Imagine owning a life insurance policy and feeling confident enough in your insurer to recommend them to the next generation. That’s not just a policy—it’s a relationship built on trust, consistency, and value. For life insurers, this level of policyholder loyalty—known as persistency—is gold. But achieving high persistency isn’t just about selling the right product anymore.

With evolving customer expectations and digital-first habits, Insurtech and AI are redefining what it means to retain a life insurance customer. Persistency is no longer just a number—it’s an outcome of consistent engagement, relevant service, and personalized experiences powered by technology.

What Is Persistency in Life Insurance?

Persistency in life insurance refers to the percentage of policies that remain active over a specific period, reflecting the customer’s ongoing commitment to their insurance plan. It is a critical metric used by insurers to assess how well they retain customers beyond the initial policy sale.

High persistency ratios indicate customer satisfaction, trust, and a successful alignment between policy design and policyholder needs. Conversely, low persistency often points to gaps in product clarity, servicing, or customer engagement—leading to early surrender or non-renewal of policies.

How Is Persistency Calculated?

Persistency is measured over specific intervals and typically reported as:

Persistency Ratio (%) = (Number of policies still in force at the end of a period ÷ Number of policies issued at the beginning of that period) × 100

Persistency ratios are not just financial metrics—they reflect the effectiveness of product design, communication, and customer service strategies.

What are the Factors Contributing to Life Insurance Customer Retention?

35% of the retail policyholders struggle with understanding complex terms during the onboarding process. There are multiple factors that contribute to elevating the Life insurance customer retention dynamics. Here’s a closer look:

1. Product Design

Policies must align with long-term goals and offer clear returns. Poorly structured products or complex terms lead to confusion and early drop-offs. Inconvenient premium collection methods also weaken commitment.

2. Customer Service Quality

Slow, unresponsive service and broken promises create distrust. Insurers that fail to adopt modern, modular service systems often fall short of policyholder expectations.

3. Distribution Channels

Selling methods must match product complexity. Mis-selling or using the wrong channel—like selling complex plans online—leads to customer dissatisfaction and lapsation.

4. Premium Affordability

High or inflexible premiums often lead to lapses. Offering tiered, flexible, or stage-based payment options can help retain customers through financial ups and downs.

5. Customer Engagement

Engagement shouldn’t stop after the sale. Lack of communication, updates, or reminders leads to policy neglect. Regular digital touchpoints help reinforce value and build loyalty.

6. Economic and Lifestyle Factors

Financial hardships or life changes can interrupt payments. Insurers that offer flexible solutions or proactive support during such times see better retention.

Why Persistency Still Matters in Life Insurance?

Persistency—measured as the percentage of policyholders who continue their policy after a set period—is a critical metric for life insurers. In a market like India, where the life insurance penetration is rising, improving persistency means building long-term profitability and brand trust.

Yet, several longstanding challenges continue to affect retention:

- Lack of consistent customer engagement

- Generic communication strategies

- Policy mis-selling

- Delayed or poor servicing

- Minimal use of digital tools and insights

While these issues have historically weighed down insurers, modern Insurtech platforms coupled with AI offer a powerful path forward.

The Role of Insurtech & AI in Solving Life Insurance Retention Challenges

1. AI-Powered Chatbots & Virtual Assistants

Gone are the days of frustrating helplines. AI-enabled chatbots are now capable of handling policy queries, change requests, and complex conversations with ease—across mobile apps and web portals. These tools reduce service wait times and provide real-time, personalized engagement, especially during policy renewals or lapsation risk periods.

2. Personalized Portals and Mobile Apps

Over 40% of life insurers now use AI to personalize their digital platforms. Smart, AI-driven portals offer:

- Tailored policy recommendations

- Self-service options

- Engagement nudges at critical moments (like premium due dates)

By integrating Insurtech platforms with wearables or IoT devices, insurers can go a step further—linking lifestyle behavior to policy benefits, making the relationship more relevant and long-term.

3. Accurate Need Analysis to Prevent Mis-selling

Mis-sold policies often lead to early lapses. AI can assess a customer’s financial profile, risk appetite, and past behavior to recommend right-fit policies from the start.

Plus, digital platforms can:

- Record and store the entire sales journey

- Offer transparency into risks and benefits

- Ensure regulatory compliance through audit-ready trails

This is especially helpful for multi-channel sales involving brokers, bancassurance, and direct digital models.

4. Data-Driven Insights & Proactive Retention

Modern Insurtech solutions provide life insurers with real-time dashboards and predictive analytics.

Key benefits include:

- Tracking policyholder engagement

- Predicting churn before it happens

- Triggering automated interventions

- Analyzing customer sentiment for proactive servicing

This makes retention not just reactive, but strategic.

Still Relying on Traditional Methods? The Cost of Inaction

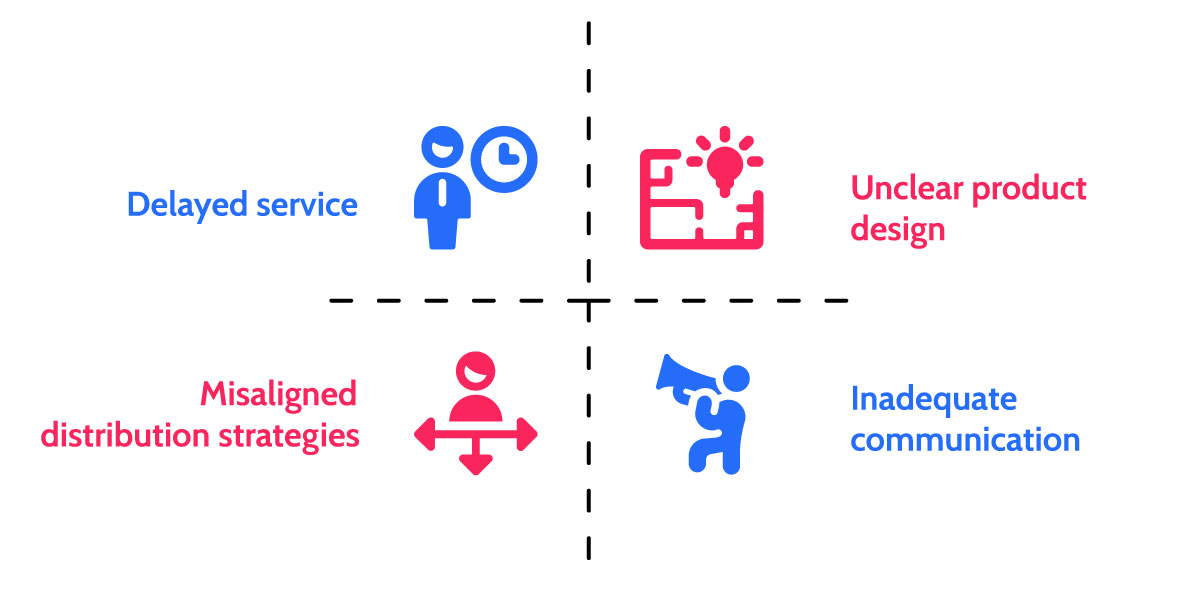

Today, 35% of retail policyholders drop out due to onboarding confusion. Others leave because of:

But while these are known, many insurers fail to act because they lack the right digital infrastructure. Modern Insurtech tools are modular, meaning they can be deployed around existing systems—without a full tech overhaul.

Conclusion: Technology is the New Trust Builder

Persistency is no longer just about policy terms or agent relationships. It’s about how connected, responsive, and intelligent your customer engagement is.

By embracing AI and Insurtech, life insurers can:

- Strengthen policyholder trust

- Prevent unnecessary churn

- Offer real value at every stage of the policy journey