AI is transforming insurance operations worldwide, but will it always be tagged as a buzzword? It’s high time for insurers to understand the full potential of AI and leverage it to not just streamline operations but offer value. While this mindset is slowly growing amongst insurers, the use of AI in insurance distribution is making progress. The intersection of AI and insurance distribution platforms is creating a significant shift in the way insurance products are being sold and managed. For instance, 76% of the US insurance firms have already implemented AI capabilities for effectively making an impact in insurance distribution.

Let’s dive deeper to understand the impact of AI in insurance distribution!

The Impact that is Loud- Gen-AI in Insurance Distribution

GenAI is used in a variety of ways for improving insurance distribution. Some of the foundational suggestions that proves AI is improving insurance distribution is through personalized policies and empowering the insurers tap into multiple other aspects of the insurance distribution journey.

A Closer Look at Gen-AI in Insurance Distribution

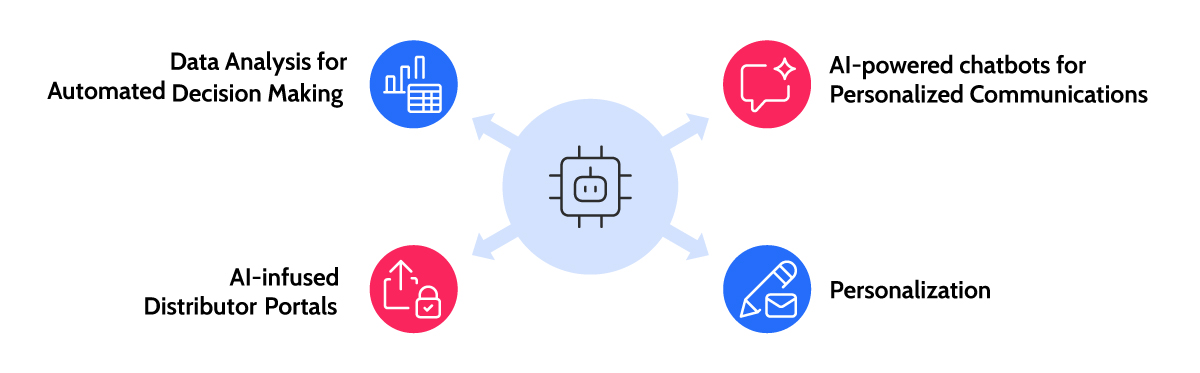

Insurers are leveraging the robust capabilities of AI and transforming the regular insurance distribution processes. Here’s a closer look at how AI is boosting insurance distribution:

AI powered Chatbots for Personalized Communications

AI chatbots are redefining traditional customer experiences. These tools offer instant, 24/7 customer support, answer queries and are well equipped with vast amounts of knowledge that effectively guides customers through policy selection and basic claims processing. In a report by Forbes, there is a 95% improvement in customer satisfaction due to AI powered chatbots offering personalized support. This personalized support will help in customer retention and increases the chances of insurance distribution due to the personalized communication support

Personalization

Personalization is no longer a far-fetched reality in insurance. Personalization stands at the forefront of customer-centric strategies. With AI, insurers can leverage AI driven insights for tailoring experiences, to seamlessly offer policies which perfectly align with their unique needs. AI has made everything possible, from personalized insurance coverage options to real-time policy adjustments, this dynamic approach will foster customer loyalty and satisfaction for insurers. Infact, insurers that offer personalized experiences and products tailored to their customers see an 81% increase in customer retention and an 89% increase in customer engagement.

The key area that AI is helping insurers is by enabling insurers to analyze vast amounts of data for generating personalized risk profiles and customize insurance coverage to meet their specific needs and preferences.

AI infused Distributor Portals

Online insurance distribution and management is not an unknown practice, but with AI integration in these platforms, traditional operations are taking a spin. AI infused Distributor portals are significantly enhancing insurance distribution in several ways. With AI powered portals, there will be real-time support and personalized interactions which leads to a more seamless customer journey. AI helps insurers analyze customer behavior, predict needs, and personalize offerings that makes the distribution process more efficient.

Data Analysis for Automated Decision Making

Automated decision making is now the norm. GenAI is a tool which can help insurance companies analyze large amounts of data for identifying patterns and trends. This information can be better used for improving products and services along with automated decision-making. For example, insurers can consider using GenAI for analyzing insurance claims data to identify risk using any of the cloud AI platforms. This information will be increasingly useful for enhancing risk prevention and claims processes.

Conclusion- Going Beyond Just Automation with AI

AI is fundamentally transforming traditional operational processes. By strategically leveraging AI, insurers can transcend mere automation and harness its potential to enhance customer retention through personalized communication and tailored products. This strategic use of AI not only streamlines operations but also significantly boosts insurance distribution, driving growth and customer satisfaction. Therefore, to make AI and insurance distribution a winning match, insurers need to understand its maximum potential to make the most of this advanced technology.