as core insurance platforms but as customer experience engines. This will be shifting the traditional viewpoint of insurers and customers alike for core insurance systems as just policy repositories.

Predictive Insights and Policy Intelligence

This is another one of the significant things that insurers need to keep in mind when they are strategically looking to adopt the modern PAS trends. With AI and machine learning seamlessly incorporating in modern PAS solutions, risk prediction will become much easier. This advanced technology will be empowering the insurers to help the insurers to analyze vast datasets, and this also includes the non-traditional sources. Insurers can effortlessly gain a more detailed understanding of the individual risks that leads to much more accurate underwriting decisions as well as policy pricing.

For instance, by leveraging the telematics data from vehicles, insurers can increase their chances of predicting the likelihood of any accidents, or health wearables data can help in informing health insurance premiums accurately.

Seamless Integration into Ecosystems

Modern PAS trends will be empowering insurers to effortlessly integrate:

Focus on Customer Experience

The modern PAS trends will be empowering the insurers to enhance customer experience which is one of the pivotal goals for every insurer in 2025. Policyholders can expect to give consistent and effortless experience in all the interaction channels, from online portals and mobile apps to agent interactions. The modern-day PAS will significantly be helping in supporting an omnichannel approach.

Additionally, they can enhance the customer experience further by offering self-service portals that will enable the policyholders to access different policy related information such as policy information, making any policy changes, and to initiate claims. A modern-day Policy Administration system can offer robust and user-friendly self-service functionalities that will help in expediting policy issuance process and will also be enhancing transparency in the process.

Another one of the advantages of giving policyholders the power to transparently communicate with the insurer. These communication platforms integrated with self-service portals can offer policyholders information about potential risks, coverage gaps, or any sort of relevant product update which will help in enhancing customer engagement as well as trust.

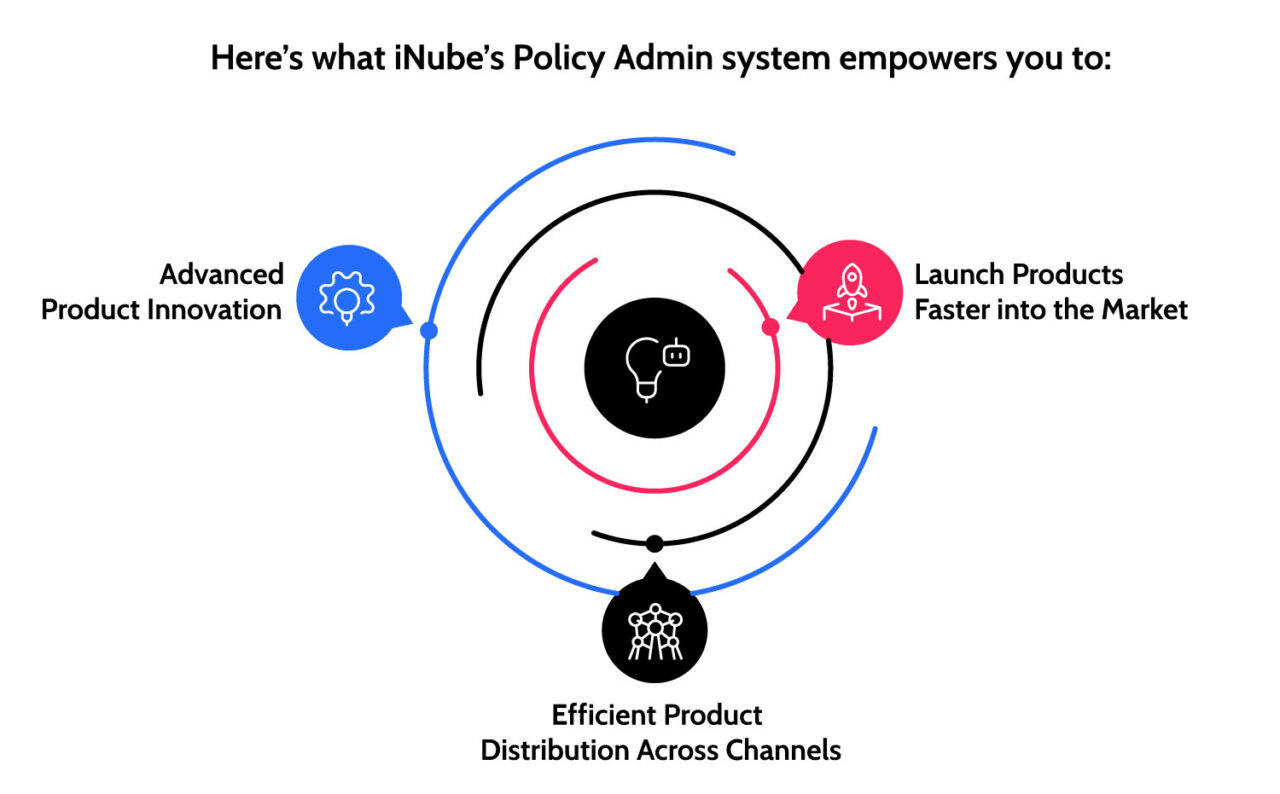

Why Choose iNube?

iNube, is one of the prominent names in offering quality insurance software solutions. With a team of insurance domain experts, every insurance technology is designed for streamlining complex operational functions and addressing pivotal challenges across the insurance value chain. With iNube’s robust Policy Admin System, insurers can not only streamline end-to-end policy administration but also improve their operational efficiency.

A modern-day digital core platform that seamlessly integrates into the existing IT infrastructure of the insurer, replaces legacy systems or co-exist with them. The core system is built to transform the pivotal tasks in policy management.

All these and more with iNube’s Policy Administration system which is built for scalability, efficiency and to accelerate the tedious and manual intensive policy management tasks. Our core platform is designed to enhance operational efficiency while also facilitating minimal disruptions.

Insurers in 2025 need to understand the importance of policy administration systems which will not just be aiding them in smooth policy administration but also will be helping them to evolve beyond their traditional transactional and operational processes. The focus is purely on harnessing the capability of predictive analytics deeply and also policy intelligence for driving better decision making. When insurers adapt strategically to robust core platforms, they can effortlessly personalize customer experiences, optimize operations as well as achieve sustainable growth.

Its time insurers understand that incorporating a modern PAS is beyond just a strategic adoption, but a fundamental requirement that is needed for surviving and success of the insurance industry. Additionally, it will be forming the bedrock on which the insurers can build upon a competitive advantage, foster customer loyalty and seamlessly navigate through the complexities of the future. Insurers need to acknowledge that ignoring these imperatives is not just a technological oversight and hence it’s a strategic misstep which will potentially have severe and long-lasting consequences. With this strategic adoption of the PAS trends, the future of the insurance core platform relies upon the ability to adapt, anticipate and innovate. All the policy admin systems can significantly help the insurers to adapt to the PAS trends effortlessly. Before jumping into the adoption of PAS trends, it’s important to understand the business necessity and also whether the business goals will align with the trends or not.

For a brighter policy administration journey, insurers need to adapt to core platforms that effortlessly are capable of handling volumes of policies, expedite slow processes and improve the policy issuance turnaround time.

Swift adaptation of the PAS trends is not the key to gain a competitive advantage, but understanding the need for adaptation and the business relevance will be playing a part in rapid evolution of legacy systems to modern policy admin systems. Instead of falling for strategic misstep, insurers need to align their business goals in such a way that they can seamlessly integrate policy administration systems and enhance operational processes while causing minimal disruption.

Today, the policy administration systems are robust and modern enough to seamlessly enhance operational processes while also empowering the insurers to not disrupt their operations drastically, especially when it comes to data migration. Modern day PAS systems are efficient, flexible and seamlessly integrate into the existing IT infrastructure of insurers, thereby enhancing their operational efficiency, and also increasing their operational capability.

Insurers can adapt to this strategic necessity of adopting a modern PAS, rather than jumping into the fad of hasty technology adaptation.

As the insurance landscape become more AI and tech-driven, insurers need to increasingly acknowledge the growing necessity to accomodate a PAS which effortlessly fits into their existing IT infrastructure and also helps them in streamlining tedious administrative tasks.

The Way Ahead…

As insurers embrace the rapidly evolving PAS trends, strategic investment and adoption will be the ultimate gamechanger that they would not anticipate. Understanding this growth strategy is exactly where the power of insurers would lie.