Imagine Alexa running a car on human commands? Futuristic and fascinating, isn’t it? There is still time for this imagination to turn into a regular reality, but AI in Motor insurance isn’t a possibility anymore. Today, AI is making waves in Motor insurance with its robust capabilities that is enabling Motor insurers to streamline their otherwise tedious and manual intensive operations. For instance, AI powered car damage recognition applications can significantly enhance efficiency of the claims process. As the landscape of operational complexity and customer expectations keep changing, it’s high time for Motor insurers to leverage AI in their operations to save up on time and bandwidth and ensure long term scalability.

Why the Motor Insurance Landscape Needs an AI Spin?

Frauds in Motor Insurance is a significant issue with estimates suggesting that up to 20% of insurance claims may be fraud. While insurance frauds are just one aspect in Motor Insurance, there are multiple other challenges that Motor insurers deal with. That’s where the need for AI is aggravated. AI can not only help streamline operations but also enhance accuracy in operations which was earlier unaccounted for due to manual intensive nature of the traditional operational infrastructure.

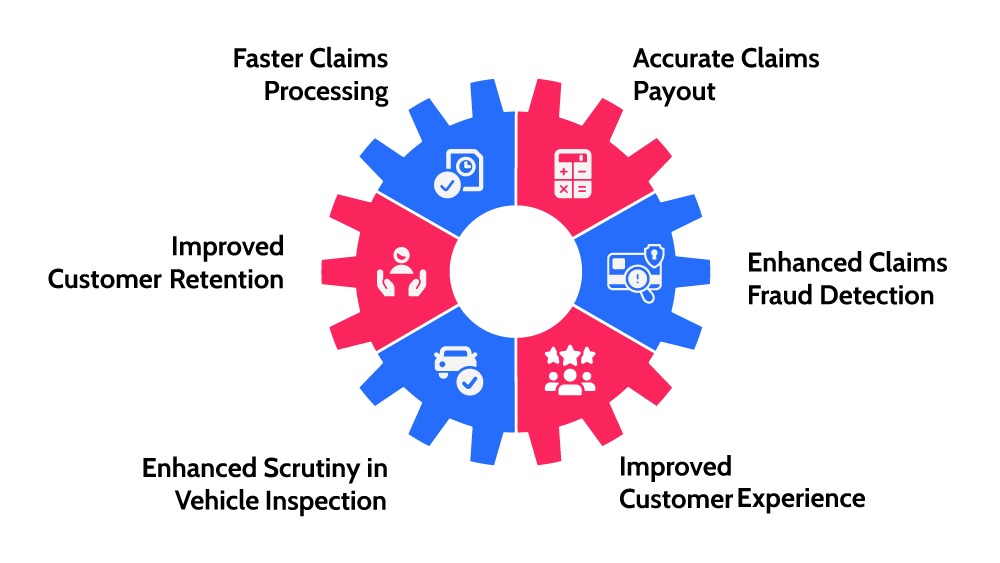

A Glimpse of the AI Impact in Motor Insurance

Meet AI Quest

AI Quest by iNube is the dedicated labs wing that is developed to empower insurers with advanced GenAI powered solutions. Every GenAI powered solution is developed by expert AI enthusiasts and seasoned insurance experts to adequately help insurers tackle the complex operational challenges and unlock multiple operational achievements.

How AI Quest by iNube can Help Turn Around Motor Insurance?

AI Quest offers robust AI Quest powered solutions that helps insurers tap into key areas in the insurance value chain. Here’s a more nuanced look at the AI Quest impact in Motor Insurance:

Enhancing Policy Purchase Experience- Selling the Right Product to the Right Customer

Policy Mis selling is a pivotal issue, isn’t it? But, with AI Quest’s AI Quest powered Agent Assist this is in the past. The AI Quest powered Agent Assist is equipped with multiple product knowledge and offers an aggregator platform for enabling the insurer to offer a compare and purchase journey.

Additionally, this GenAI solution also aligns with the insurer’s recommendations and generates accurate quotes that helps in reducing Policy mis-selling.

Our Agent Assist will be helping in uncovering end-to-end policy coverage terms which otherwise goes unnoticed during an insurance agent interaction

With this AI Quest powered solution, the Motor insurers will be gaining an upper hand in enhancing transparency and accuracy while also increasing the chances of customer retention.

Bullet Proofing Claims Management- Improving Claims Assessment Accuracy with AIClaimXpert

Manual claim assessment in Motor insurance claims can significantly lead to oversights and biases. Does this feel relatable to you? It’s time to slash this relatability and taste accuracy in claims assessment with AI.

Our AI Quest offers a AI Quest powered claims assessment expert that adequately analyses the key details from multiple vehicle documents which includes repair bills, FIRs etc.

Additionally, the solution helps in comparing vehicle details against the policy details and summarizes accident-related details in claims forms, compares claim estimates from garages and flags discrepancies by extracting the damage descriptions from survey reports. Ensuring a complete touchless claims settlement.

From Envisioning to Reality- Boost Policy Renewal Rates with GenAI Powered Renewal Optimizer

During policy renewals, are you still manually extracting previous policy details? The AI Quest powered Renewal optimizer leverages the advanced capability of GenAI and automates the extraction of policy details and effortlessly generates renewal quotes and compares them.

The solution allows Motor insurers to offer hyper-personalized quotes and boost renewal rates by a whopping 75-80%, giving an easy way for them for customer retention.

Leverage an Advanced Set of Eyes in Garage Bill Analysis with GenAI

How do you know that manually analyzing multiple garage bills is not making you a victim of claims overcharging? Did we convince you to rethink your operational methods?

It’s time for a spin off with AI Quest’s AI Quest powered Garage bill analyzer. Our GenAI solution easily automates the analysis of multiple garage and repairing bills that includes spare part invoices and labor charges and effortlessly compares them against the insurer approved rates for detecting overcharging.

This solution empowers Motor insurers to reduce inflated costs by 30% and help them from falling victim to claims overcharging

Refining Vehicle Damage Inspections with AI Quest powered Vehicle Damage Inspector

Do you manually look for pre-existing vehicle damages? Are you sure that you are not overlooking any pre-existing damages? Did this stir up a thought in your mind?

Time to enhance accuracy in detecting pre-existing vehicle damages with AI Quest powered vehicle damage inspector. Our solution leverages advanced image analysis technology and automates the comparison of images from pre-policy issuance against the post-accident images and effortlessly flags pre-existing vehicle damages.

Our solution allows Motor insurers to reduce vehicle analysis errors and gives an upper hand in reducing fraudulent claims by 50%.

Unlocking the AI Quest Impact in Motor Insurance

While these possibilities are not just limited to these AI Quest powered capabilities, we are always looking to refine our AI expertise with more capabilities.

Time to experience the power of AI Quest first-hand!

Contact our insurance technology expert today!