Offering smooth policy management in Health Insurance is one of the pivotal functions that every Health Insurer aims to offer to their customers. However, long standing challenges like onboarding new business into the existing complicated processes with manual repetitive tasks is a hindrance that every insurer actively faces.

A leading Indian standalone Health Insurer faced similar policy management issues. Replacing iNube Policy Administration system for their newer lines of business revolutionized their operations. This case study will highlight their challenges and our system’s pivotal role in overcoming them.

About the Insurer

Our client, a leading standalone health insurer in India, is recognized for their innovative and comprehensive healthcare policies tailored to individual needs, with the core aim of making quality healthcare accessible to everyone.

What we Solved for the Health Insurer:

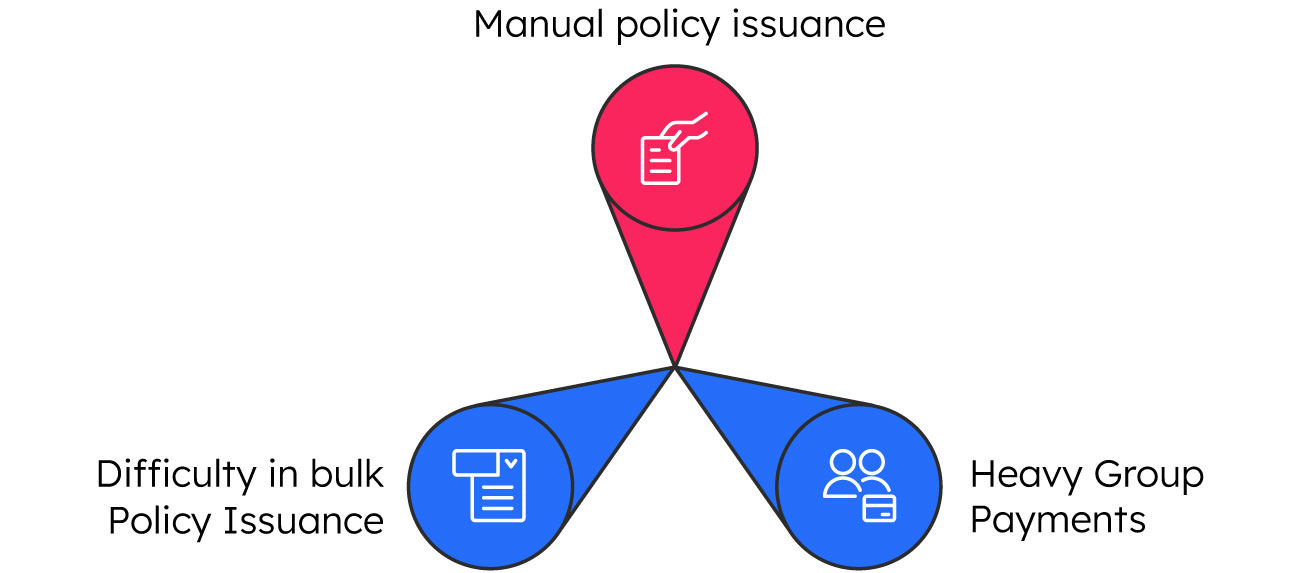

The Health Insurer had difficulty in seamlessly expanding their business to Travel Insurance and operating their end-to-end functions over a single unified platform.

In addition to this, we solved some other operational hurdles for them. Here’s a quick glance at them:

iNube’s Solution to Business Challenges:

iNube implemented an end-to-end policy administration system along with multiple functional solutions that streamlined the manual policy management process.

User Management Platform

The platform enabled effortless customization of access for various business users.

Partner Creation Module

Facilitated seamless partnerships, catering to diverse policy issuance preferences and conditions.

Cash Flow Creation and Replenishment

Streamlined customer cash flows and transactions from a secure cash deposit account, providing alerts for replenishment.

Policy Issuance Module

The automated module supported both group and retail policy issuance journeys for customers.

Hassle-Free Endorsement Module

Digitized changes in claims, personal details, and other documents, leading to on-spot endorsements.

Reports and Analytics

Allowed for seamless report generation, providing visibility into transactions, CD account balances, and other accounting details.

CKYC Integrations

Plugged-in the KYC module that enabled instant CKYC retrieval at the front end and post-issuance KYC uploads at the back-end core policy management.

Bulk Policy Issuance

The end-to-end system facilitated the issuance of policies in bulk without compatibility issues through digitized customer data input.

External Integrations

These integrations enhanced Customer communication (CCM) and offered seamless payment options during policy issuance.

One Solution, Multiple Business Benefits

Impact that Makes the Noise

- Over 580k+ Policies issued

- Over 600k+ Quotes issued

- 90k+ volumes handled per month

- 250+ users created