Imagine being in a hospital for a regular checkup and an AI robot checks your heartbeat without any physical contact or using a stethoscope. Fascinating, isn’t it? While this is a far-fetched reality, AI in Health Insurance isn’t! AI in Health insurance is slowly but steadily becoming a cornerstone for innovation and enabling insurers to improve the customer experience while also getting an upper hand in streamlining operations.

Are you intrigued to know what AI is helping Health Insurers unlock?

Keep reading the article till the end to decode!

A Glimpse at the Role of AI in Healthcare

AI is significantly transforming the way Healthcare works. From enabling healthcare providers to offer personalized treatment to enhancing accuracy in disease detection, AI is genuinely changing the game.

Here’s a closer look at the way AI is transforming healthcare with its robust capabilities:

Looking at the Role of AI in Health Insurance

60% of Health Insurers use AI to enhance their services. AI is proving to be the ice breaker in debunking most of the operational hurdles and empowering the Insurers to downsize challenges and harness operational efficiency.

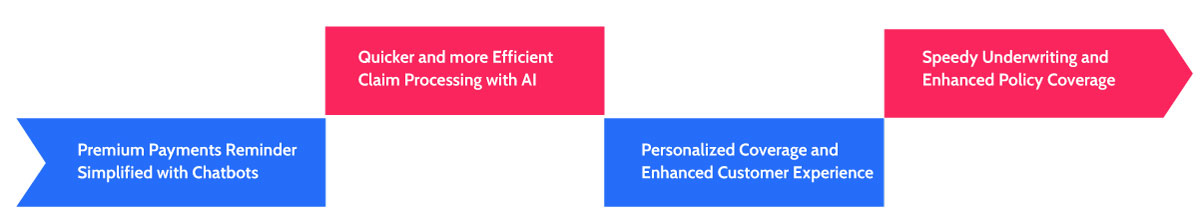

Premium Payments Reminder Simplified with Chatbots

Chatbots are truly transforming regular human interactions. These are AI-powered software which is capable of simulating human conversations using text or voice. In a slightly earlier time, these Chatbots were only capable of handling answering general policy-related queries. But, this is slowly becoming the past and now these chatbots are assisting customers in selecting suitable plans by analyzing their needs, budgets as well as coverage preferences. With these chatbots in place, sending premium payment reminders and offering updates on Health Policy renewals is now becoming easier and efficient. They are available 24/7 and offer quick and efficient support that reduces wait times and improves the overall customer experience.

Quicker and much Efficient Claim Processing with AI

Waiting for longer days to get health insurance claim reimbursed is now a thing of the past. Whether you are filing a reimbursement claim or availing a cashless facility, upon the submission of the necessary documents and details, AI will be taking care of a lot of things in the entire claims process. With the help of AI, Health insurers are now able to accelerate claims processing by automating data retrieval and fraud detection.

Personalized Coverage and Enhanced Customer Experience

A decade back, getting a personalized health insurance policy was a dream, however, with AI this is no longer a distant possibility. When filling out the critical illness form, the insurer will need all the details that will be helping them to offer tailored policy coverage. These details include habits, genetic predispositions and medical history. Once all these details are shared, the AI systems will be analyzing it and offer a personalized policy that features customized premiums. These days insurers can offer more enhanced coverage by analyzing the health data that are recorded in fitness tracking devices. Policyholders can link it to their insurance and can offer more precise coverage.

Speedy Underwriting and Enhanced Policy Coverage

This is another one of the benefits of AI in Health Insurance. While manual underwriting can increase the chances of errors in coverage, AI powered underwriting enhances accuracy in policy coverage. AI driven tools are well suited to offer accurate risk analysis and that too with high accuracy in detecting pre-existing conditions and tailoring the premiums accordingly.

The Robust Impact of AI in Health Insurance

The integration of AI has significantly streamlined operations within the health insurance sector, and has enhanced efficiency, accuracy and ease. The overall impact of AI in this industry is both robust and empowering.

By leveraging advanced AI algorithms, Health insurers can now improve their underwriting risk analysis and elevate their customer experience. These advancements will help address the traditional challenges which have long been an obstacle for Health insurers

Conclusion

With AI in healthcare, medical professionals are not getting an upper hand in improving customer experience but also actively leveraging AI to transform their manual intensive processes. Additionally, with AI in Health Insurance, insurers can actively contribute to enhance their operational processes and improve customer experience.

Archismita Mukherjee

Content Writer